This post builds on the groundwork in the Synthetic Pools introductory post: https://hive.blog/bitshares/@btwty/how-two-swap-synthetic-pools-work

We're going to get more concrete and specific about a real synthetic pool on BitShares DEX, so if you need any refresher on synthetic pool mechanics please review the above post before continuing.

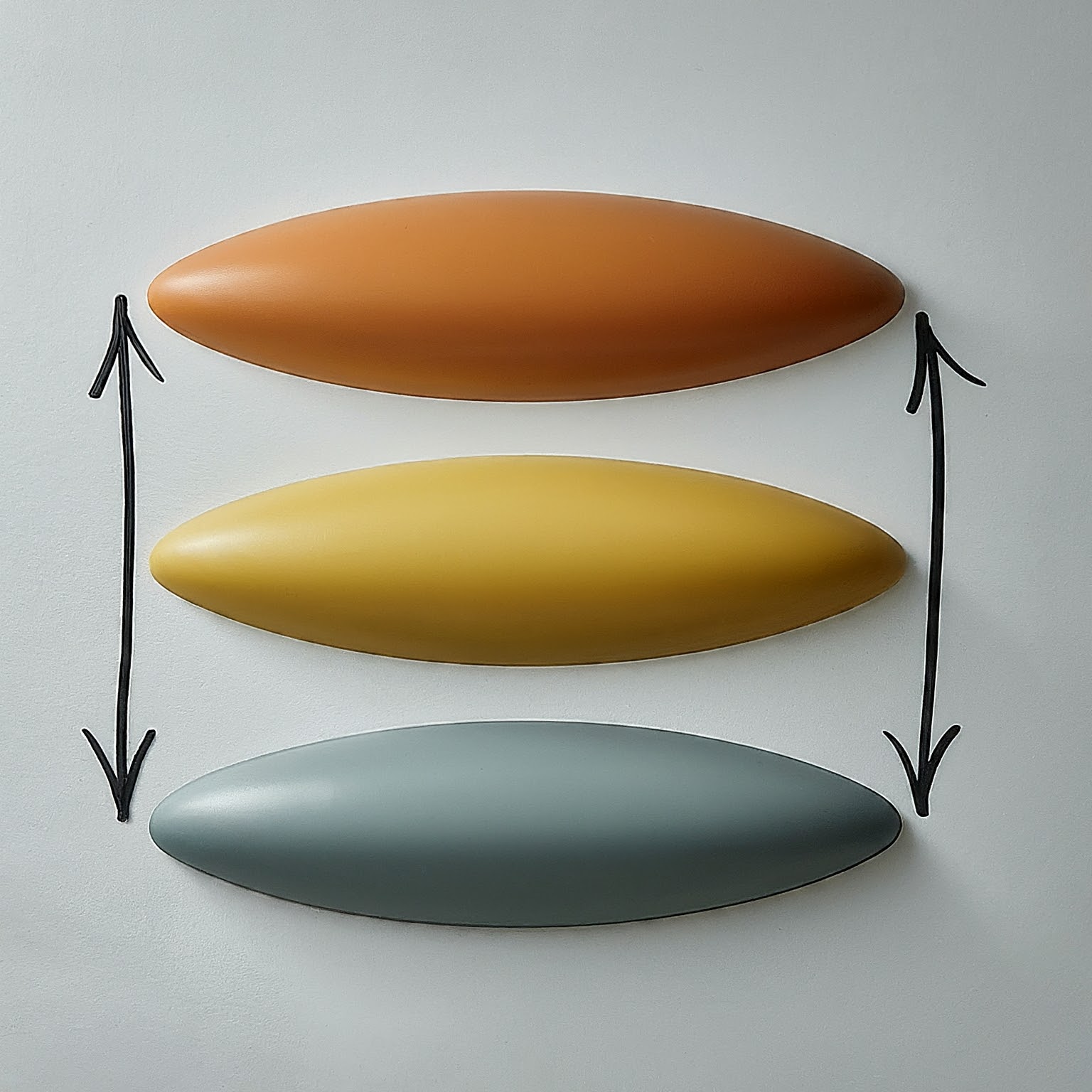

In this scenario, the following pools are available on BitShares:

IOB.XRP/BTS: This pool allows trading between XRP (represented by IOUs from the issuer IOB) and BTS (the native BitShares token).

BTS/BTWTY.EOS: This pool allows trading between BTS and BTWTY.EOS (an EOS-backed asset issued by BTWTY).

By utilizing these two pools, we can effectively create a synthetic XRP/EOS pair:

XRP to BTS: A trader can first swap their XRP for BTS in the IOB.XRP/BTS pool.

BTS to EOS: The trader can then swap the acquired BTS for BTWTY.EOS in the BTS/BTWTY.EOS pool.

This two-step process effectively allows trading between XRP and EOS, even though there's no direct liquidity pool for this pair.

Benefits of this Synthetic Pair

Enhanced Liquidity for XRP and EOS: By enabling trading between these two popular assets, we can potentially increase liquidity and trading volume for both XRP and EOS on the BitShares platform.

Expanded Trading Options: This synthetic pair opens up new trading opportunities for users who want to trade directly between XRP and EOS without needing to use external exchanges or go through multiple steps.

Price Discovery and Arbitrage: The existence of this synthetic pair can contribute to price discovery and create arbitrage opportunities for traders who identify price discrepancies between the synthetic pair and other markets.

Considerations and Implementation Strategies

Slippage: As with any synthetic pair, slippage can be a concern, especially with large trades or during periods of high volatility. Smart routing algorithms and optimal trade execution strategies can help minimize slippage.

Price Oracles: Accurate and reliable price oracles are essential to ensure fair pricing and prevent manipulation. Integrating reliable price feeds for XRP, EOS, and BTS is crucial.

User Interface: Designing a user-friendly interface that clearly displays the synthetic XRP/EOS price and allows for seamless execution of the two-step swap is important for user adoption.

Potential for Further Development

Market Maker Bots: Introducing market maker bots specifically for this synthetic pair could further enhance liquidity and ensure tighter spreads.

Arbitrage Strategies: Developing tools and strategies to identify and capitalize on arbitrage opportunities between the synthetic pair and other markets can contribute to market efficiency and price convergence.

I'm excited to see how this synthetic XRP/EOS pair could evolve and potentially unlock new possibilities for trading and liquidity on the BitShares platform.

The rewards earned on this comment will go directly to the people sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.