Overview of the Statement

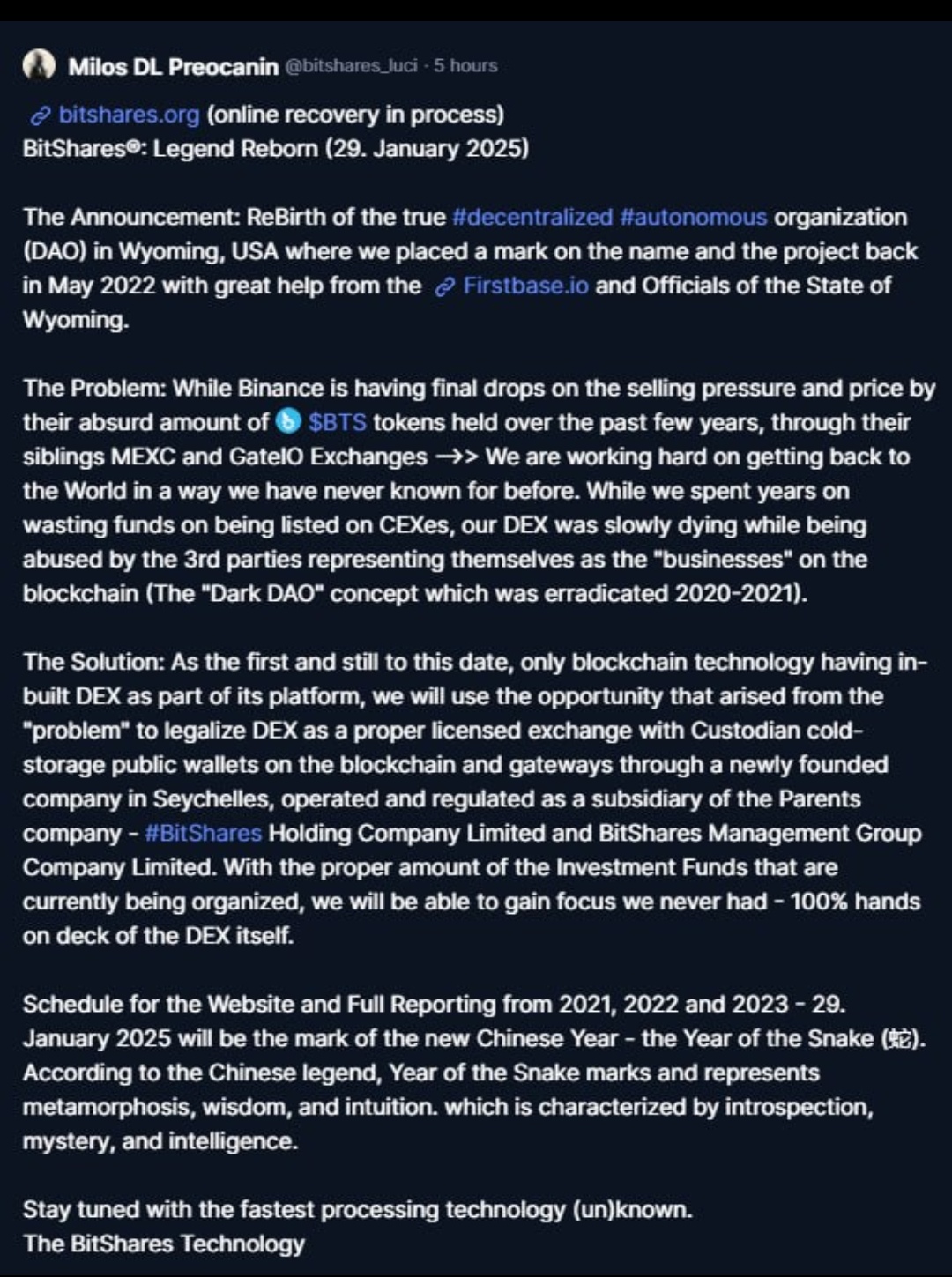

Milos DL Preocanin is promoting the "rebirth" of BitShares, with a relaunch event scheduled for January 29, 2025. He mentions plans to establish a legal and licensed DEX (Decentralized Exchange) under a structured framework involving Seychelles-based companies and a parent company registered in Wyoming, USA. He also touches on historical challenges, the role of centralized exchanges (CEXs) like Binance, and a vision for future growth focused entirely on BitShares' DEX technology.

Key Claims and Analysis

1. Recovery of bitshares.org

- Claim: The website bitshares.org is undergoing recovery.

