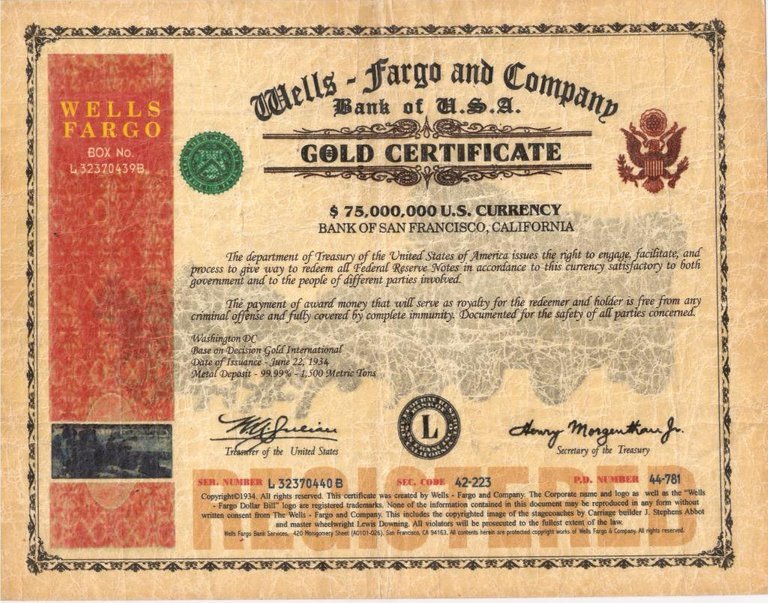

It was long claimed that each tether is backed at 1$. And historically we had very similar situation with gold certificates where we already know how it did end.

Gold Certificates

Gold was rather unpractical to carry around and divide up and validate. Instead to make trade more convenient many private banks offered gold certificates that were redeemable in gold at the bank and had a written face value. This value was backed by the gold reserves securely stored in the vaults of the banks.

Obviously there is a huge incentive for these banks to issue gold certificates without actual gold backing. And as long as the bank has about 10% of the gold, customers will never discover since they experience that they can liquidate their gold certificates. However when all customers redeem at the same time the system crashes.

The reasons why the banks started to issue fake gold certificates are very different. Some did out of pure greed, others because they messed up somewhere else and were in need of money. But over time almost every gold certificate was only baked by a fractional reserve. And as soon as this became well known it triggered a bank run. The people redeeming their certificates early left with their gold. The people that came later in a panic had nothing left but worthless paper.

USD Tether/ USDCoin / ....

A lot of the stable-coins are just a reinvention of this old system. Instead of having actual dollars, you get a dollar-certificate that promises to pay you dollars on request from a hidden stash of dollars. And because this stash cannot be verified, it has exactly the same problems as gold certificates.

If history repeats, we should expect to have crypto bank runs and these coins eventually crashing down to a value of zero. And for tether there are already clear signs that this may happen rather soon.

Initially tether had the reserves, but then bitfinex messed up and had trouble to access 750 million dollar. The story about this is not really settled and it is not clear what exactly happened.

But what we know it that tether then gave a 750 million dollar loan from their tether reserves to bitfinex. And while they now hold a loan of 750 million dollar, this loan does not have the same value as actual 750 million dollar (there is a 6% interest on that loan, but that interest will almost certainly not be distributed to the holders of tether that will however pay for a potential default.). Tether is therefore no longer fully backed and this is not a conspiracy but a proven fact. And 750 million dollar is about a fourth of their total reserves.

And this will not only continue to happen for tether but for all centralised stablecoins. Right now tether is still valued at 1$. I would suggest it is time to get out so you do not end up being the last person in the eventually coming crypto bank run.

I am not a big fan of MAKER/DAI, but if you choice is tether or DAI, then I know what I would choose.

Because in crypto there is no need to trust in hidden dollar reserves. We can build public verifiable stablecoins that do not require trust and that do not have the same flaws of fractional reserve systems.

