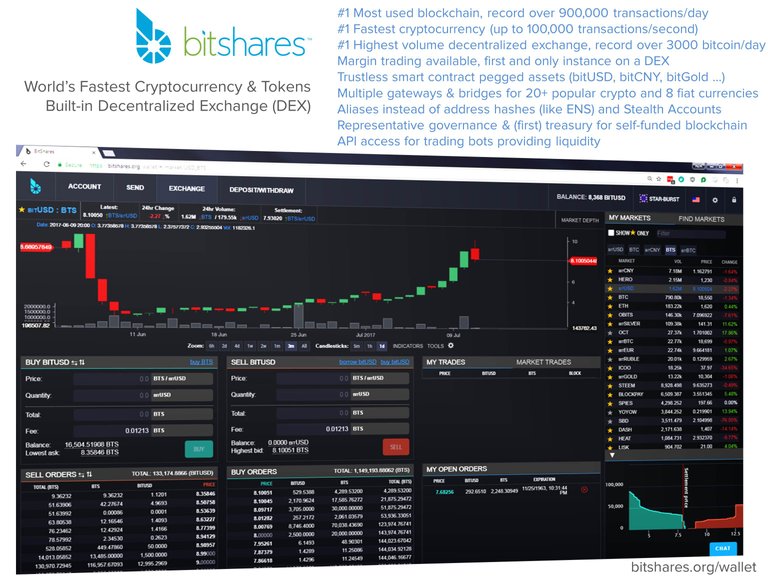

Hope you guys are familiar with Bitshares

https://bitcointalk.org/index.php?topic=1949828.0

On the Bitshares DEX you have trustless assets like bitUSD, bitCNY, bitBTC

The reason they are trustless is no matter how you got them, you can always hit settle and get exactly that much worth of BTS out of them as they are backed by collateral in BTS smart contracts.

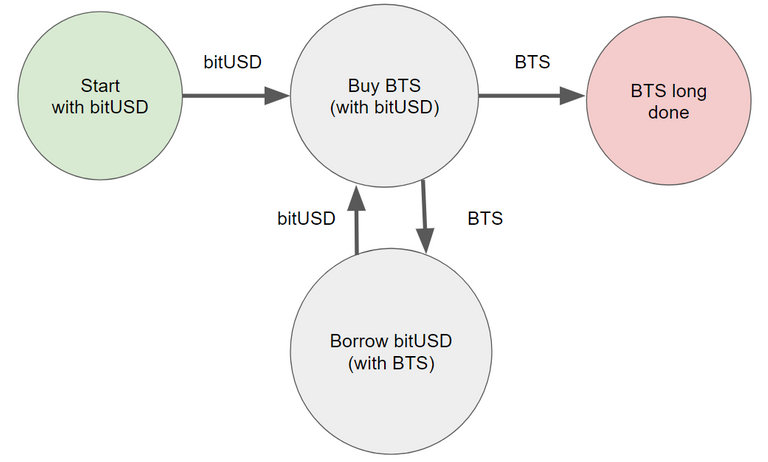

You can margin long BTS by borrowing bitUSD (locking up BTS) and buying more BTS with it.

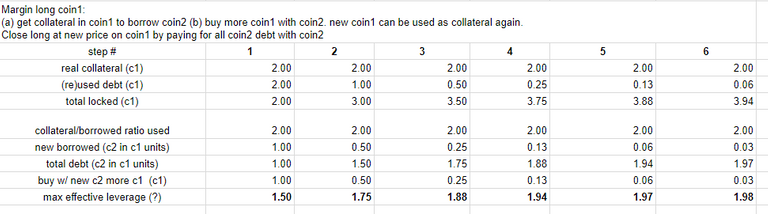

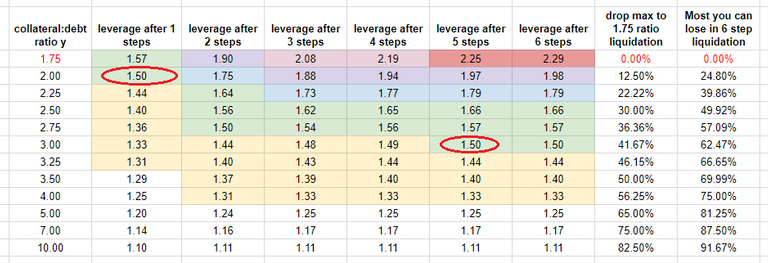

You have to put up more than minimum liquidation 1.75:1 collateral to BTS to do so, so lets say we use 2:1 ratio below which you shouldn't really go. At 2:1 ratio, you effectively have 1.5x leverage on your BTS long (locked BTS + new BTS from selling borrowed bitUSD).