- Analysis: If true, this is a positive step toward restoring BitShares' online presence. bitshares.org has long been the primary domain associated with the BitShares project. However, the vague term "online recovery" lacks specifics. Transparency in ownership and the exact recovery process will be critical in building trust.

2. BitShares: Legend Reborn (January 29, 2025)

- Claim: A relaunch event is planned, coinciding with the Chinese New Year of the Snake, symbolizing transformation and wisdom.

- Analysis: While the symbolic timing is compelling, the real significance will depend on concrete actions, updates, and deliverables. Promises of transformation are only valuable if paired with transparent development milestones.

3. Legalization and Licensing of the DEX

- Claim: Plans to legalize the DEX with licensed custodial services and gateways under Seychelles jurisdiction, operated by a parent company in Wyoming.

- Analysis:

- Feasibility:

- Seychelles is known for its favorable crypto regulations, making it a realistic jurisdiction for registering such operations.

- Wyoming, USA is progressive in blockchain legislation, especially regarding DAOs (Decentralized Autonomous Organizations).

- Concerns:

- Licensing and legal compliance for DEXs are complex and costly. A clear roadmap, funding transparency, and expert legal advice will be required.

- Without detailed information on the structure, governance, and investor protections, there is potential for skepticism.

- Feasibility:

4. Criticism of Centralized Exchanges (CEXs)

- Claim: Binance, MEXC, and GateIO have suppressed BTS prices due to large holdings.

- Analysis: This aligns with general concerns about how centralized exchanges handle large token reserves. The notion of abandoning reliance on CEXs and focusing on DEX functionality is consistent with BitShares' decentralized ethos. However, blaming price suppression solely on CEXs lacks nuance and ignores internal BitShares challenges.

5. Investment Funds and Operational Focus

- Claim: Investment funds are being organized to focus solely on DEX development.

- Analysis:

- Positive Potential: Dedicated funding for the DEX is a strong initiative if properly managed.

- Risks: Without clear details on where the investment is coming from, how it will be used, and who oversees it, there's a risk of mismanagement or failure to deliver.

6. Past Challenges and Dark DAO

- Claim: The "Dark DAO" was eradicated between 2020-2021, and funds were previously wasted on CEX listings.

- Analysis:

- The history of "Dark DAO" (groups exploiting blockchain governance for selfish interests) is documented in BitShares' community lore. Addressing governance flaws is crucial for BitShares' future.

- The decision to focus on DEX operations rather than CEX listings is a strategic shift that could benefit the project if executed well.

Evaluation of Legitimacy

Background and Credibility of Milos DL Preocanin

- Pros: He claims long-standing involvement in BitShares, including domain ownership, trademark registration, and contributions to governance.

- Cons: His low follower count and limited online presence could raise doubts about his authority. Verifying his claims through third-party sources or established community members is advisable.

Viability of the Plan

- Strengths:

- Aligns with BitShares' decentralized vision.

- Legal structures in Seychelles and Wyoming are plausible.

- Focusing on DEX innovation addresses longstanding issues.

- Weaknesses:

- Lacks specifics on execution, funding, and governance.

- Promises without clear milestones could lead to skepticism.

- Strengths:

Potential for Scam or Mismanagement

- Red Flags:

- Vague language and lack of concrete details.

- Grand promises with no clear roadmap.

- Mitigating Factors:

- Involvement of regulatory jurisdictions (if genuine) could provide oversight.

- Community scrutiny and transparency can help mitigate risks.

- Red Flags:

Conclusion: Is It a Good Idea?

- Potential: The vision for a legally compliant, decentralized BitShares DEX is promising and aligns with current trends in blockchain sovereignty and decentralization.

- Challenges: Success hinges on transparency, detailed execution plans, and trust-building. The community must demand regular updates and clear milestones.

- Recommendation: Approach with cautious optimism. Engage with the community, ask for specifics, and verify claims before fully endorsing or investing.

Next Steps

- Stay Updated: Follow the bitshares.org recovery process and January 29, 2025, developments.

- Community Engagement: Participate in discussions, ask for transparency, and offer feedback.

- Resource for BitShares Users:

- BitShares User Manual: Bitshares - User Manual for essential guidance.

- How to Claim Free Airdrops: How to Get Free Bullion Tokens for opportunities within the BitShares ecosystem.

I wouldn't trust anything milos has to say, he overpromises and never delivers.

Don't forget his abandoned bitshares ui: https://github.com/bitshares/bitshares-community-ui

Plus his management company investment staking programme turned out to be a complete load of shit.

You only need to watch his latest youtube video to understand the level of incompetence we're talking about.