History tells us that every great wave of transformative innovations is accompanied by a financial mania leading to a financial meltdown. The beginning of the 20th century, had seen the widespread of an amazing range of technological innovations including radio, automobiles (ford's model T), aviation and the deployment of electrical power grids. The huge interest and speculative activity surrounding these technological breakthroughs, leaded the American stocks market to a big bubble in the 1920s which sadly burst in October 1929(Black Tuesday) triggering then the Great Depression (1929-39). Throughout that century, the same situation was recurrent and the list ended with the Dot-com bubble. In every bubble instance, the pattern was the same a disruptive technology creates a set of risky startups and ignite the vicious cycle: Boom, bubble, bust and resurrection. Whereas, the investors get excited and rush in to buy a piece of the future, before all ends in tears, bankruptcies, foreclosures and stock market immolation.

Bubbles:

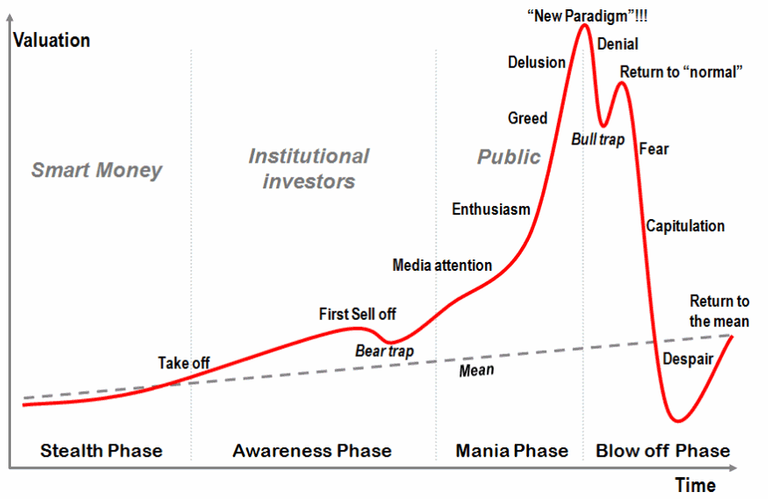

The historical wave of disruptive technologies continues with the emergence of the blockchain and the cryptocurrencies. Since 2015, we live in a boom of these technologies, which changes the financial landscape by building a parallel finance (crypto-finance). this new finance is irregulated, uncontrolled and without without neither bailout programs nor banks. In the recent two years, People get excited about the bitcoin’s price surge and the widespread adoption of the blockchain, thus many ICOs (initial coin offering) and funds rise took place with millions of dollars accompanied by a huge media coverage. This massive enthusiasm put us in the verge of the mania phase in a bubble lifetime.

fig. The bubble phases chart of Hofstra University's Jean-Paul Rodrigue

Undoubtedly, bitcoin is the success key of the blockchain industry and ironically it may become the key of its ‘failure’. the cryptocurrency world and the attractiveness of the blockchain are tightly correlated, who says that bitcoin may fall and the blockchain survive and thrive might be mistaken. The trust ensured technically by the blockchain is at his turn buttressed by the economic model of the bitcoin and other cryptocurrencies in a complex way, a kind of yin-yang. When this underpinning economic model melt down by a bubble burst, the trust in the technology behind will be hardly impacted and your business too.

To avoid all the risks of a sharp bubble burst we need to learn all the lessons we can get from the e-commerce and dotcom bubble to figure out the path ahead. while, there is a big resemblance between the internet bubble and the possible blockchain bubble . The dot-com bubble Started around 1997 and burst in 2002, The dot-com bubble is a big lesson that people tend to forget. As the name suggested, the dot-com bubble evolves from a speculative investment in the internet companies. Back in 95, Netscape launched its improbable and widely successful IPO (initial public offerings) on the stock market, a year later came the IPOS of search engine companies such as Yahoo. Afterward, the amazon IPO took place in 1997 and the Theglobe in 1998, pushing the web boom in the direction of a bubble. People thought it is a tremendous new model and these companies are going to grow so quickly. As an example, amazon was called the earth's biggest bookstore and people hyped its potential to the sky. Worst, the investors were so excited about the internet at the level they invested in any tech company, with a pulse they didn’t care if the company is profitable or not.

