Dear Community,

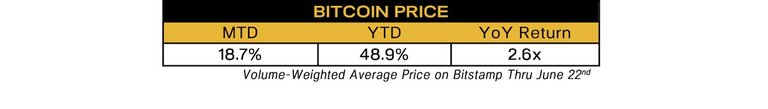

Bitcoin’s volume-weighted price on the Bitstamp exchange has risen 18.7% month-to-date thru June 22nd. Year-to-date, bitcoin has appreciated 48.9%. An investment one year ago would return 2.6 times ones’ investment.

BITCOIN PRICE SURGE

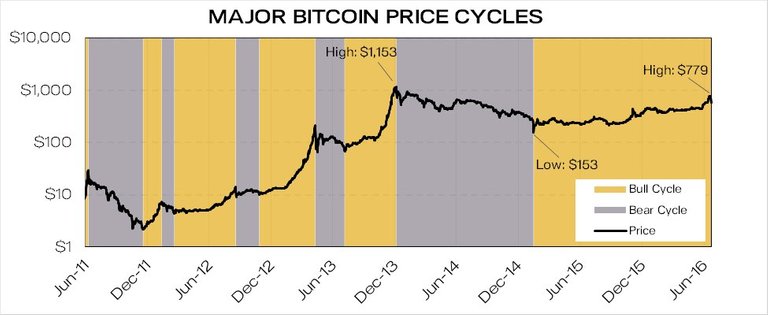

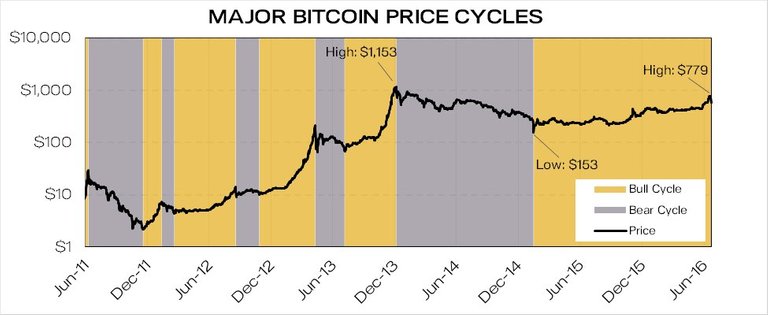

The price of bitcoin has increased steadily over the past 18 months — marking the longest bull run in bitcoin price history.

Since hitting a low of $153 on January 14, 2015, bitcoin has appreciated 409% to the recent high price of $779 /BTC. As can be seen in the chart above, bitcoin appreciation has been more gradual than in past cycles. We feel that this is a reflection of the maturation of the bitcoin ecosystem and breadth of ownership.

The price appreciation may be entering a more sustainable price cycle in which price appreciates with fundamentals in a more gradual and less speculative manner.

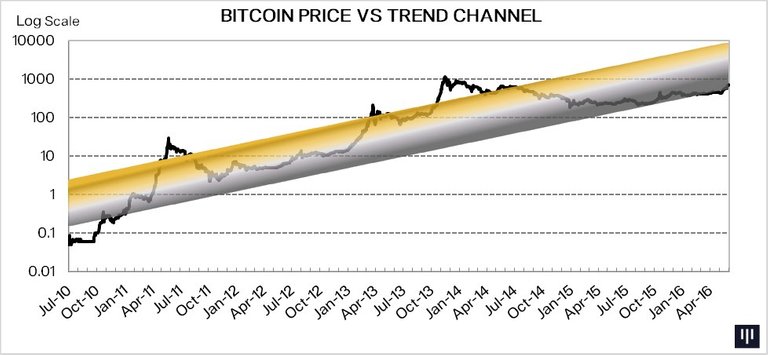

When a logarithmic regression is applied there are only very brief periods when the price is outside the bands. Late 2013 clearly one such bubbly period.

