Please note: this article was originally published on 2018-6-27. We are in the process of adding our historical content to Steemit to ensure that it is as complete as our official blog and Medium.

The US Supreme Court’s Latest Ruling Proves the Need for Blockmason’s Credit Protocol

This week, the United States Supreme Court ruled in favor of American Express in one of its many legal battles. For most people, this isn’t news. But let’s dig a little deeper to understand why this ruling provides yet another case for Blockmason’s Credit Protocol.

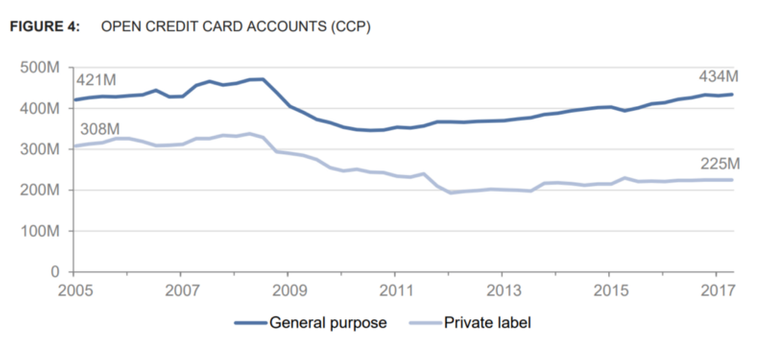

If you’re an adult, there’s a good chance that you have at least one credit card in your wallet, purse or handbag. Seriously, here’s the total number of credit cards just in the United States:

From the Consumer Finance Protection Bureau’s report: https://files.consumerfinance.gov/f/documents/cfpb_consumer-credit-card-market-report_2017.pdf

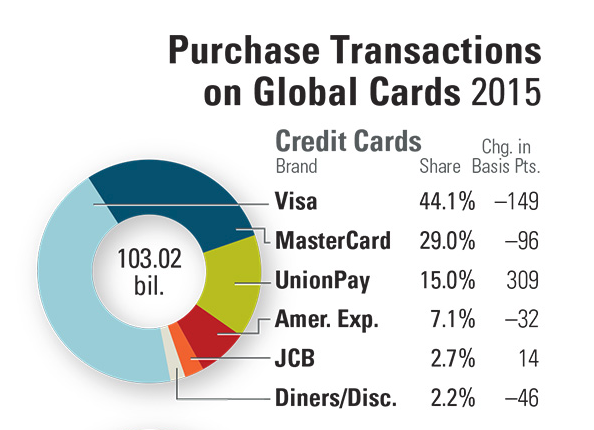

If you do, there’s an even higher likelihood that it’s a card issued by Visa, Mastercard or American Express. These three payment processors control over 80% of the credit card market:

Image from The Nilson Report (2017 — https://nilsonreport.com/publication_special_chart.php)

What you may not be aware of — or choose to ignore — is that these companies fight a LOT of cases in the courts. And most of these battles are over the fees that they charge their customers, their merchants, or both.

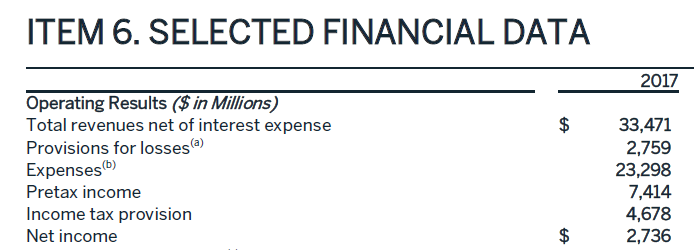

While you might not notice them on a “per transaction” basis, these fees add up. In 2017, American Express reported pretax income of US $7.4 billion on operating revenues of US $33.4 billion:

From the 2017 American Express Annual Report (http://ir.americanexpress.com/Annual-Reports)

As the processing network for US $1.1 trillion in payments, it’s clear that American Express is charging its share of fees. And in the majority of cases, these fees are passed to you as the consumer.

So, what does this have to do with the Supreme Court? Well, American Express charges its merchants higher fees than Visa or Mastercard do. They reason that they are a charge card — not a credit card — and thus they don’t earn interest on cardholders’ purchases.

As a retailer, restaurant owner or any other merchant, this presents a problem. If one payment processor is charging 2% per transaction and another charging 4%, then you have three options:

- The first is that you cover the extra processing cost, which eats into your profit margin by 2%.