You can re-use that new BTS to borrow bitUSD again and then sell that again with same ratio. Below is a table showing how you can quickly reach 1.98x leverage in 6 steps

Just be careful, if that position is liquidated at 1.75:1 collateral ratio by 12% price drop at 1.98x leverage or as the least collateralized, it will settle your debt by taking it out of the collateral and return the rest of the BTS to you.

Increasing collateral to 2.3:1 collateral to debt ratio, makes the leverage ~1.75x after 6 steps.

For those interested in seeing an comparison between spot position and leveraged position at 1.98x, example here.

So for any collateral:debt ratio you pick in the dex, you can repeat the steps in diagram to get higher effective leverage. Layering magnifies risk and reward but doesn't change tolerance for % drop to liquidation.

Layering effectively allows you to sometimes get same leverage with higher collateral ratio and tolerance for larger % drop in price as riskier lower collateral (e.g circled leverage).

I've also written up a proposal to how a decentralized lending market could be used to achieve the same thing with any pair on the DEX: https://bitsharestalk.org/index.php/topic,24890.0.html - please review it and let me know

That could become useful after they add trustless btc gateway through the witness system to the DEX and even allow margin trading with even higher leverage.

Credit to Permie to introducing me to this concept originally.

Haven't worked up the courage to trade yet. I keep buying BTS though :)

tbh I prefer just buying/selling without margin, but trying to understand mechanics possible on the dex if we ever do implement lending markets

I struggle to see why I would do this, is there an even simpler explanation a available? Is Bitshares a bank? Can someone just borrow money or do we have to take short positions?

This assumes some knowledge of trading terms. New stuff is concept of borrowing on a decentralized exchange.

Why trade with leverage? you can magnify gains and risk by 2x - so more dangerous but also pays better. Additionally, higher leverage helps keep trading and providing liquidity profitable on smaller % changes helping stability - e.g. forex is often 50-100x leverage.

The DEX is interesting because you can actually borrow and move coins you borrow off the exchange. I borrowed a bunch of bitUSD when I thought BTS bottomed out, bought BTC with it, and moved it off exchange. I'll settle the debt in future if BTS is higher (and if not the loss is fine).

Smart contract on BTS blockchain is what holds your BTS as collateral and creates new bitUSD coins - not sure that counts as bank since there's no expectation of returning what you borrow. You can always hit settle on it and destroy the coin to get $1 of BTS out of the contract. If you never return bitUSD, doesn't matter, and you helped reduce supply of BTS increasing its value.

You can borrow bitUSD, and return it later, which will make 0 net difference. Shorting is the act of selling what you borrowed and buying it back at another cost to return later keeping the difference.

shorting a coin can also be thought as margin longing the coin you buy with the borrowed money.

tbh I found it fascinating and people introduced me to concept of stacking these - although have to keep in mind higher leverage = higher losses too.

thx for explanation, so is there no interest anymore for lending the dollar?

Like I saw some old video's which talk about someone lending the dollar and getting bitusd for it + interest versus the other guy borrowing the money and put 200% extra colletaral on it?

Where can I find this info?

I think they used to have interest on the dex, but it's been removed for some older reasons, which I think worked because fiat stable currencies exploded in market cap. right now blockchain can lend you bit* assets for locking up your bts as collateral.

check out the bitcointalk thread, it has lots of info links!

Congratulations @eosfan! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPThis post was very informative thank you for sharing

you have my upvote

Keep smiling, reading, writing and voting!!!

@mannyfig1956

Thanks for sharing this with me on Reddit. Layering, huh? That's crazy. I think I'll start with a simple short sell, but I won't forget about this. :)