The very consistent exponential price appreciation has kept bitcoin just on the bottom of the regression channel since the bubble unwind. Kinda feels like a surfer pined to the ocean floor by a huge wave. Now that the repercussions of 2013’s 83x year-on-year wave have subsided, maybe it’s time to resurface?

PRICE FOLLOWING FUNDAMENTALS

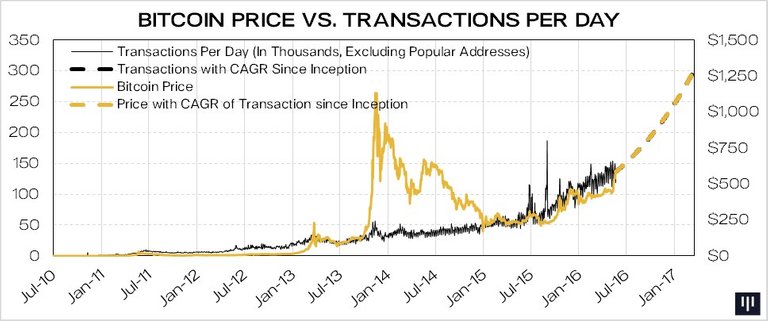

One of our favored metrics for developing our price expectations is to regress the price of bitcoin against the number of bitcoin transactions per day. We feel that this fundamental metric best correlates to the long-term demand for bitcoin. Apart from the speculative surge in 2013, the price of bitcoin has closely followed the growth in daily transactions.

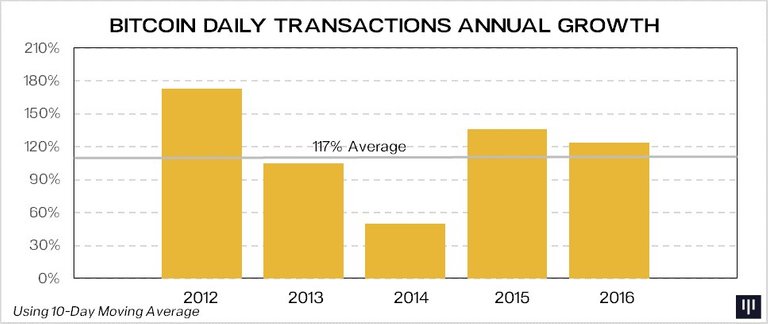

The actual use of bitcoin has seen relatively consistent exponential growth over the past five years. This consistent growth has likely contributed to the decrease in price volatility. The below chart displays the growth rates of transactions per day in each of the past five years. Transactions for 2016 have been annualized based on the growth rate year-to-date. The growth rate has averaged 117%.

NEW HIGHS

For those scoring at home, there are a few perspectives on when we’ve reached a new high. The peak bitcoin price was $1,153.27 on Bitstamp on December 4, 2013. Who knows when that price will be breached.

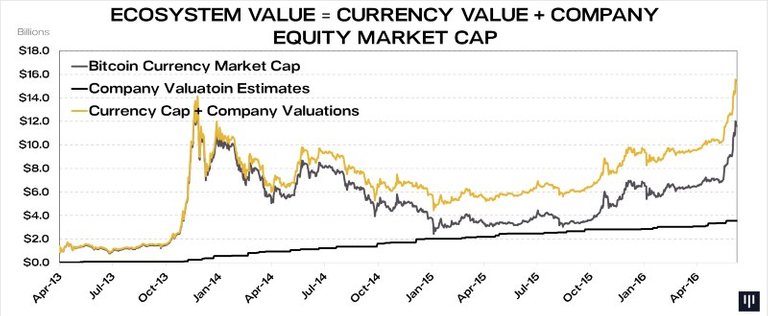

At the time there were 12.1 mm bitcoins in circulation. At the peak the market capitalization of bitcoin was $13.9 bn. Today there are 15.7 mm bitcoins in circulation. At the recent highs — $778 /BTC — the market capitalization was $12.2 bn. A 14% rally to $886 would be required to reach a new high in market capitalization/money stock value.