Over evaluation:

The hot IPO markets misallocate investment funds to areas dictated by speculative trends, rather than to enterprises generating longstanding economic value. After the amazon IPO, the shares prices double continuously from 2$ to reach its zenith (about 100$) in a year. Suddenly after the start of maniac bubble, millions of people stamped to their brokers snapping up shares in any company with a dot com attached to its name (something.com) fuelling the wildest specular frenzy. Typically, when there is an overabundance of IPOs in a bubble market, a large portion of the IPO companies fail completely, never achieve what is promised to the investors, or can even be vehicles for fraud.

fig. Amazon's stock price evolution 97-2008

After the burst, we have seen companies goes from market cap of 300M$ to 0$ within less a year. However, there was some success story like amazon who goes from 100$/share(bubble) in the bubble peak to 7$/share after the “burst” but it climbed back up to 00$/share (resurrection).

Empower user:

Among all the forces were propelling the dot-com boom, none was more profound than democratization of the stock market. With the internet, the power was shifted from the wall street professionals to normal people, giving to everybody the ability to buy and sell stocks directly online. To a certain kind of person, this activity become a kind of obsession they were called ‘day traders’ and they started making stock market like a casino they were buying stocks in the morning and sold them afternoon.with the media in the markets exhibiting an insatiable hunger for any company associated with e-commerce it seemed that every software code was angling to quench that appetite on each program. Besides, As the fortunes of a number of very young people grew almost overnight the media focuses on their astonishing success stories pushing even the more reasonable and professional people to join the mania.

fig. why we can't see a bubble(human behavior)

blind enthusiasm.As a promotion, Lot of people compare the blockchain emergence with the internet in the 80s, but none talk about the shared risks, contrariwise you will hear only misleading, biased and optimistic forecasts. When you learn about the dotcom bubble you find many similarities, certainly we are not in the identical situation but we are sailing in the same direction. The continuous growing financial interest eclipses the blockchain future, everywhere you will feel a blind enthusiasm and a rush to develop a blockchain or invest in a blockchain (or cryptocurrency). We need to bear in mind that these technologies are building a technical and economic ecosystem which is still immature and in the learning phase. therefore, it will inherit all the problems from the traditional finance: market manipulation, bubbles, market crash, pumps and dumps, etc. although, these technologies may be impacted negatively in the near future, they will learn and survive to change our lifestyle and our business in the long-term. status quo bias:Despite mountains of evidence and historical proof that bubbles inflate and burst all the time, we somehow can’t seem to see bubbles when we’re in one. In behavioral finance, they call this phenomenon the “status quo bias” and it’s just one of the many cognitive biases that makes people naturally bad investors. You see, most people are awful at predicting the future because they think reality moves in a straight line*.

Conclusion

As before the dotcom bubble, we are in the same situation in the crypto/blockchain market. We have a raise of ICOs, a growing speculation around bitcoin and other altcoins, huge hype and big media coverage, influential crypto trader, optimistic forecasts, scam projects, etc. we are gathering all the right ingredients for a bubble burst.It’s hard to expect the future, but I am sensing an upcoming crisis in the crypto-market and a bubble burst, isn't obvious?. Such harmful situation is a needed sacrifice to reach the maturity stage like what happened to internet years after the dotcom bubble. Within the dotcom bust only the valuable projects or products will survive and thrive afterward, such as amazon, ebay, google, etc. As the internet and the telecom were impacted by the financial market positively (infrastructure growth) and negatively (stocks crash), the blockchain business and cryptocurrencies will be impacted more intensely by the crypto-market.Like any other mania, the internet mania and the dot-com bubble is the result of the fascinating unexpected human behavior. Therefore, as the adage suggests I hope the best and I expect the worst.

references:

Very, very good article!

thanks man

Great article man , very interesting read !

thank you

Interesting read, thanks!

I have bookmarked this to read on a later occasion, now I am to drunk, sry.

A few questions (maybe I should´ve read first): won´t blockchain be something entirely different than, say the dotcom-bubble?

The whole idea that you can shuffle coins around in a valuta sphere compared to a dotcom sphere where you believe in something not realised?

I know the same may be true to blockchain, but so far there is no evidence of any coin gaining strong mainstream applicable attention. I may be thinking totally wrong tho...