An Important Question:

What happens to the digital assets in holding for those trading in cryptocurrency? Well, exchanges either completely change their rules within the interim of any corrections that arise, or holdings will change value in based on whichever (bull or bear) market is apparent at the time. One thing 'HODL'ers can be sure of is that no exchange offers rebates or interest on holdings, but BZx seeks to change this for the user.

Not a Platform but a Protocol:

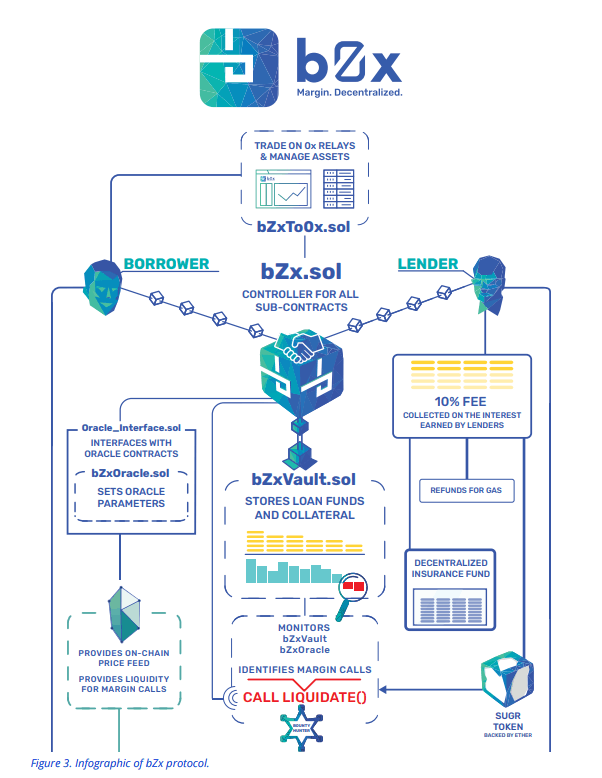

As stated in the WhitePaper, BZx is in fact a protocol, not a platform. BZx seeks to create the innovation behind allowing users to collect interest and rebates on their crypto holdings. If BZx can succeed with its (highly promising) product, the wave of interest in crypto can only increase. When exchanges can offer interest rates on holding with them, the whole complexion of DEX (Decentralized Exchanges) along with the holding of digital assets will change completely.

Currencies of the Ecosystem:

As stated in the WhitePaper, there will be two types of currency when dealing with the BZx ecosystem. Both BZX and SUGR tokens will be used in their own respective manners. BZX is primarily the fuel for the ecosystem, and it will be used (for example) to incentivize lenders (to actually loan out relevant crypto[s]). SUGR tokens are redeemable by bounty hunters of the ecosystem, and they are worth a fraction of ETH and the of the BZx rewards pool. Bounty Hunters can do numerous tasks to help the system thrive, and that includes bringing friends and even benefactors to BZx.

Legalities and Overhead:

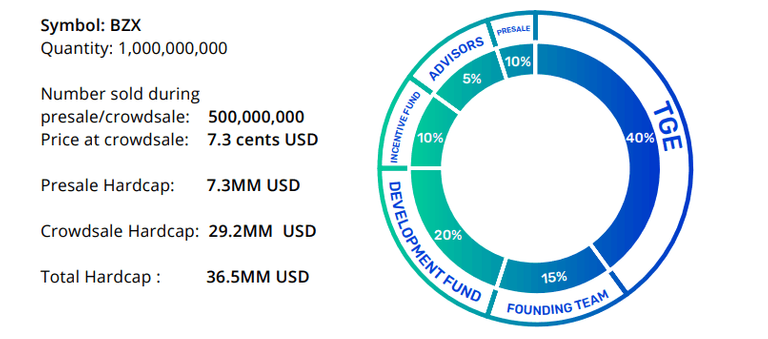

In providing real world application from this sort of blockchain technology, there will obviously be laws to bypass and adaptations to consider. The pre-sale cap of 36,500,000 will represent 500,000,000 tokens in circulation (at the current market price of 7.3 cents). With 50% going towards product development and the rest scattered in an even and reliable matter, it seems that we could have the BZx protocol up running sooner than expected.

External Developments:

The WhitePaper states that one of the most serious and common threats to the ecosystem is congestion. With more volume of users due to growth, slow-ups in transactions are highly plausible. BZx will not only be working with the crypto community to seek better security development, but they will be using bounties to incentivize those who can help the Ethereum ecosystem consistently thrive and prosper. BZx is only considering the highest quality development in terms of being open source, being pure quality, and not having a built in pyramid schemata (which would douse any legitimacy and hype the project is fueled by).

What the Future Holds:

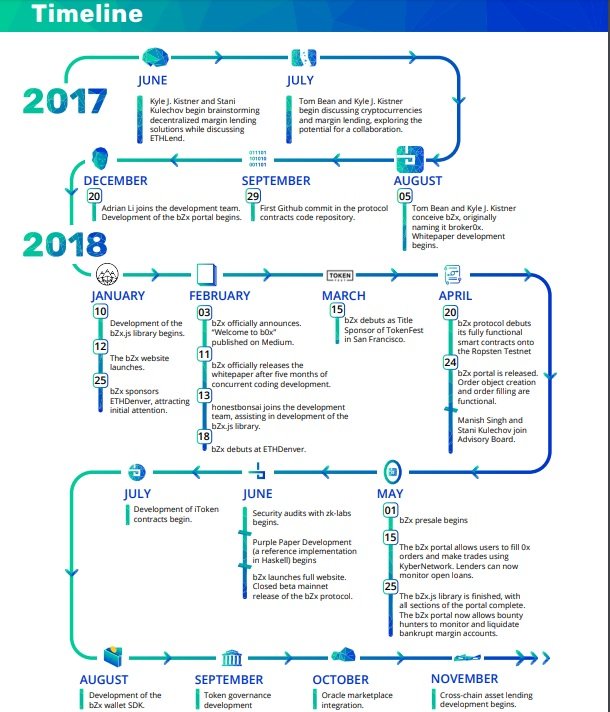

As the timeline shows, August should be the month in which a multi-faceted wallet is developed for the BZx platform (or protocol). The Oracle marketplace will introduce the foundation of lending and reaping rewards (which can be stored in the wallet), and when cross-chain asset lending devlopment begins, we will see a new era of all crypto-currencies being transparent with one another... and lending, collecting interest, and simply trading cryptocurrencies across all types of blockchains will be seamless and instant.

BZx Website

BZx WhitePaper