Back in 2013, bitcoin itself was the main way to get exposure to the blockchain ecosystem. Only $237 million had been invested in venture companies in the space. The sum of the two — the total value of the bitcoin ecosystem was $14.2 bn.

Two and a half years later the market cap of the companies in the blockchain ecosystem is $3.5 bn. The value of the entire bitcoin ecosystem has already hit a new record high: the currency/protocol is worth $12.2 bn and the companies using the protocol are worth $3.5 bn. The total value of the bitcoin ecosystem is now $15.7 bn — well above its value in December 2013.

In addition to exponential growth in transactions, several other factors have amplified the recent surge:

Wall Street

Financial institutions and corporations have changed from standoff-ish to extremely interested — directly investing into startups, creating research and development labs focused on testing blockchain technologies and use-cases, and partnering with blockchain startups for paid pilots.

Regulation

Regulators are embracing bitcoin. Circle was the first company to receive the BitLicense from the state of New York. Ripple Labs just become the second company to receive the BitLicense. In Europe, Bitstamp became the first nationally-regulated Bitcoin exchange by becoming licensed in Luxembourg and in turn should be able to passport this license to cover the rest of the European Union.

“The Halving” — Money Supply Will Be Cut In Half

The Bitcoin code states a total of 21 million coins will be released and how the supply of new coins will decrease over time. Starting sometime in July, the mining reward will decrease from 25 BTC per block to 12.5 BTC per block, thus referred to as “the halving”. Some argue that as the demand for bitcoins stays constant and the supply of new bitcoins is cut in half will force the price up. The theory is that there will be a demand surge for bitcoin right before the halving event because of the anticipation of a price increase.

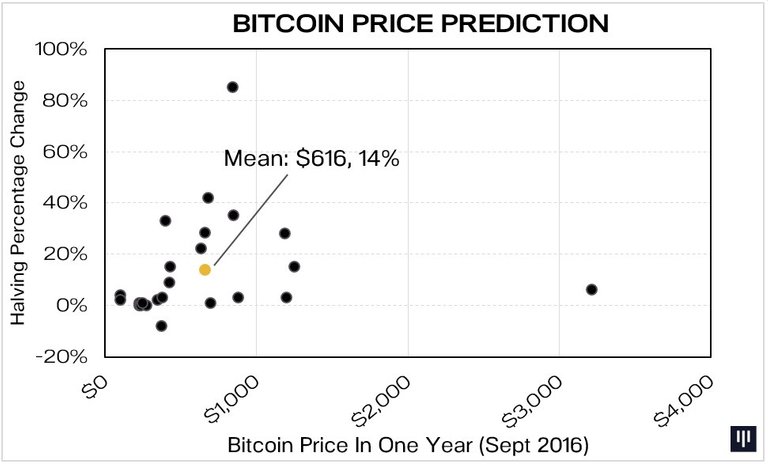

At our Bitcoin Pacifica conference in September 2015 we got the illuminatis’ guesses as to the future price of bitcoin in a year’s time and the impact of the halving.

Bitcoin was trading at $233 /BTC on September 18, 2015. The median forecast was for a 164% rally to $616 /BTC. Pretty dang close to today’s level. Hopefully the guy who predicted $3,200 wins the bet.