Well, if this situation is true and not just another FUD, new lows for Bitcoin (and everything else) will appear shortly. 😛

I have a friend who guarantees Tether's reserves are fully backed... and another one who is 100% sure that the opposite is true. Both are really confident in their sources. But only one of them can be correct.

I guess time will tell...

Thanks for your article, @frdem3dot0!

We will see. At least historically it is not looking good for tether.

Have you ever had any Tether? That's one of those things I never used. Not even once.

What do you think of TrueUSD?

Posted using Partiko Android

As far as I understand they are trying to connect smart contracts with law enforcement to create a stablecoin. Honestly this seems better than having a secret deposit, but it still has some centralised overhead. We simply do not need any authority to have pegged assets, smart contracts are already enough. These kind of legal contracts might be more useful for trading houses on the blockchain or similar.

But obviously I am not an expert at all in law so I cannot give a full analysis other than that it is not needed in this case.

What do you recommend?

Maker Dai? Grin?

What about long term.

Posted using Partiko Android

For a stablecoin that is easy to use I would use Dai even though I do not like their implementation too much. But then I am not that much into stablecoins :)

I personally have a lot of bitcoin and grin, plus some of the bigger altcoins. We will see how this goes.

Losing access to or "misplacing" $750m should be grounds enough for most sensible people to get out of USDT. There are also a lot more options for stable coins than there were 12 months ago

Officially this was bitfinex and not tether, but factually they are the same company. So essentially they are giving themselves a loan of 750 million.

I should do the same, give me a loan of a few million and then use that loan to myself to back a stablecoin :)

They treat themselves so nicely. 😅

Wasn't the whole reason for the loan something to do with Crypto Capital holding their funds and then they couldn't get it back? Haven't followed all the details on this one

yes, but they are both accusing each other and nobody knows what really happened

This post is promoted by @reversed-bidbot as an upvote lottery with a jackpot of 0.500 steem!

There are still up to 2500 tickets waiting to be distributed.

Tickets are distributed according to the value of your upvotes with a multiplier of 1500.0.

Upvote the post to participate and claim your tickets!

Excluded from participation are: bidbots, autovoters.

discord server or read my introduction postFollow me to also earn steem on my other promoted posts; or use @reversed-bidbot to hold your own raffles. For more details please visit my

Congratulations @frdem3dot0! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Hi @frdem3dot0!

Your UA account score is currently 4.061 which ranks you at #3518 across all Steem accounts.

Your rank has improved 416 places in the last three days (old rank 3934).Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

In our last Algorithmic Curation Round, consisting of 205 contributions, your post is ranked at #105.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.Congratulations! This post has been upvoted from the communal account, @minnowsupport, by frdem3dot0 from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

I was called to perform a provably fair random drawing for @reversed-bidbot!

There are a 756 tickets participating in this round.

The merkle root of the block in which this post will appear determines the winner. @inversionistam holds tickets number 0 - 7 @frdem3dot0 holds tickets number 8 - 37 @freebornsociety holds tickets number 38 - 55 @sacred-agent holds tickets number 56 - 60 @trincowski holds tickets number 61 - 106 @kabir88 holds tickets number 107 - 472 @luegenbaron holds tickets number 473 - 507 @reversed-bidbot holds tickets number 508 - 512 @steem-raffle holds tickets number 513 - 534 @curatorbot holds tickets number 535 - 535 @clm holds tickets number 536 - 556 @hiblockchain holds tickets number 557 - 558 @zoidsoft holds tickets number 559 - 660 @builderofcastles holds tickets number 661 - 674 @freebornangel holds tickets number 675 - 743 @mcoinz79 holds tickets number 744 - 749 @rufusfirefly holds tickets number 750 - 755

The block in which the above post is included has a merkle root of 801a65be95b1a78ada8757b22ddb66ce10c2480d.

To find the winner we:

801a65be95b1a78ada8757b22ddb66ce10c2480d = 731339501234119484146176429698022074480888793101.

Congratulations!