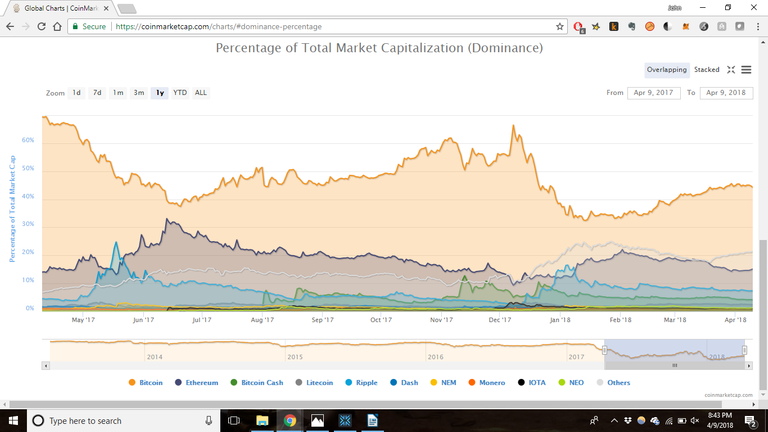

Crypto markets are heading towards saturation – with a predictable result. After 2017 witnessed a token offering bonanza, it is no longer interesting to mention that a business has incorporated some token into its revenue model (unless it is truly revolutionary and escaped public attention before now). The next step in market evolution is differentiation. An opportunity for functional projects delivering real-world value to separate from the vaporware and take a lions’ share of the outstanding market capitalization (number of coins outstanding multiplied by market price). This is a graph of coin market value relative to Bitcoin, sometimes called a Bitcoin Dominance Chart.

It is clear Bitcoin remains well past one billion USD but a pack of followers are establishing themselves above the critical threshold. One billion USD as a representation of total network capitalization is a blunt instrument for measuring total value. But it is 2018 and “coinmarketcap” has become a measuring stick to many cryptoasset investors.

In fact, only 20 coins have a total market capitalization (as calculated on coinmarketcap.com). This may be a signal that the broader market is maturing in a sense and offering more discipline to market participants. There are no Graphene based chains among those coins over one billion USD. Let that sink in.

What are your thoughts on implementing index funds (of various types) in crypto land? Do you think there would be any purpose in creating a value weighted index fund that excluded BTC in its holdings entirely? I guess it ultimately comes down to how you plan to seek value (i.e.are you playing the Satoshi or fiat game).

Exactly as you say it depends what is the denominator - satoshi or dollars and cents. I think an index fund has real potential as the market matures and a smaller group of DAOs/DACs establish some "Blue Chip" status similar to US equities. An index of the steady horses would be likely perform very well.

I was thinking something along the lines of this. Although this is 'index' is bit biased as it is purely meant as an example. Lemme know what you think.

I see what you are saying. Also have you considered a "small cap" and "large cap" separate indices? I believe all the coins on the chart above are promising, especially VTC, the volatility on the sub-billion dollar mkt cap coins may drown out some of the results.

Truly interesting @john-robert. Hope everything will all favor in our way in this crypto market. Shalom man

some question...

All additional coins being added almost on a daily basis, has the cryptocurrency space become saturated?

Is this continued growth sustainable and manageable?

Congratulations @john-robert! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPI am agreed with you.

Thanks for your informative post.

Nice shearing.

Happy Steeming.