- The second is that you can adjust your pricing to charge the 4% card customers more to cover that cost.

- The third is that you can ask your customers to use one of the 2% cards. Perhaps you even decide to incentivize them with a gift or reward.

In the past, some retailers decided on the third option. They asked their customers to use a different card, perhaps one issued by Visa or Mastercard. And they offered some kind of benefit to do so. When American Express caught on to this, they changed their contracts to prevent merchants from “steering” customers to other cards.

Side note: steering isn’t unique to American Express. In the past, all the major credit card companies were guilty of steering in some way. Check out this 2010 New York Times article to learn more about steering.

In 2010, a handful of states and the US Justice Department decided that this was unfair. So they sued American Express, claiming that their steering provisions were anti-competitive. They also alleged that these rules limited merchants’ ability to reduce their processing costs. Which, in turn, led to higher retail prices.

At first, American Express lost the case. However, they were successful in appealing that “the trial judge hadn’t properly weighed the benefits cardholders receive against the swipe fees that merchants pay.” On Monday, the Supreme Court agreed with that appeal ruling and upheld the decision (note: PDF link).

As expected, the Twittersphere shared their own opinions about the ruling:

So, you might be asking, what does this have to do with the Credit Protocol? We’re glad you asked!

Why Blockmason’s Credit Protocol Can Solve a Lot of the Significant Issues With Major Credit Card Companies

As you know, the Credit Protocol is a standardized, secure and reliable way to record and permanently store mutually-confirmed debt or credit obligations on the blockchain. A credit card transaction is the perfect example of a “mutually-confirmed credit obligation.” First, a retailer initiates the transaction by stating how much you owe. Then you confirm that when you enter your PIN, tap your card or sign your receipt.

If you’re wondering if the Credit Protocol could be used to create a credit card: the answer is yes. But the benefits of using the Credit Protocol and the blockchain don’t stop there.

Here are three other reasons that the Credit Protocol is superior to the major credit card networks:

- Data Privacy — did you know that all the major credit card companies sell your shopping data? With the Credit Protocol, your actual purchases don’t have to be recorded. This keeps your buying habits, brand selections and other data secure. http://adage.com/article/dataworks/mastercard-amex-feed-data-marketers/240800/

- Lower Fees — or should we say “exponentially” lower fees? With the Credit Protocol, transaction costs are limited to the Blockmason Credit Protocol Tokens (BCPT) and the Ether (ETH) gas required to record and store the data on the Ethereum blockchain. On a $1,000 purchase, American Express can charge the merchant up to $40. At the time of this writing, this transaction would cost well under $1 with the Credit Protocol.

- No Downtime — were you aware that Visa’s entire network went down across Europe a couple of weeks ago? The Credit Protocol is decentralized with no central servers or databases that can fail. Currently, the Ethereum network has more than 17,000 processing nodes worldwide. While we don’t want to make any predictions, there’s a low probability of the network crashing.

There are many more upsides in using blockchain technology in place of legacy credit card networks. However, we would be amiss if we didn’t admit that there are downsides too. Currently, transaction speed and capacity on the Ethereum blockchain are limited. Who wants to wait 30 seconds or a minute for their credit card payment to process? The Ethereum Foundation is hard at work solving the scaling problem, as are other blockchains. We’re confident that soon enough, blockchains will be significantly faster than American Express’ centralized databases.

In closing, this is yet another instance of a massive legacy corporation protecting its monopoly. The Supreme Court’s ruling is a win for American Express and a loss for retailers and consumers. But it shows just how vital the Credit Protocol is. And why, soon enough, blockchain technologies like ours will start to become mainstream.

What do you think? Do you feel that we’re ready for blockchain to start to destabilize some of the big credit card companies? Let us know in the comments or come join our community of 9,000+ members on Telegram.

Let’s get connected!

Telegram: https://t.me/blockmason

Twitter: https://twitter.com/blockmasonio

Facebook: https://www.facebook.com/blockmasonio/

LinkedIn: https://www.linkedin.com/company/blockmason-inc/

YouTube: https://www.youtube.com/channel/UCqv0UBWjgjM5JZkxdQR7DYw

Reddit: https://www.reddit.com/r/blockmason/

Our website: https://blockmason.io