90 countries and large financial institutions with blockchain technology to secure transactions and increase their speed, but the potential benefits of this technology is not limited to developed economies and rich countries, but also extends to developing countries, such as facilitating remittances and improve funding opportunities and mechanisms of verification.

blockchain offers a safe, cheap and transparent way to record transactions between parties who do not know each other and may not trust each other without fear of fraud or theft. A distributed database between many devices and across the world is a public bulletin board that everyone can add to without changing or canceling records. Digital currencies are best known for their applications in different fields.

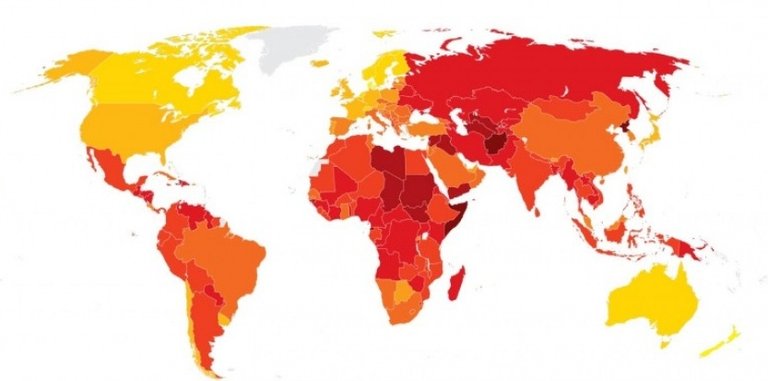

امCurrently, blockchain services are available in developed countries thanks to strong regulations to protect bank depositors' funds and laws governing compliance with official contracts. In contrast, the developing world often lacks similar laws and therefore services are absent or available at a higher cost than the majority. For example, in some African countries, banks are required to open a deposit account in excess of the annual income of the average person.

Given the underlying rules of blockchain on transaction documentation and security, it will allow the retention of any security and confidentiality funds. In developing countries, the main benefits of blockchain are four main aspects: financial transfers, insurance, small business support, and identity verification.

Remittances are a key factor in supporting the financial well-being of families and communities. In 2016, overseas workers sent $ 442 billion to their families in their home countries. In fact, remittances require high fees; in 2015 international remittance charges ranged from 10.96% for bank transfers and 6.36% for remittance services. Companies and banks say the high costs are for reliable and convenient services.

In Hong Kong, Bitspark's money transfer service relies on Block Qin technology, charging a much lower fee of about $ 2 for amounts below $ 150 and 1% of the value of larger conversions. The company uses secure digital communications that allow it to bypass existing banking networks and traditional remittance systems. Similar services to send money to the Philippines, Ghana, Zimbabwe, Uganda, Sierra Leone and Rwanda cost less than current bank fees.

Blockchain systems can prevent fraud and expose any attempt to cheat and reduce costs. In Mexico, Consuelo Insurance operates through a mobile payment service, through which subscribers pay health and life insurance premiums, and claims are electronically verified and paid promptly.

Small businesses often suffer from the lack of cash needed to continue their business, while banks refuse to lend money because of fears of fraud, stumbling, and errors in financial records. Block Qin's systems help soothe these fears because of record-keeping and impossibility of changing records.

In China, the Yijan system relies on Block Qin technology to help drug distribution companies address the banking system's shortcomings and secure the capital needed for its work, and is the result of cooperation between IBM and a Chinese supply chain management company.

Building Blocks project of the World Food Program

WFP implemented the Building Blocks project in Sindh province in Pakistan to document the distribution of cash assistance using blockchain technology

The prospects of using Plocken in developing countries and emerging economies include their contribution to improving the distribution of humanitarian assistance. Corruption, discrimination, mismanagement and fraud often hinder access to aid for those who are entitled to poverty alleviation, education and health care.

Earlier this year, the United Nations World Food Program (WFP) launched the first phase of a project that uses Block Qin to document food and cash assistance in Pakistan to ensure that food vendors receive their dues, receive subsidies to recipients and maintain aid funds.

WFP expects the blockchain to reduce operating costs from 3.5 to 1 percent, accelerate aid to remote areas and a cyclone that may lack ATMs and where banks do not operate normally. In some cases, digital currencies may be a substitute for scarce cash and allow relief organizations, residents and traders to exchange funds electronically.

Moreover, blockchain facilitates "contributing to aid efforts. For example, the South African Usizo platform allows donations to pay electricity bills for community schools. Donors can monitor the electricity consumption of schools and calculate the amount of energy their donation will provide and pay through bitcoin. "

In the future, blockchain may help provide a simple and reliable identification and verification mechanism. At present, 1.5 billion people or 20% of the world's population lack identity documents, limiting their access to basic rights such as education, health care, voting, travel and their access to banking services . Companies and initiatives have begun to look into using the Block Qin system to register and examine identities, which will facilitate the daily lives of millions and expand opportunities for them

Follow me @abdellkarim for daily reports!Follow @abdellkarim for daily reports!Follow @abdellkarim for daily reports!

I have long believed this is one of the best use cases for bitcoin. The ability to have a monetary system without a middle man is a game changer!

It most certainly can. And here is how.