Cryptocurrency mining rig manufacturer and mining pool operator Bitmain has announced that it will destroy a portion of the transaction fees that it accrues from mining Bitcoin Cash blocks in a bid to support the economic health of the network.

Cryptocurrency mining rig manufacturer and mining pool operator Bitmain has announced that it will destroy a portion of the transaction fees that it accrues from mining Bitcoin Cash blocks in a bid to support the economic health of the network.

AntPool, the Chinese company’s mining pool, made the announcement on Friday, explaining that it will “burn” 12 percent of all the transaction fees from Bitcoin Cash blocks that it mines by sending them to “burn addresses,” whose funds are unspendable.

Arguing that Bitcoin Cash “is at the tipping point of becoming a widely used public blockchain,” Bitmain explained that burning a portion of the network’s transaction fees will strengthen its internal economy and help investors “profit from the growth of BCH.”

From the statement:

while having active users spending BCH is very important for the ecosystem, having investors who hold BCH is also a fundamental requirement for maintaining a strong economy. Without these holders, BCH’s exchange value loses significant support. We believe that they too should profit from the growth of BCH by their continued stake in the Bitcoin Cash ecosystem.

The transaction fees earned by miners are an important growth indicator of the BCH ecosystem, and if a portion of the fees are burnt, it is effectively miners sharing revenue with the entire BCH network.

By reducing the total supply of Bitcoin Cash in circulation, Bitmain believes that it can reduce sell pressure on the coin, ultimately making it more valuable.

Those comments are notable, given that many of Bitcoin Cash’s advocates — a group that includes Bitmain CEO Jihan Wu — argue that Satoshi’s vision for cryptocurrency was that it should be a currency first, not a store of value.

bitmain

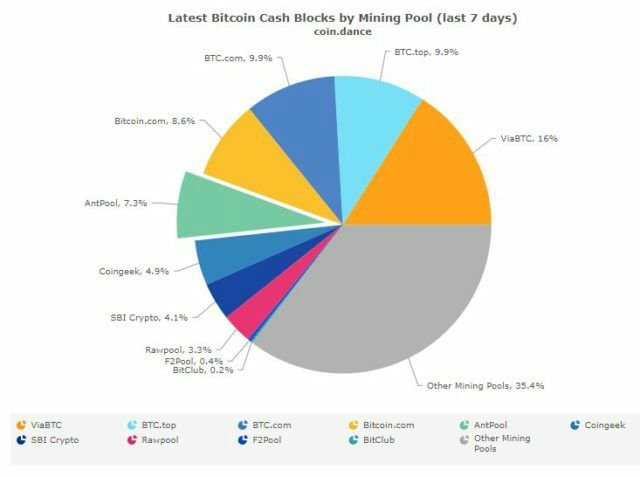

Source: CoinDance

At present, AntPool accounts for 7.3 percent of Bitcoin Cash blocks mined within the past week, though it has mined more than 10 percent of blocks mined in the past 24 hours.

Bitmain called for other mining pools to follow its example and burn 12 percent of the transaction fees from blocks that they mine, which would make the practice de facto economic policy for the network.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://finance.yahoo.com/news/bitmain-burn-12-bitcoin-cash-171143933.html

Thanks for sharing. This is equivalent to a share re-purchase by listed companies. It is also a sign that "managers" don't have any more ideas how to make the company more valuable so their last option is to increase the share price (and other financial indicators) by buying them back. Compare this to networks with built-in inflation (STEEM, EOS) and you'll know where the confident people work.

absolutly sir,

WARNINGCONFIRMED SCAM!

DO NOT FOLLOW any instruction and DO NOT CLICK on any link in the comment! - The message you received from @srimulyani is a

For more information, read this post:

https://steemit.com/steemit/@arcange/phishing-site-reported-autosteem-dot-info

If you find my work to protect you and the community valuable, please consider to upvote this warning or to vote for my witness.