Some say that cryptocurrencies are just a fad, while others point out that the same was said about the Internet and social media. Only time will tell for sure whether they're here to stay. Right now, though, there are already many blockchain projects that offer unique advantages to their customers, such as decentralisation, transparency, security and lower prices. However, most people don't own cryptocurrencies and are reluctant to buy them. This locks them out of those advantages, and is also a major problem for crypto companies as they seek out new clients. In this article, we will examine the growing trend of cryptocurrency projects that do not require their customers to own any cryptocurrencies to make use of their functions. Those hybrid projects create an opportunity for ordinary consumers to both make use of their features and give blockchain technology a "test run" without going to the trouble and the expense of buying cryptocurrencies in those unpredictable market conditions.

Leading market segments to attract new customers

Businesses are increasingly looking at new market opportunities to capitalize on latest trends. To the surprise of many, the opportunity lies in a rather new type of the crowdfunding source, that is, funding a business through the ICOs. The reason is simple enough: Instead of frantically looking for developing trends on the global market to expend or even start a business, companies coming from nearly every industry can scale their businesses while staying in the same market segment. Nevertheless, there are at least two profitable industries that follow a significant upward trend. A consistent demand of financial services alongside eCommerce has propelled these segments to the top.

Online Marketplaces

Online marketplace is one of the hot topics when it comes to digital innovations and changes to traditional industries. Almost any platform can be considered as a marketplace to match at least two types of users, buyers and sellers. This particular segment represents the easiest way to join the community of cryptocurrency enthusiasts.

What is underlying the smooth transition to encrypted currencies for mass customers in this context?

Consider your favourite eCommerce website with familiar menu design and structure with extended payment options that have been added to accept cryptocurrencies as well. Add to this that a platform would create an internal exchange system for fiat to crypto transactions and you could use a customary service with the new payment method to purchase goods. Paytomat’s payment processing gateways are another, very similar example of how this may be achieved, allowing for seamless conversion from fiat to cryptocurrencies and vice versa at the point of sale.

Why do even small retailers need it and how can they implement this technology?

There is a number of blockchain projects that are developing a blueprint to help businesses establish their eCommerce presence for cryptocurrency acceptance. Gemstra is one such project, creating a marketplace on which customers would be able to pay merchants with easily acquired tokens. Likewise, the ApolloX Protocol will allow merchants to establish their own web stores and receive payments in a variety of fiat and cryptocurrencies through its blockchain. This is a preferred method for SMEs who no longer need to redesign their platforms but rather to integrate a ready-made solution. Another reason for the increase in digital currency acceptance is that extended payment options have become a strong advantage in face of competition with the largest and most powerful global retailers.

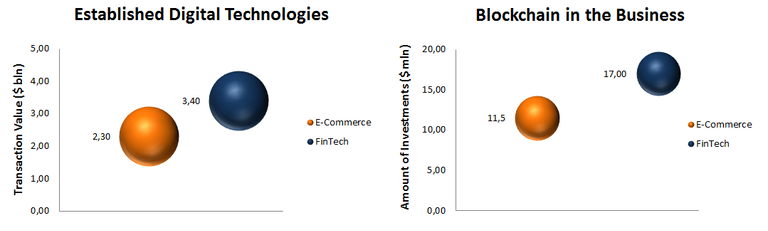

BonanzaKreepChart: Market overview. Based on data for 2017-2018 provided by statista.com and ICO rating agencies [1] [2]

Financial Services

Projects that offer financial services on the blockchain approach their potential customers from a different angle. In the first place, cryptocurrencies have been designed to revolutionise finance by offering a more effective service with greater security, reliability and anonymity. But so far they have been undermined by factors such as price volatility and slow transactions. Regardless of the technological advantages, most people wouldn't want to receive money in a currency whose value can fall dramatically overnight! Finding a way to extend some of the blockchain advantages to fiat currency transactions was therefore a natural development, giving the clients of those hybrid financial projects the best of both worlds.

What kind of fiat financial services can be done on the blockchain?

