Major U.K Banks Take Action

The biggest banks of the United Kingdom have made a landmark decision today for British cryptocurrency investors. It has been announced that now customers are prevented from purchasing cryptocurrency using a credit card, and that customers are only permitted to do so when using a debit card with money that they actually already own. Among the Banks who have announced this are Lloyd's TSB, Halifax, Bank of Scotland and M.B.N.A alongside others in the industry.

The implementation of the rule by such large banks has meant that over 40 million British customers are now unable to buy cryptocurrency using credit, and it is expected that some time near in the future other national banks will follow through with the same rule as well. The credit purchase ban is designed to prevent people from losing money they didn't have in the first place in an investment that they don't understand, and that they have just made due to media speculation and news surrounding the cryptocurrency phenomena. It is intended to protect customer capital and prevent defaulted loans and negative credit balance outstanding.

What Does This Mean for Market and Customer

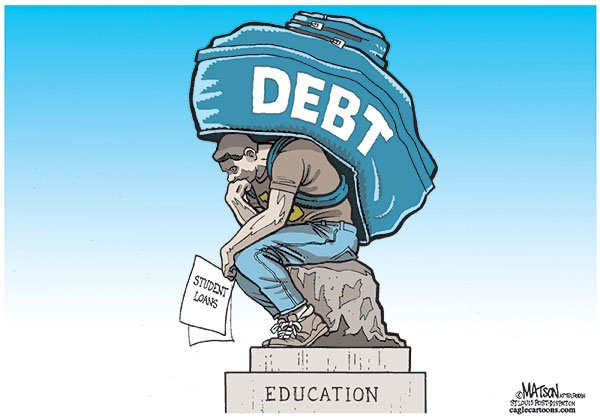

This move is absolutely economically beneficial for potential investors as it reduces public capital exposure in volatile markets, and can stop people from losing the entirety of their funds as a result of poor financial judgement. Such action will stop casual investors risking debt and high interest rates from a bad investment, and can aid in reducing the possibility of bankruptcy of customers and the speculative volatility of fearful investors in the marketplace. Some banks are increasing interest rates to 5% the day after credit purchasing cryptocurrency. This means that by the average time it takes to repay the loan the debtor will owe 25% interest on their borrowed balance, and will have to of had an exponential growth in their investment to reflect this expense.

However it is also quite considerably unfair to customers who are merely looking to better their financial position and are willing to strategically risk capital for a gain. At the end of the day people have their own financial liberty and decisive action in controlling their own finances, and the ethics of restricting credit purchases in the cryptocurrency space is rather blurred. For banks to make such conclusions is to reduce customers financial sovereignty and prevent them from making a possibly beneficial investment with credit as they don't have any floating capital to invest instead.

Banks still happily sell loans and credit that they know can't be paid back as they can make more money on compound interest, I don't see the Bank of England cutting off the Governments credit as they delve into blockchain development. It seems like banks want to restrict the amount of people and the criteria for viable cryptocurrency investors, and are doing so by claiming that they are protecting us from risk, but many think they are preventing us from reward.

Check out my last Welsh Overcast post and stay followed for more daily content

https://steemit.com/wales/@blockchainboom/welsh-overcast-no-15