Welcome to the THIRD article of my BlockTech series! Today, we will be taking a dive into Bitshares. You can check out the previous post in the series, 'IOTA - Going beyond the blockchain!' at the following URL: https://steemit.com/cryptocurrency/@bitboss/blocktech-series-iota-going-beyond-the-blockchain

What is Bitshare?

Bitshares is far more than just your ordinary cryptocurrency. Bitshares is also a decentralized exchange that utilizes financial tools and contract types.They offer "SmartCoins"/BitAssets on the exchange which are pegged to assets such as gold, silver, the US dollar, Bitcoin, and more.

“BitAssets, the currency of BitShares, are digital asset tokens that have eliminated the burden of price volatility. This means that bitUSD, bitEuro, bitCNY and bitGold will always trade near par value for the dollar, euro, yuan and gold on cryptocurrency exchanges worldwide.”

These market-pegged assets become “smart currencies,” pegged by market forces to underlying fiat currencies (USD, EUR, CNY) or commodities like gold and silver. This provides stability, allowing merchants to hold the currency rather than selling it quickly to avoid volatility of first-generation crypto currencies like bitcoin. These assets are also backed by 250%+ their value in BTS which makes it even more amazing.

The ability to hold between transactions minimizes the taxes, fees and counterparty risks incurred going into and out of fiat in search of stability.

The native currency is called bitshares (BTS). Viewed as a mere currency, it is just as volatile as first-generation currencies like Bitcoin. But, viewed as equity in BitShares the unmanned company, BTS value is derived from demand for the company’s incorruptible products and services. So, BTS makes an excellent form of collateral with which to back stable smart currency derivatives and other financial products.

The BitShares blockchain uses a Delegated Proof-of-Stake consensus mechanism, which means that voting on consensus issues can be done democratically by stakeholders. “All network parameters, from fee schedules to block intervals and transaction sizes, can be tuned via elected delegates,” the company states on its website. There are 101 elected delegates in the BitShares network who secure the network and, therefore, receive transaction fees as rewards. DPoS allows for ten transactions per second, making the BitShares network one of the fastest in the industry.

New bitshares are created in each block, and the maximum number of new shares per block decreases over time as it is the case with Bitcoin. New shares are given to BitShares’ workers who have been elected by the shareholders to run the company.

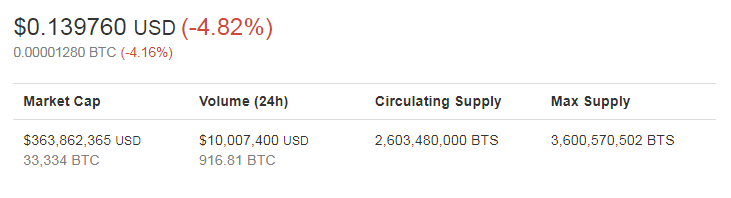

The current circulating supply of bitshares is just under 2.6 billion BTS, and there is a 1 billion BTS reserve fund held by BitShares. The BitShares reserve pool is used to pay workers and receives an income from transaction fees. The total supply of BTS will not exceed 3.6 billion.

The DEX (Decentralized Exchange)

My favorite part about Bitshares is the decentralized exchange. I've found it very easy to learn and the volumes seem to be on the rise every week.

The main benefit to a decentralized exchange is the fact that it's not centralized. You have no one party holding your private keys so it's essentially trustless as are the assets on this exchange. Also, it is close to impossible to shut it down.

Decentralization of the exchange gives BitShares robustness against failure because any attack or failure impacts only a single user and their funds.

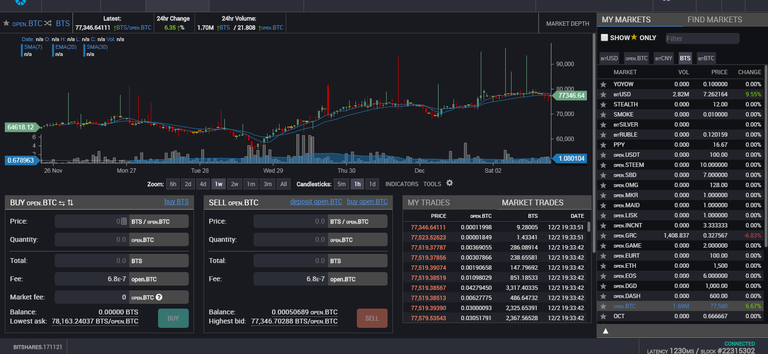

Being among the first approved tokens by the TXSRB, the BitShares DEX has essentially become the safest exchange in the world! Below is a screenshot of what it looks like.

Transaction Speed

One huge advantage to Bitshares is the transaction speed and the sheer mass of transactions the network can handle. Bitshares can handle more transactions than Visa and Mastercard COMBINED and faster too!

The amount of transactions Bitcoin could handle before Segwit was 7 tx per second after the Segwit implementation is 11 tx per second. Bitcoin Cash, which is slightly faster, might be able to do 15 tx per second in November after another hardfork. VISA on average processes2000 tx per second. Now, BitShares can handle 100000 tx per second making it by far the quickest most efficient means of transacting (the fees are also less than 1 cent on Bitshares).

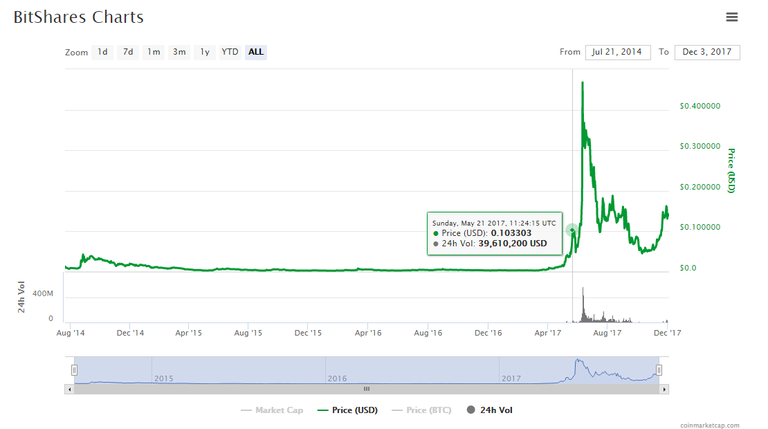

Bitshares Price Chart

Accurate as of Nov. 25, 2017. $0.14 per BTS at the time of writing.

I think we've covered a good amount on Bitsharesand what makes their technology different. If you'd like more information please visit their website (listed below).

More Information

Website: https://bitshares.org/

Symbol: BTS

Popular Markets: Binance, Bitshares

This concludes the third post of the BlockTech series. I hope you enjoyed it. Be sure to resteem, upvote, and follow if you enjoyed this post to receive more like it! And as always, stay classy Steemians! Don't forget your tie!

Support Me

Like my content? Be sure to follow and upvote! Also, I appreciate any donations greatly! These donations will help me with videos, website, and my future non-profit! to spread awareness and adoption of crypto technology.

BTC - 15HktA1DSkE8fTKDCfMnCDPHTihtc1Ur8X

ETH - 0x3366387Da91f504DA3c4293cE1Ea39023FE3caB4

LTC - Ld1mdtJj8MZpMTdka1z8Cu1N6iFJvnDJzs

You can also send Steem/SBD to @bitboss.

Congratulations @bitboss! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP