Honest Money. The hero is a stable, fast, appreciating market pegged asset that is backed by the equity of the platform which manages it. No counter party risk like other currencies backed by government debt or gold that may or may not be in a vault. And it grows, by definition, by 5% APR against the dollar.

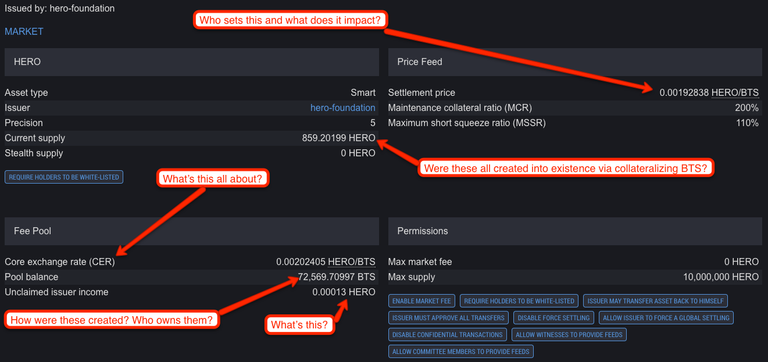

I was reading up about it last night and borrowed 50 into existence, but I'm still not clear on what to do with them. Like bitUSD, it makes sense to sell them for BitShares and as the price of BitShares increases, buy them back cheaper later to close out the position. What I'm still confused on is why I would do this with HERO instead of bitUSD? The document I read makes it sound like you take a 5% haircut for the days you were shorting it. Who does that 5% go to? If HERO doesn't pay interest or dividends, I'm confused on how holders of HERO gain 5%? Is that just built into the settlement smart contract and only materializes if they settle back to BTS? I'm still reading and learning, but it's quite confusing.

The HERO price feeds simply grows by 5% against the USD annually. The HERO will get adopted faster than bitUSD because of this. It's better to not give up the 5% as a shorter, but the market will determine what you can sell bitUSD for if the HERO is available.

So when I run the python script, I get 155.834857014 today. Is this something where I have to run a script each time I want to know what the price should be on a given day? If that's what the price feed / smart contract is based on, then selling HERO for BitShares below that means I'm starting at a loss until the price of BitShares rises high enough to re-buy the HERO I need to close out my margin and selling above that means I'm all good. As of this moment, there's a buy order for 1 HERO at 493.80000 (roughly $150.41148) so that's below the theoretical ideal price. I've written four different posts about shorting USD via bitUSD, but this seems to add another level of complexity that I'm still trying to wrap my head around. I'll keep reading and learning and maybe just put in some sell orders near the price feed to see if there's any takers.

I'm still a little confused on how the settlement works as well. That essentially guarantees you can convert HERO to BitShares at the feed price, correct? Or is that not how it works? I have yet to do a settlement with bitUSD before, so I'm not quite familiar with it.

I wrote some about the theory of HERO recently; my first post suggests that HERO isn't going to work how Stan and company expect, my second digs a bit deeper into why.

Basically, if you're shorting HERO, you need to be aware of the likelihood that HERO should trade on average above its price feed.

Thank you! So if someone does pay fees using HERO, the issuer gets a portion of those fees? Many of the user created assets (like the OPEN stuff) have transaction fee percentages assigned, but I don't see that here. That means there are none, I assume? I'm still a little confused about what the 72k BTS is, but I'm figuring things out slowly but surely. Thanks again for your help!

cool experiment.

Thanks for the tip, I am going to join the challenge. :)

Honest Money. The hero is a stable, fast, appreciating market pegged asset that is backed by the equity of the platform which manages it. No counter party risk like other currencies backed by government debt or gold that may or may not be in a vault. And it grows, by definition, by 5% APR against the dollar.

I was reading up about it last night and borrowed 50 into existence, but I'm still not clear on what to do with them. Like bitUSD, it makes sense to sell them for BitShares and as the price of BitShares increases, buy them back cheaper later to close out the position. What I'm still confused on is why I would do this with HERO instead of bitUSD? The document I read makes it sound like you take a 5% haircut for the days you were shorting it. Who does that 5% go to? If HERO doesn't pay interest or dividends, I'm confused on how holders of HERO gain 5%? Is that just built into the settlement smart contract and only materializes if they settle back to BTS? I'm still reading and learning, but it's quite confusing.

The HERO price feeds simply grows by 5% against the USD annually. The HERO will get adopted faster than bitUSD because of this. It's better to not give up the 5% as a shorter, but the market will determine what you can sell bitUSD for if the HERO is available.

So when I run the python script, I get 155.834857014 today. Is this something where I have to run a script each time I want to know what the price should be on a given day? If that's what the price feed / smart contract is based on, then selling HERO for BitShares below that means I'm starting at a loss until the price of BitShares rises high enough to re-buy the HERO I need to close out my margin and selling above that means I'm all good. As of this moment, there's a buy order for 1 HERO at 493.80000 (roughly $150.41148) so that's below the theoretical ideal price. I've written four different posts about shorting USD via bitUSD, but this seems to add another level of complexity that I'm still trying to wrap my head around. I'll keep reading and learning and maybe just put in some sell orders near the price feed to see if there's any takers.

I'm still a little confused on how the settlement works as well. That essentially guarantees you can convert HERO to BitShares at the feed price, correct? Or is that not how it works? I have yet to do a settlement with bitUSD before, so I'm not quite familiar with it.

I wrote some about the theory of HERO recently; my first post suggests that HERO isn't going to work how Stan and company expect, my second digs a bit deeper into why.

Basically, if you're shorting HERO, you need to be aware of the likelihood that HERO should trade on average above its price feed.

Thank you! I'll do some further reading.

I think the HERO concept is interesting, but it contains some weird little hidden risks that stan never mentions.

More questions, if you're willing:

Thank you! So if someone does pay fees using HERO, the issuer gets a portion of those fees? Many of the user created assets (like the OPEN stuff) have transaction fee percentages assigned, but I don't see that here. That means there are none, I assume? I'm still a little confused about what the 72k BTS is, but I'm figuring things out slowly but surely. Thanks again for your help!

No - fees go to referral system and reserve pool.

Thanks Stan for what you are doing :)