NOTE: Content mirrored on Bitsharestalk!

One of the major selling points of BTSX for me back in 2014 was the 5% (or x%) on 'anything' marketing (that and sharedrop theory). The idea that I could store MPAs/UIA in effectively my own bank and get better interest rates than that FIAT banks were offering was a powerful message that had me (and a lot of other users) sold.

I realise that in the migration from BTSX (BTS 0.x) to BTS 2.0 we removed 'socialized yield', however I believe that the removal of profit sharing though asset fee yields was a mistake.

The following quotes are from the following blog post: "Lessons learned from bitshares 0.x"

Under BitShares the BitAsset holders receive a yield simply by holding BitUSD. This yield was between 1% and 5% APR on average. Unfortunately, yield harvesting can happen at any time by someone shorting to themselves to gain a very low risk return and undermining goal of encouraging people to buy and hold BitUSD. The yield was funded from transaction fees and by interest paid by shorts.

The funding of yield through fees was successful despite the fluctuating rates (1 - 5% APR AVG).

The issue was that users were able to 'yield harvest' by shorting to an alt account, effectively cheating the system.

An alternative distribution mechanism to paying interest by shorting is required.

Peerplays has the ability to distribute 'dividends' to users that hold the peerplays tokens, we should be doing something similar for tokens on the BTS DEX. Hopefully peerplays dividend/profit-sharing code is somewhat compatible with Bitshares (it's using graphene after all).

Relevant peerplays docs:

http://www.peerplays.com/news/how-does-the-profit-sharing-function-work/

https://peerplays.com/docs/Peerplays_Whitepaper.pdf

As we stated previously, undercharging for transactions is bad for business and BitShares was effectively earning nothing for all transactions of BitUSD because 100% of the income generated from fees was paid out to BitUSD holders as yield and nothing was left over to cover network expenses.

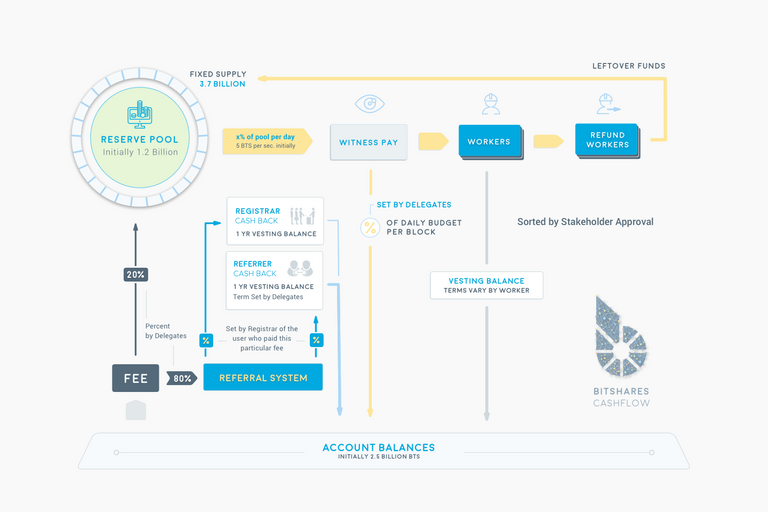

We now gather 20% of fees into the reserve pool (which also contains over 1 Billion BTS), which goes towards workers and witnesses.

80% of fees go towards the referral system.

I would propose that we re-evaluate the distribution of fees between the reserve pool, referral system and asset holders. We could burn through a chunk of the reserve pool, but this would be temporary as we would eventually need to reintroduce such fees to build the reserve pool back up. I think it's most fair to take a chunk of the fees from the referral system.

Infographic showing current BTS cashflow:

While Socialized Yield is broken, BitShares 2.0 offers a far better alternative: Collateralized Bonds. Collateralized Bonds enable arbitrary shorting between any two assets, guaranteed interest, and no risk of being force settled. This system privatizes the yield to individual bonds and the terms and leverage available can be far more flexible. In effect, BitUSD becomes cash and a Bond becomes a Certificate of Deposit.

The concept of "Collateralized Bonds" did not make it into Bitshares 2.0, so in effect we cut asset holders out of fee redistribution without providing a replacement source of income for holding assets on the Bitshares DEX. I believe this may be a reason why we had a downtrend when switching from 0.x to 2.0 (disregarding merge drama).

Does anyone have any further information on this collateralized bond market? I could only find the following:

https://bitsharestalk.org/index.php?topic=16752.0

https://bitshares.org/technology/collateralized-bond-market/

What do you think? +5%

Best regards,

CM.

Did it ever get changed or is it still like this?

Someone promoted your post. Promotions help every steemians.

Your reward is an upvote and 0.239 SBD extra promotion.

Good job, see you next time in

Promoted! ;)If you have not done so yet, check out the Bitsharestalk forum thread, the discussion is picking up there!

The thread on bitsharestalk has passed 2000 views and over 100 posts! :D

Please like/retweet:

Thanks in advance, tweetbot! :)

Disclaimer: I am just a bot trying to be helpful.

This post has been ranked within the top 80 most undervalued posts in the first half of Apr 08. We estimate that this post is undervalued by $0.17 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Apr 08 - Part I. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.