As bureaucratic and parochial modus operandi of the centralized businesses system keep losing its grip to Satoshi Nakamoto superb idea of decentralized business system by the day. As the continuous wide spread adoption of Blockchain technology advances, the fertile it becomes for the businesses world.

In spite of the booming of crypto-businesses; the banking/financial sector are left behind because of the absent of a Blockchain technology platform to render banking services which will be different from traditional bank mode of operation. Here comes a goodnews, the first cryptocurrency banking platform is in town “Distributed Credit Chain Banking”; the pacesetter. The monopoly of traditional banking era is over. The platform with high technology and technical know is here to revolutionalizes the banking system through Blockchain technology. https://dcc.finance/

What is Distributed Credit Chain banking?

Distributed Credit Chain is the first Blockchain technology banking platform that makes banking services available for the ecosystem members. The activities of Distributed banking operate on a Fintect which is perfect technology for the cryptocurrency banking operations. Distributed Banking covers the following: distributed credit reporting, debt registration, wealth management, asset transactions etc. The unifying of loan seekers and the provider is a key part of Distributed banking.

The concept of Distributed Banking

Distributed Banking aim is to break the monopolization of traditional financial institutions by rendering just banking services to the providers and sundries in the ecosystem, so that all grows together.

Distributed Banking will make traditional banking's debt, asset, and intermediary business structure through by replacing liability business with distributed wealth management, replacing asset business with distributed credit reporting, debt registration and replacing intermediary business with distributed asset transaction with. Distributed banking will change tree-like management structure of the traditional bank into the flat structure of DCC platform.

Through Blockchain technology DCC will operate a decentralize system (peer-to-peer), across all regions, sectors, subjects and accounts; thereby eliminate traditional financial system banking.

Problem solving diagram of DCC

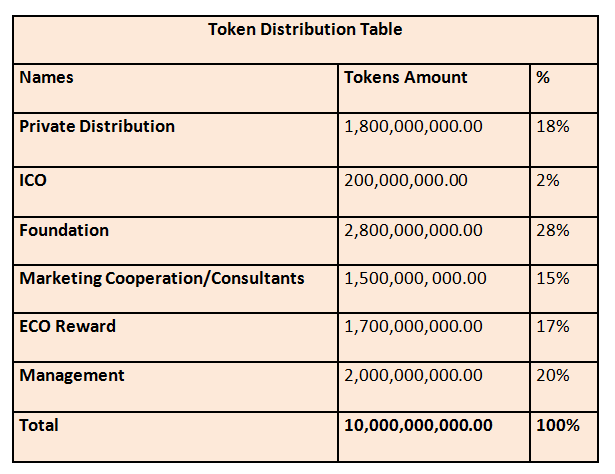

Token Production and Distribution Plan

Token Production

Total token Production 10,000,000,000.00

Notable Distributed Credit Chain Bank Partners and their brief profiles

TONGNIU Tech

TN Tech is the leading SaaS financial technology company in China. It is committed to providing consumer finance SaaS system services to licensed financial institutions such as trusts, banks, and small loan companies. TN Tech ranks first in China in trust industry market share. In the process of building the Distributed Credit Chain, TN Tech will provide historical credit data application support for historically accumulated data.

JUZIX

JUZIX is the global leader in distributed ledger technology and is committed to providing distributed data exchange and collaborative computing services in the digital age. Providing a full range of governance services for the flow of data, it makes data exchange and collaboration easier, safer and more efficient.

Based on a completely self-developed data exchange infrastructure technology platform, JUZIX integrates distributed ledgers, secure multi-party computing, pluggable cryptography frameworks, future-proof cryptography algorithms and protocols, and software and hardware-in-one solutions. It provides basic technical platform-level services in the fields of finance, transportation, logistics, aviation services, intelligent manufacturing, internet of things, HealthCare and other fields. It also fully cooperates with the world's leading cloud platforms to provide a complete solution for distributed industrial applications.

As an important technical service provider in the DCC consortium chain stage, JUZIX will provide comprehensive technical support in the construction phase of the consortium chain.

Deepfin

Deepfin is a decentralized blockchain-based asset securitization platform. In Deepfin, holders of digital assets (e.g., copyrights, articles, traffic, etc.) on different strands can easily complete asset collateralization and fundraising and use different quantitative analysis tools and services to price different assets on different strands, opening up digital assets in different chains so that users with financing needs in disparate communities can easily obtain financing through the digital assets they own. Using the blockchain technology to transform traditional ABS business can accomplish with low cost and high efficiency asset ownership, data validation, and other authenticity validation work.

WXY

A one-stop global marketing and business consulting services platform for highly valuable digital projects, WXY is headquartered in Singapore and its business covers brand names, media promotion, global traffic access, business consulting, capital interfacing, and more. WXY is comprised of former Ogilvy & Mather executives, former vice presidents of the Krypton market, former Citigroup marketing and finance investment banking executives, core resources such as media and funds, and is the most formal and professional marketing platform in today's currency market.

To know more about Distributed Credit Chain banking, visit the addresses below:

Website: https://dcc.finance/

Whitepaper: https://dcc.finance/file/DCCwhitepaper.pdf

Facebook: https://www.facebook.com/DccOfficial2018/

Twitter: https://twitter.com/DccOfficial2018/

Telegram: https://t.me/DccOfficial

Bitcointalk Link: https://bitcointalk.org/index.php?action=profile;u=2200061

Please give me a follow and I will give you a follow in return and possible future votes!

Thank you in advance!✅ @april08, I gave you an upvote on your post!