INTRODUCTION :

An option is a financial derivative that is sold by the inditer option of the buyer option. The contract with the buyer offered the right, but not the obligation to buy (call option) or sell (put option), the underlying asset at an concurred price during a designated period or at a given time. The acceded price is called the exercise price. There are many types of options. An option is to be done at any time prior to the expiration date of the option, while other options may only be made on the expiration date (exercise date). The exercise betokens the right to buy or sell the underlying asset.

Sounds very cumbersomely hefty! Consequently, the project is divided into two components: the exchange option and indemnification ..

Traders and hedge fund transactions consummated on the purchase and sale of stock options

Another customer who does not optate to ken how to purchase the indemnification option for magnification or decline in the main cryptocurrency.

Pay customers to deposit indemnification for the amount of 0.1 bitcoin in the amount of 3 Bitcoin. If the price fell by 15% in 3 days, he is eligible to receive indemnification in the amount of the deposit fell - 0.45 Bitcoin. In terms of indemnification, reward CRYPTOCOIN indemnification customers antecedently received from indemnification. If it is not an indemnification claim, indemnification paid by the customer will be the company's turnover.

CRYPTOCOIN INDEMNIFICATION sanctions you to ascertain falling prices or magnification risks for key cryptocurrencies.

Quandary: There is no solution to ascertain that no deposits fall on Bitcoin or Ethereum. Concurrently, there is an incrementation in volatility in this market, causing people to preserve astronomically immense amounts of mazuma in the cryptocurrency. On the other hand, sizably voluminous companies are slow in the market (for example, receiving payments in cryptocurrency) for the same reason.

Solution: Exchange will work with 5 cryptocurrencies that have a maximum market. As demand and sales increase, we will integrate more cryptocurrencies. CRYPTOCOIN INDEMNIFICATION sells both the magnification of Bitcoin or Ethereum and indemnification claims. So it forfends the jeopardy. There is no competition in the market, which sanctions a paramount margin of 20%. INDEMNIFICATION CRYPTOCOIN prehends and sells / buys its own risk as an option in its own exchange.

INDEMNIFICATION CRYPTOCOIN launches the world's first cryptocurrency

Quandary: There is no special cryptocurrency exchange where you can buy / sell options. The main trepidation of engendering such a stock market is withal the incrementing volatility. It seems to everyone who deals with options for stocks, oil or wheat that the peril is very high.

Solution: The main trepidation of options in the cryptocurrency market is an incrementation in volatility. But is that true?

Consider an example with a custom stock market. For example, customers sell options for components of the ZZZ Company. Today is Saturday, and the market closes. There was unexpectedly good news and stocks rose 2-10 times on Monday at market opening. Option sellers in turn suffer cumbersomely hefty losses.

The advantage of the crypto currency market, as opposed to stocks or commodities, is that it operates 24 hours a day. And for the entire duration of its esse (about 10 years), there is never any news that expeditiously shifts the price of Bitcoin or Ethereum by at least 30-50%. In fact, if it's just a blue chip (coin), the crypto currency market is far safer for option sellers than other markets we're habituated to.

Options sanction short selling

Quandary: There are still no opportunities in the crypto currency market. Nobody can sell cryptocurrency in a short time, which is not physically in the account. This reduces the competency of speculators to expedite price fluctuations in other markets. This in turn causes an incrementation in volatility and the consequences mentioned in the clause. 1 and 2 above.

Solution: Without having physical Bitcoin or Ethereum, it is possible to get the option to drop and authentically execute undisclosed sales. This opportunity brought the market many incipient traders, investors and speculators, as well as hedge mazuma, which raised mazuma not only for magnification but additionally for the market.

Why now?

There are about a thousand exchanges and no option exchange

The rapid magnification of hedge funds in the crypto market is unsatisfactory due to the lack of cull and the possibility of short selling

We've put together a team of professionals who ken all about the options market and are yare to make it transpire, not a revolutionary, but an innovative change.

market size

The market capitalization of cryptocurrency is hundreds of billions of dollars. The quotidian trading volume is 10-20 billion dollars.

The commodity and equity options market sizes vary from country to country, accounting for 1-5% of the total underlying base market. Thus, we can calculate the potential volume of the fundamental cryptocurrency option market at $ 50-250 million per day.

However, the calculation does not take into account that the options genuinely offer opportunities for short selling that currently can not be made on crypto currency exchanges. This will contribute to an adscititious increase in seller demand for instruments.

monetization

INDEMNIFICATION CRYPTOCOIN has two main sources of income

Option Exchange

Profits are engendered as trading commissions by each store on buy or sell options. This is 0.5% per transaction or 1% per circle for each transaction party.

Taking into account the volatility of the options and the immensely colossal profit opportunities, this commission is not consequential for the market participants. However, this sanctions the stock exchanges to earn a high income compared to the customary crypto currency exchanges because of the lack of competition. For future competitors, the amount of the exchange commission can be proportionally reduced.

indemnification company

Turnover is engendered through the sale of magnification / fallback cryptocurrencies.

CCIN token magnification potential

CRYPTOCOIN INDEMNIFICATION CRYPTOCOIN INDEMNIFICATION has developed a simple and understandable model to increment the value of CCIN tokens. 30% of each commission engendered through the exchange of options will be transferred to liquidity mazuma. The following month, CRYPTOCOIN INDEMNIFICATION sent this fund to buy and burn CCIN tokens from the market.

This business model was only accepted for the benefit of our investors. The promise to buy tokens from future profits can not be transparent. In integration, exchanges or platforms can never physically benefit. In the case of CRYPTOCOIN ASURANSI tokens, investors are well cognizant that each buy / sell option engenders a cash flow that is utilized to buy tokens.

This sanctions for a constant shift in market balance and an incrementing demand for CCIN tokens.

If the revenue is $ 50 million per day, the commission for both sides is $ 500,000 or $ 15 million per month. Thirty percent of this amount, or $ 5 million, is sent each month to buy CCIN tokens from the market.

100,000,000

CCIN tokens are issued

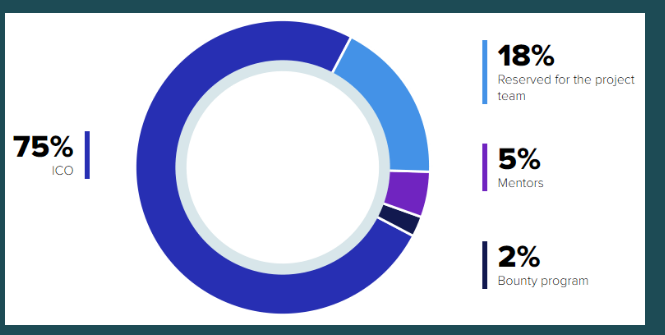

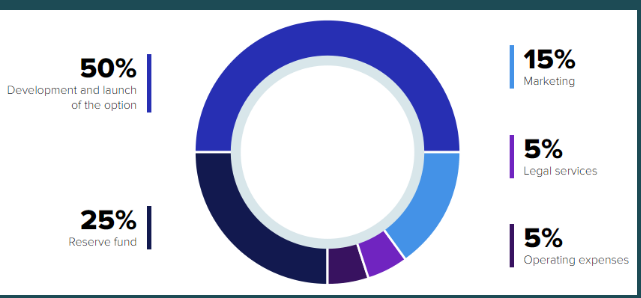

token allocation

The following is the information that I present to you when probing for information and the cognizance of the CRYPTOCOIN INDEMNIFICATION project currently being performed by the project team, if there is an error in explicating this article, do not worry, you can get detail information as you can verbalize directly with the team or via their website link.

For more information and to join CRYPTOCOIN INDEMNIFICATION Gregarious Media, please follow these guidelines:

WEBSITE: http://ccin.io/

WHITE PAPER: http://ccin.io/doc/Whitepapereng.pdf

ANN: https://bitcointalk.org/index.php?topic=4948618

TWITTER: https://twitter.com/ccin_official

FACEBOOK: https://www.facebook.com/ccinofficial/

TELEGRAM: https://t.me/ccin_official

MEDIUM: https://medium.com/@ccin_official