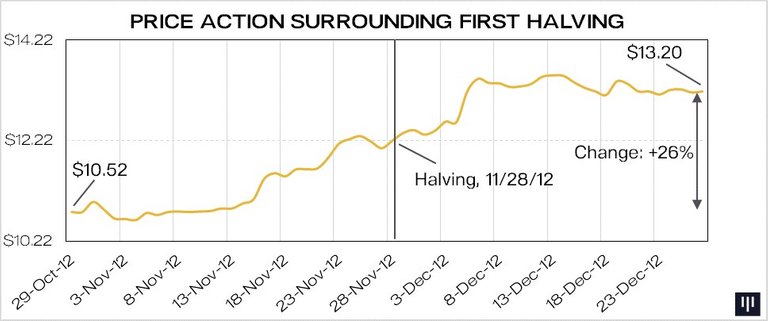

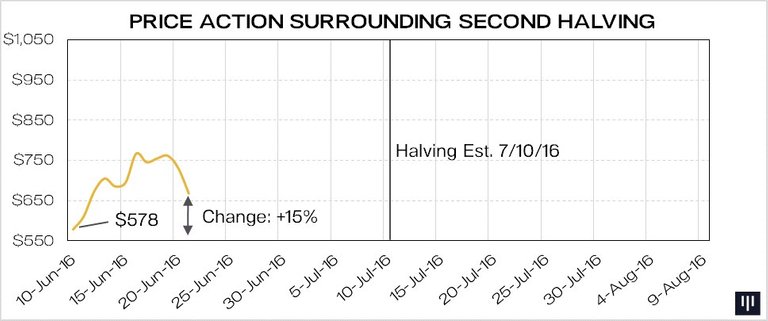

The other bet was on the change in the price of bitcoin over the halving — specifically, from one month prior to the halving to one month after. For reference, the price of bitcoin increased 26% over a similar period during the first halving in late 2012. The median forecast was a 14% increase. This is pretty spot on — so far. The price is up 15% since June 10th — a month before the halving on July 10th.

China Economic Uncertainty

Chinese investors are in search of safer asset classes to store their wealth. The Chinese stock market has been weak since last September. Their currency, the Yuan, is devaluing. Their banks are burdened with shaky debt. The policy environment has been fairly tolerant and is being accepted by academic and financial institutions. Even China’s central bank, the People’s Bank of China, is discussing blockchain. Proof that the Chinese are pushing the price higher is that bitcoin has been trading at a 7% premium compared to global exchanges.

BITCOIN AS A NEW ASSET CLASS

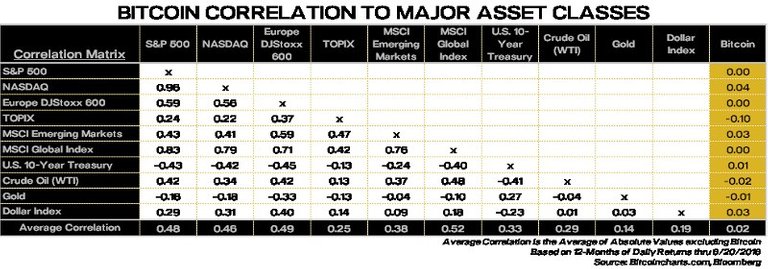

Although nobody has a “Bitcoin” box to check on their investment program yet, they will. It’s a new asset class with fantastic portfolio theory properties — very high risk-adjusted return and absolutely no correlation to other major asset classes.

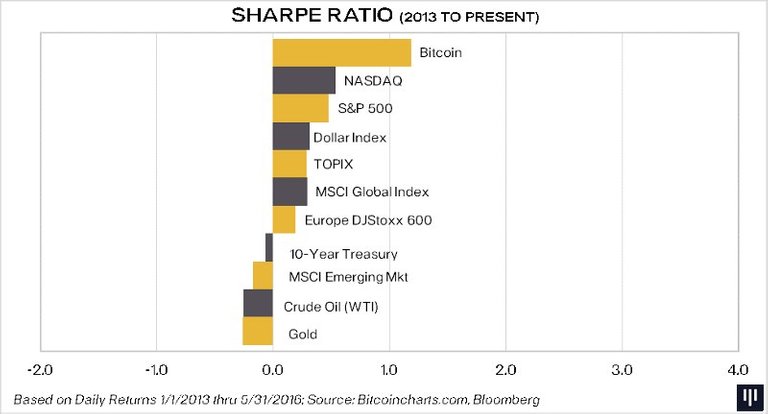

On a risk-adjusted basis bitcoin has been the best performing asset when compared to other major asset classes. The Sharpe ratio normalizes return relative to volatility. Although bitcoin’s volatility has been higher than many asset classes, the returns have more than compensated for the risk. Bitcoin has had a Sharpe ratio more than double all major asset classes.

