Global remittance of funds is one of the challenges faced by many individuals and companies around the world. It has become evident that the cross-border remittance industry is literally on the lowest ebb, and needs some propping to get to the desired height. On the other hand, the lending aspect of the global economy is not in the best form, as the investors and borrowers are saddled with many challenges.

As expected, blockchain technology has some features in place to address some of the challenges in the global cross-border remittance industry. The varieties features in place are designed via the Pngme blockchain platform, which doubles as an alternative platform for facilitating transactions around the world.

The Concept Behind Pngme

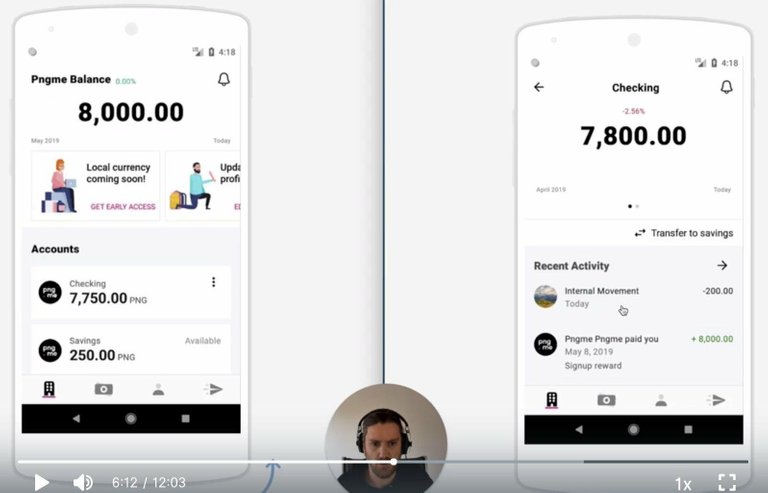

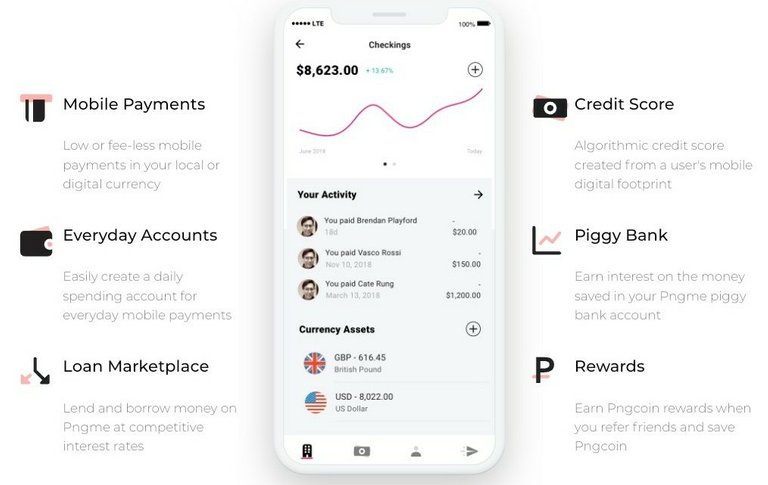

The world is already battling in all financial fronts. From the high costs associated with sending money across the borders to the slow pace of the transactions, it has become imperative to have an alternative platform for cross-border remittances. Those and many more are part of the features prominent in the Pngme blockchain. The platform aims to be the primary blockchain platform for sending money across the world in good time, and at affordable costs.

So, if you’ve been having a hard time with cross-border remittances/transactions or you want hassle-free financial transactions (lending and borrowing notably), then it’s about time you make use of the Pngme blockchain platform to bolster your efforts.

Excellent Credit Scoring

Pngme has a dedicated credit scoring model that works based on algorithms. That way, it can gain clarity into the activities of the borrowers. Therefore, if a borrower is a serial defaulter in terms of paying back loans in good time, then the credit score model would highlight that for lenders to be sure of the borrowers' activities before issuing another loan to the latter.

The credit scoring model is also extended to other participants in the broader Pngme ecosystem. Some of those are Micro, Small, and Medium Enterprises (MSMEs) Mobile Money Networks, Digital Asset Hedge Funds, and MFIs.

On the other hand, the hybrid credit score model of the Pngme platform is there to empower potential borrowers without a formal credit score or who have low credit scores. Through this medium, they can access cost-effective loans, which are issued by Mobile Money Networks and MFIs.

Reduced Costs

Contrary to the conventional high fees associated with the loaning niche, the Pngme platform created an alternative approach, which is the reduction of the lending rates. In this instance, the platform uses the dedicated decentralized marketplace on a reverse auction model. That, in turn, empowers other market participants and lenders to repurchase the loans hitherto acquired by the borrowers. The aim of buying back is to help the borrower repay off the loan, while they (the re-buyers) get to buy the loans at competitive rates using the details from the credit score as mapped on the transparent digital bond of the platform.

Final Words

Gaining access to financial instruments just got the better courtesy of the decentralized and alternative lending platform instituted by the Pngme blockchain. Therefore, take advantage of the working features of the platform to take your financial transactions to the next level.

visit useful pngme project links for updates

Website

BITCOINTALKANN

Telegram

Twitter

Medium

Congratulations @abdulbc! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!