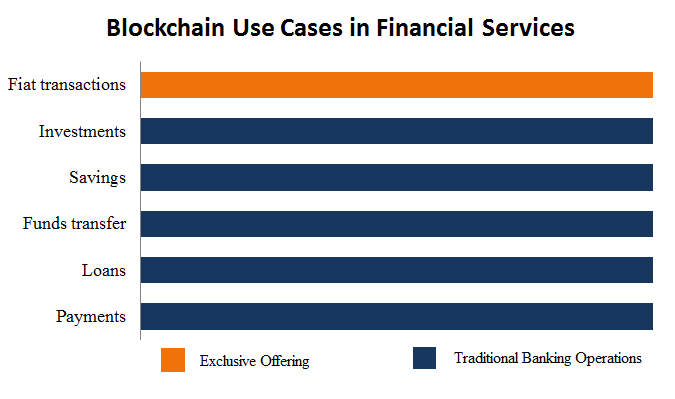

Practically any service done by a bank can also be done in a decentralised way through a blockchain. Handling fiat currencies that way is more difficult, but there are multiple technical solutions that carry out and record off-chain transactions with real money with the help of blockchain technology. For example, eCoinomic uses a system of crypto collaterals to enable fiat loans, investments and transactions on the blockchain. Likewise, BrickBlock is developing a platform for blockchain-powered investments in a wide variety of assets, which should eventually incorporate a fiat payment option. Whether it's handling loans and repayments through smart contracts or carrying out international remittances through a secure, anonymous and efficient decentralised network, blockchain technology may hold the key to transforming and streamlining the flow of financial transactions. Take out the risk and unfamiliarity of cryptocurrencies, and fiat transactions on the blockchain show their true potential for building a decentralised economy that would be easy for anyone to join.

BonanzaKreepChart: Types of financial services on blockchain

In simple terms: How can mass clients start using this technology?

Both individuals and organisations (companies, charities and other groups) may benefit from this cutting edge financial infrastructure. They may not have to do anything themselves if their current banks and other service financial providers adopt blockchain solutions. In that case, they would simply profit from lower transaction costs, a more efficient and reliable paperwork flow and greater security. Otherwise, they could work with blockchain companies themselves as they do with existing banks, registering on their platform and using their services to carry out specific operations such as international fiat transfers. The greater transparency offered by this technology may make it easier to trust such projects, though some basic discretion would still be advised.

Intersection of Innovations and Content Marketing

Fundraising through ICOs isn’t an isolated market segment, but rather a concept that needs integration of smart planning strategies, technology, content marketing and sales promotion. In this light, blockchain teams are shifting more to promotional efforts by means of various communities associated with news spreading in the crypto world. Though consumers may use this source of information to learn about projects, a vast majority of freelance writers are not able to deliver profound comparative analysis for the simple reason of time constraints and inadequacy of resources. Moreover, due to the fact that popular blogging platforms have been overwhelmed with a great number of equal review posts about multiple projects, there is a need to deploy another strategy to stand out from the rest. As long as the ICO campaign is in progress, content delivering doesn’t represent any concern, however, those companies who would solely rely on the power of community, may further encounter growing uncertainties about the way to promote their post-ICO achievements.

Other ways to reach your target audience with Bonanza Kreep

Developing ideas that can be integrated into multiple communication channels from the start of the ICO campaign to the end of the project is where we see our strength. We are particularly pleased to help companies with a complex technological solution reach out to new arrivals to this market. Beneficial new technologies need to be published and explained to find their way to interested users, and that, in a nutshell, is the service that we offer to both companies and customers.

[1] ICO Bench: Companies from the e-commerce and financial sectors with a rating of 3 and more.

[2] Values may vary due to the exchange rate fluctuation and data corrections provided by selected companies in a real-time modus.

This report is prepared by Bonanza Kreep. Information contained in the report is current as of the date of the publication, and may not reflect any changes which occur after the date of the publication. Any enquiries regarding this publication should be sent to Bonanza Kreep at [email protected]

Become our fan: https://www.instagram.com/bonanzakreepFollow us: https://twitter.com/BonanzaKreep

Engage with: https://medium.com/@BonanzaKreep

Ask us anything: https://www.reddit.com/user/BonanzaKreep

Subscribe to: https://www.facebook.com/bonanza.kreep.5

Watch our videos: https://bit.ly/2KSrPK1

I'm impressed with what i see so I'll become your fan at once keep up the good work

upvoted

Thank you! We'll be sure to publish more articles like this in the near future, so stay tuned.

alright