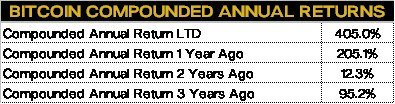

Holders of bitcoin do have to endure heightened volatility; however, they have been rewarded for that risk with outsized returns. The below table shows the compounded annual return over multiple time periods.

In addition to superior risk-adjusted returns compared to other major asset classes, bitcoin is almost totally uncorrelated to every other asset class. Bitcoin would provide return and diversification benefits when added to a portfolio. This is especially true in an era when most assets are highly correlated — “risk on/risk off” world.

THE DAO OF ETHEREUM — By Steve Waterhouse

Bitcoin was originally conceived in 2008 in a white paper. The first version of the Bitcoin codebase was released in January 2009. The last seven years has seen many changes, including revisions to the code base as bugs have been found and scalability concerns addressed. Over the last year a fierce debate has raged over how to move Bitcoin forward, all centered around the size of a block — which currently sits at 1MB. Changing the block size would require a “fork” in the code base — in which all participants of the network would be required to upgrade their software in order for their transactions to be valid and accepted. The arguments have reached such frenzy at times that they have led to resignations of key developers and strong words exchanged in public forums. Proponents of a larger block size point to the congestion in the Bitcoin network and the desire for extra functionality in the Bitcoin blockchain.

Over the last year, driven partly by the uncertainty around Bitcoin, an alternative blockchain has emerged as a strong contender to Bitcoin. Ethereum was originally conceived in late 2013 by Vitalik Buterin. In contrast to Bitcoin’s simple blockchain which could be compared to a read-only spreadsheet, Ethereum allows arbitrary computations to be performed in its blockchain, called “smart contracts.” Smart contracts are written in a new programming language “Solidity” which is similar in form to javascript.

Ethereum smart contracts have many interesting applications and have captured the imagination of developers, corporations, and investors. Many of Pantera’s portfolio companies are using Ethereum in their blockchain development and we have been a supporter of the concept since its inception, but with some ongoing concerns over security and scalability.

In 2016 a great deal of attention was brought to Ethereum — initially with a strong rise in its market cap from $60mm in Jan 2016 to over $1bn by May 2016. In April 2016 a new project was launched on Ethereum — “The DAO” or “Decentralized Autonomous Organization”. This was originally conceived as a way for a specific project — “Slockit” which was developing a smart lock which could be remotely controlled using smart contracts — to raise money. The DAO evolved beyond this concept and became a general purpose fund in which the investors had a vote in which projects received investment.

By 21st May 2016 the DAO had raised over $150m and attracted 11,000 investors and significant attention. The DAO raised several questions about how such an organization would conduct itself. In addition in May 2016 a paper was published noting several security vulnerabilities and recommending that investors hold off before the vulnerabilities could be resolved. Further attention was brought to these and other vulnerabilities in June 2016 and fixes developed.

Before the fixes could be voted in and adopted however, a developer / “attacker” published a smart contract which drained $50m from the DAO into a separate “child DAO”. Because of an unforeseen issue in the DAO codebase the attacker was able to call a function to withdraw ether from the DAO which unfortunately recursively called itself again — thus withdrawing more and more ether every time it was called.

If this sounds complicated — it is — but thats the problem with developing new programming languages and virtual machines — its hard. In a future version of Etherum we might have a validating complier which checked for weaknesses such as this, but in general every time we push for more functionality in Blockchains we run into potential issues like this.

The “stolen” funds are still in question right now. The child DAO cannot have its ether withdrawn for 27 days so there is some time to figure out a solution. Proposals include:

Forking the entire Ethereum codebase (see earlier comments about Bitcoin forks) which is essentially putting the entire principle of Ethereum of being contracts without people, just code, into question. This would also shut down the DAO forever and return funds to the investors.

Allowing the attacker to keep the funds — which is complex because 11% of all the Ethers were invested in the DAO and many insiders invested in the project. This would allow the DAO to keep going with its mission however, albeit with reduced funds.

Clearly option (1) is a challenge for Ethereum in general as a platform. By upgrading the network just to return some funds to investors in the DAO calls into question the entire principle of Ethereum and sets a precedent for future situations where a judge or lawyers may use the same principle to override a smart contract which is supposed to run only on code.

Excerpt From Attacker’s Statement

I am disappointed by those who are characterizing the use of this intentional feature as “theft”. I am making use of this explicitly coded feature as per the smart contract terms and my law firm has advised me that my action is fully compliant with United States criminal and tort law. For reference please review the terms of the DAO:

“The terms of The DAO Creation are set forth in the smart contract code existing on the Ethereum blockchain at 0xbb9bc244d798123fde783fcc1c72d3bb8c189413. Nothing in this explanation of terms or in any other document or communication may modify or add any additional obligations or guarantees beyond those set forth in The DAO’s code. Any and all explanatory terms or descriptions are merely offered for educational purposes and do not supercede or modify the express terms of The DAO’s code set forth on the blockchain; to the extent you believe there to be any conflict or discrepancy between the descriptions offered here and the functionality of The DAO’s code at 0xbb9bc244d798123fde783fcc1c72d3bb8c189413, The DAO’s code controls and sets forth all terms of The DAO Creation.”

A soft or hard fork would amount to seizure of my legitimate and rightful ether, claimed legally through the terms of a smart contract. Such fork would permanently and irrevocably ruin all confidence in not only Ethereum but also in the field of smart contracts and blockchain technology.”

Peter Van Valkenburgh, Director of Research, Coin Center:

“DAOs are an important experiment in community governance — governance by code rather than law or norms. Experiments come with risks and rewards and we only learn from the process by letting them run, succeed or fail.”

“It looks like The DAO is failing, but there are some bright spots and the community is already learning critical lessons.”

“For one thing, it’s good to see that delays were built into the code so that even though funds are being “stolen,” they are stuck in limbo for at least 27 days because of the code that governs the system. That will give the community of users, miners, and developers time to decide what to do. It could mean that we accept the loss, or that changes are made to Ethereum’s protocol to return the funds. But those decisions will be made by a decentralized community that votes.”

“This is a laboratory for community governance, and it won’t always be pretty. But it’s important we let the process play out, and take a longer view of the evolution of these fantastic new tools.”

PANTERA PUBLICATIONS

You can subscribe to our publications by visiting www.panteracapital.com/subscribe or by e-mailing [email protected]:

· Blockchain Letter: a monthly letter with our thoughts on significant market and ecosystem-related developments. Also includes our thoughts on blockchain venture capital and news on our portfolio companies for accredited investors.

· Blockchain Investor Letter: Public Letter plus exclusive information for accredited investors.

· White Papers: periodic, original blockchain research and academic papers.

· Portfolio Company Profiles: inside looks into some of our portfolio companies, featuring our general perspectives in addition to overviews of each company’s industry positioning.

Our content is publicly available at www.panteracapital.com/research. However, the SEC mandates that only accredited investors can access certain information. If you are an accredited investor, register here to access restricted content.

We tweet Bitcoin news and insights on Twitter and Medium at @PanteraCapital and @Dan_Pantera.

We tweet Bitcoin news and insights on Twitter and Medium at @PanteraCapital and @Dan_Pantera.

Hi! I am a content-detection robot. This post is to help manual curators; I have NOT flagged you.

Here is similar content:

NOTE: I cannot tell if you are the author, so ensure you have proper verification in your post (or in a reply to me), for humans to check! http://bestthenews.com/article/price-surge-dao-hack-analysis-bitcoin-letter-june-2016-mon-06272016-1355.html

Hi!