According to a report by the Analytics service CryptoCompare, in November South Korean Bithumb surpassed the trading volume of the popular crypto currency exchange Binance.

When compiling the report, experts analyzed the data of 70 crypto-currency trading platforms. In particular, it was found that the share of spot transactions in the total trading volume is 75%, futures — 25%.

90% of the volume is generated on spot platforms, where trading commissions are provided. 8% of trading platforms work on the trans-fee mining model, which usually involves the issuance of its own token to pay commissions or reward for trading activity of traders. Only 2% of platforms offer Commission-free trading.

A third of exchanges support spot trading of digital assets in pairs with Fiat money. The remaining two-thirds support only trade in crypto assets.

South Korea took the lead

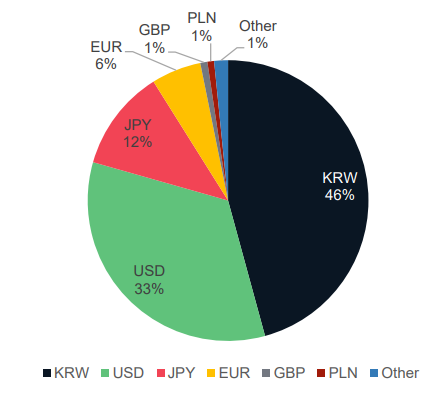

Korean won was the most popular Fiat currency used in bitcoin trading last month.

KRW accounted for 46% of the volume of transactions with BTC. The share of USD-33%, Japanese yen-12%.

The average daily turnover of the South Korean exchanges in the past month amounted to $1.4 billion In based in Malta sites daily, there were deals for $1.2 billion.

South Korean crypto-exchange Bithumb came in first place in terms of daily trading volume, beating Binance.

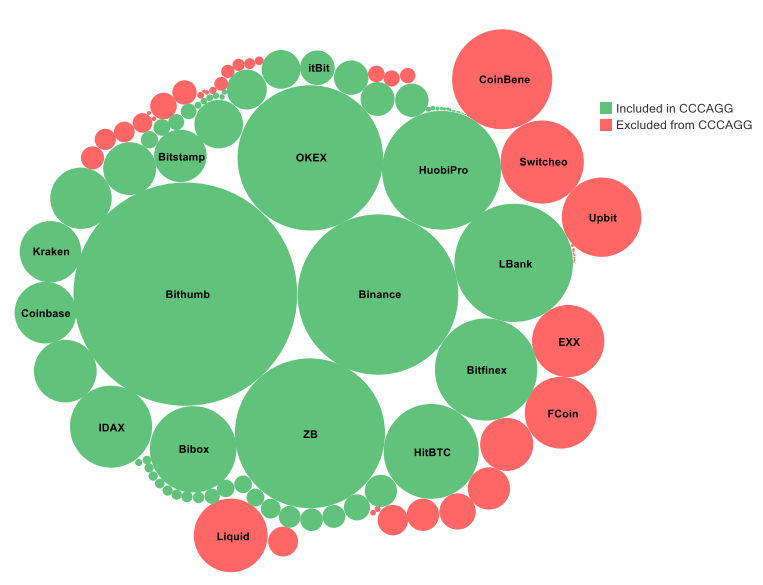

Highlighted in green exchange, for which data is used in aggregate price index CCCAGG from Cryptocompare

In November, Bithumb's trading volume reached $1.24 billion, while Binance's trading volume was $641 million And ZB's $560 million.

If we compare the data on the exchange of service data CryptoCompare no less popular service CoinMarketCap (subsection Top 100 Reported By Volume), it appears that currently Bithumb really far ahead of Binance:

However, if you choose the Top 100 By Adjusted Volume, it turns out that Binance occupies a leading position, and its main competitor is OKEx:

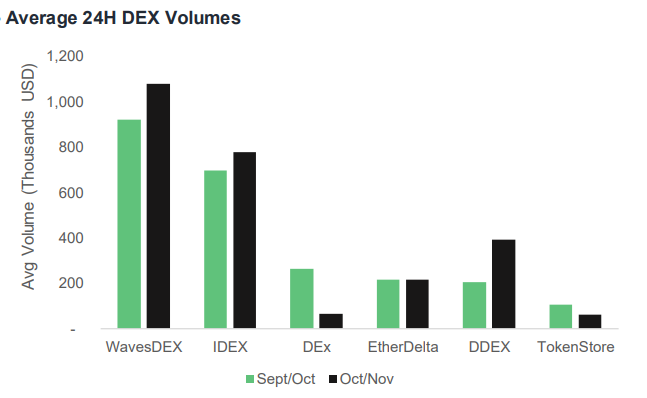

As for decentralized exchanges, WavesDEX is the leader in this segment:

Earlier, experts of the Belarusian marketing Agency BDCenter came to the conclusion that most traders are in the US, Russia and China.