I was going through Reddit the other day and one post on Bitmax.io caught my attention. In case you did not know Bitmax is a cryptocurrency exchange with an API. The post I came across was about the possibility of adopting what is called Margin Trading? From my understanding and according to Investopedia it is a scheme where you trade using borrowed money.

If such a plan is executed it might serve some and it might not for other but that is not what got me interested. What got me interested is the fact that they are constantly planning for new models and new schemes. I mean updates keep coming. I've been using other exchanges and the only change I've witnessed was an upgrade in the UI. Bitmax since its launch has introduced several interesting coins and models. Not long ago reverse-mining and trans-fee models where introduced. The former allows the user that executes the maker trade to receive a rebate of the transactions fee in exchange of BTMX tokens; the latter models allows the user to get back the transaction fee in form of BTMX tokens. As you can see in the image below the models have allowed for 40,335,824 BTMX to be locked up hence reducing supply of BTMX tokens within the platform.

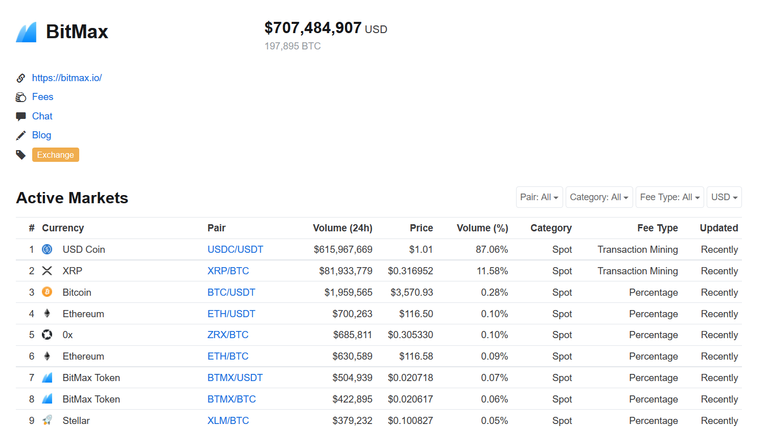

Since the introduction of those two models, Bitmax has marked great numbers on the exchange. Their daily volume ranges between $50 mil and $100 mil. Those numbers shouldn't be taken lightly; there are other exchanges that have been struggling to get over $2 mil; you can check out their volume on CMC. As the day of writing the volume was market at $707,484,907 USD. The highest traded pair is of USDC/USDT.

I think from what I've read around the models have greatly contributed to that progression. That is not all; on Jan 23rd Bitmax rolled out several order types in its exchange as part of the continuous progression. The order types introduced are Market Order and Stop Order.

We might be familiar with what Market Order is; since it is present in almost all exchanges. It basically allows you to immediately execute an order at the best available price. Market Orders usually only require the amount to trade and not the price; the price is obtained by the exchange for the best and next best prices in the order book. With Bitmax the order is executed if the order is within 10% spread from the market price. For example, you would like to buy 10 ETH. The offers book has 3 ETH for 0.5 BTC and 7 ETH for 10BTC and many other offers; the system would calculate the deviation and if 3 and 7 ETH fall within 10% spread they will be executed otherwise only one would be executed hence a partial order.

The other order type is the Stop Order. Personally is one of my favorite types since it allows you to sell or buy when a specific price is reached. Bitmax has two types of Stop Orders. Stop-Limit Order and Stop-market Order. The former allows the order to depend on both the stop price and limit price. When the Stop Price set target is reached the limit order will be executed. The latter type (Stop-Market Order) a Market order is executed when the stop order is reached.

The exchange is constantly pushing updates and is not afraid to roll out new models. I hope they keep at it especially with a highly competitive field. I should also mentioned that they have issues both Android and iOS apps and have an active airdrop.

If this got you interested here are some resources you could use to know more:

Resources:

BitMax Official Website: https://bitmax.io

Twitter: https://twitter.com/BitMax_Official

Reddit: https://www.reddit.com/r/BitMax

Telegram English Official: https://t.me/BitMaxioEnglishOfficial

Telegram Official Announcement Channel: https://t.me/BitMaxOfficialAnnouncement

Congratulations @ethninja! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOP