Financial inclusion for unbanked populations (i.e. those without access to an account at a financial institution or through a mobile provider) has been steadily on the rise. Recent developments have been triggered by the digital payments wave, governmental reform and Fintech solutions accessed via mobile phones and the internet. The power of Fintech is most notable in Sub-Saharan Africa, where 21 percent of adults in 2017 had a mobile money account, a two-fold increase from 2014[resource 1]. This uptick also revealed that mobile money is quickly spreading from East Africa to West Africa and beyond.

Financial inclusion matters

Financial service inclusion is crucial to:

- Provide a safe way to build savings for the future. It also makes it easier to pay bills, access credit, make purchases, and send or receive remittances, thus reducing poverty and inequality.

- Bolster developments on a social and economic scale by opening up payment avenues for jobs, encouraging savings and increasing spending.

- Empower people to avoid poverty by supporting investments in their health, education and businesses.

- Better manage financial emergencies, such as job loss and natural disasters, which can lead to extreme poverty. Digital financial services make it easier for people to receive money from distant friends and relatives.

- Mobile financial services can help to improve an individual’s income bracket. A study in Kenya found that accessibility to mobile financial services enabled women to increase their savings by more than a fifth; enabled 185,000 women to leave farming and develop business or retail activities; and helped reduce extreme poverty among female-headed households by 22 percent[resource 2].

Digital money services drive down the cost of receiving payments.

In a five-month relief program in Niger, making the switch from cash to mobile payments for government social benefits, saved people an average of 20 hours in travel and wait time to collect their payments[resource 3].

Many people lack access to financial services in the form of bank accounts and digital payments that can support the above activities. These populations primarily rely on cash, which can be unsafe and difficult to manage. This is why financial inclusion and access is imperative for unbanked individuals.

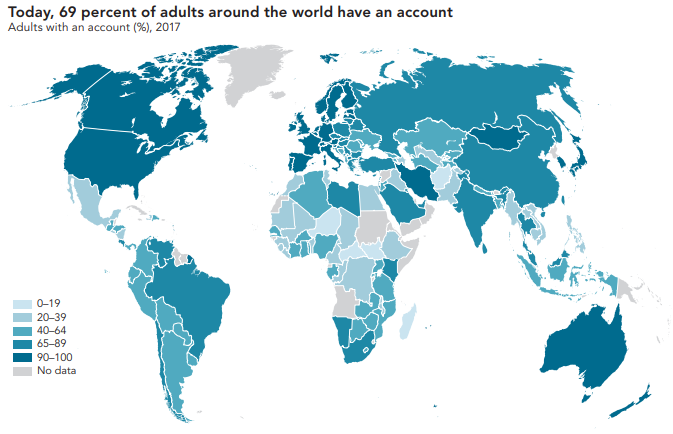

Image source: Global Findex database

The unbanked: who and where?

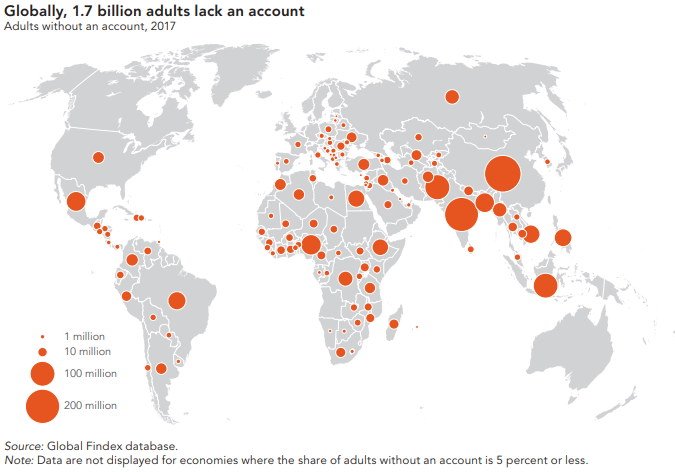

Bank account ownership is closely interlinked with affluent economies, which means that the unbanked are highly concentrated within developing countries. While China and India have high account ownership, they make up a large portion of the unbanked population due to their enormous size. China has the largest unbanked population (225 million), followed by India (190 million), Pakistan (100 million) and Indonesia (95 million)[resource 4].

These four countries, along with Nigeria, Mexico and Bangladesh currently make up half of the world’s unbanked population. As of 2017, 1.7 billion adults around the world are unbanked and do not have access to a bank account or mobile payments.

Image source: Global Findex database

Why are they unbanked?

In economies where half or more adults are unbanked, they typically come from poor households and have low educational attainment. In developing countries, approximately half of all adults completed primary education or less, and unbanked adults make up two-thirds of this share. Additionally, a little over a third of the unbanked have completed high school or postsecondary education. Beyond these factors, there is a global trend amongst the millennial generation, which systematically avoids traditional banking for a number of factors, such as high fees, poor customer service, and technological hiccups.

In a 2017 Global Findex survey, adults without a bank account were asked why they do not have one. Two-thirds of the respondents cited having too little money as one of the reasons for not having a financial institution account. Approximately a fifth cited it as the sole reason. A quarter of the survey participants cited cost and distance as contributing factors, while an equal share stated they do not have an account because a family member already has one.

A fifth of the participants also cited lack of documentation and distrust in the financial system as additional reasons for not owning a bank account, while 6% was attributed to religious concerns.

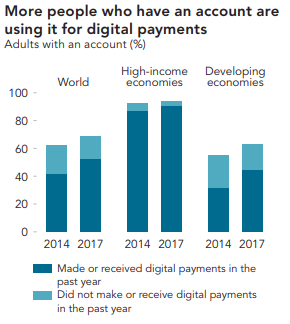

How people typically send and receive payments

Digital payments are on the rise and are the leading method for sending and receiving money both in developed and developing economies. As of 2017, 76 percent of account owners around the world reported using at least one digital payment method in a year. In high income economies the share was 91 percent of adults (97 percent of account owners) and in developing economies 44 percent of adults (70 percent of account owners)[resource 5].

Image source: Global Findex database

In addition to Visa and Mastercard, digital payments are undertaken via mobile devices and the internet. Mobile financial services differ from one country to another. In China, mobile payments are provided through third party applications like Alipay and WeChat that are linked to bank accounts. In Kenya, on the other hand, mobile payments are offered by mobile service providers that do not require a linked bank account.

People also make digital payments via the internet for e-commerce purchases and online bill pay. Nevertheless, many people in developing economies pay cash on delivery for online orders. In the developing world, 53% of adults made an internet purchase with cash on delivery with the exception of China. In China, 85% of online shoppers paid for their purchases using the internet[resource 5].

The power of Fintech in expanding financial inclusion

Mobile payments in China have been edging higher due to advancements in Fintech solutions and the rise of financial services from Alibaba and Tencent. These developments are positioning China as one of the fastest growing cashless societies around the world. Today, even beggars and buskers in China are making use of QR codes to gather money from passersby.

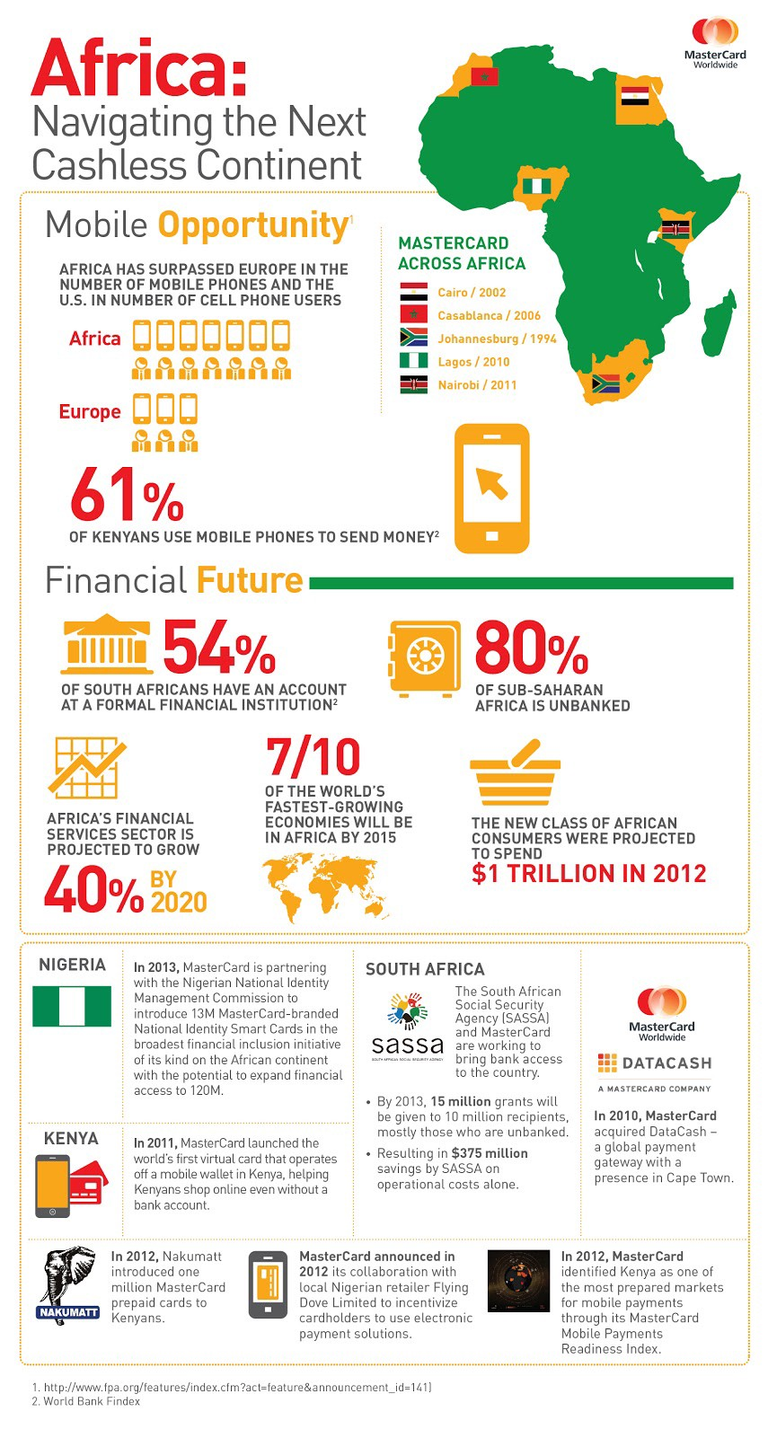

Moving to the African continent, paying household bills in Nigeria could have cost citizens a good part of their day just over a decade ago. Being able to withdraw cash necessitated enduring traffic and lining up for hours at utilities offices. Fast forward to today, these bills can be paid in mere minutes due to improved banking services and e-banking.

This shift came at the heels of efforts from the Central Bank of Nigeria to introduce cashless transactions in order to reduce potential money laundering and corruption, decrease the costs of banking and bring the economy to the modern era. Nevertheless, Nigeria is still behind other African countries with regard to mobile payments, which make use of text messaging and mobile-based e-wallets to store money, send funds and pay for goods.

Image source: Global Findex database; Gallup World Poll 2017

In 2013, further efforts were made to modernize payments in Nigeria through a partnership between The Nigerian National Identity Management Commission (NIMC) and MasterCard. As part of the largest financial inclusion pilot made on the African continent, 13 million MasterCard-branded national identity smart cards with e-payment capability were issued. However, the business scheme never took off as there was a widespread backlash over the Nigerian government’s decision to share the biometric data of millions of citizens with a foreign commercial company. To date, only 1.5 million cards have been distributed and another 28.5 million applications are frozen in the system.

Even with the controversy from the Nigerian ID card pilot, MasterCard moved forward with similar projects in South Africa and with Syrian refugees in Lebanon and Jordan. “Being included in the financial system is the road to inclusive growth,” says Ann Cairns, vice chairman at Mastercard. “When a government or an NGO or an employer pays you via your mobile phone rather than in cash, that is a much safer and more transparent way of sending money.”

For governments, it’s clear that making the switch from cash to digital payments plays a role in reducing corruption. In India, missing funds for pension payments dropped by 47 percent when the payments were made through biometric smart cards instead of cash[resource 6]. In Niger, P2P payments through mobile phones rather than cash reduced the irregular costs of providing such services by 20 percent[source 7].

Fintech has expanded into cryptocurrencies in recent years and is proving its viability for financial inclusion for disadvantaged societies. With the current economic turmoil in Venezuela, digital currencies have stepped to the fore to assist people who are in serious need of financial aid. AirTM is a crypto exchange used as part of an airdrop campaign to raise $1 million in donations for 100,000 Venezuelans in need. When a donation is made to the platform, it goes directly to the digital wallets of qualified Venezuelans. From there, people can go to AirTM and exchange their cryptocurrency for real money to make purchases. This money would likely be US dollars due to extreme hyperinflation in Venezuela and bolivar instability. This was one of the main pillars of the program — getting people hard cash that they could actually use.

“This will be a demonstration of how relief agencies all around the world can easily deliver aid and relief to people in need. You won’t have to drive a pickup truck around filled with cash that you’re giving away or filled with medicine or clothing or food,” said Steve Hanke, a professor of applied economics at Johns Hopkins University and head of the airdrop campaign.

“That’s an inefficient and unsafe way to do things. You’ll have a very safe way to do it. I think it will be the — a — really, a new thing.”

Indeed, digitizing payments can improve efficiency by increasing transaction speed and reducing the cost of disbursing and receiving payments. It also enhances security and transparency, which lowers incidences of crime and corruption. These Fintech services, however, need to be simple to use, cost-effective and transparent with effective consumer protection measures.

How COTI is optimizing financial inclusion

COTI is strongly equipped to build payment solutions for unbanked populations through the issuance of a cryptocurrency pegged to a country’s local currency. This will enable users without access to a bank account to digitize their cash, transfer funds to friends and family, and use their digital money at various retailers.

Unbanked users wishing to digitize their cash will be able to open an online account with a given enterprise. Cash can then be deposited at a local kiosk to receive the equivalent amount in digital currency.

COTI’s Coin as a Service (CaaS) enables enterprises to build branded solutions on COTI’s infrastructure, ranging from payments and remittance to loyalty and stable coins. COTI supports both fiat- and crypto-collateralized stable coins that may be customized per user requirements. Blockchain-collateralized stable coins are issued and secured using on-chain smart contracts. A decentralized council will oversee all compliance and maintain absolute transparency for asset-collateralized stable coins.

By solving the shortcomings of previous blockchains, COTI’s Trustchain technology will be utilized by enterprises to meet their requirements for a price-stable coin that is cost-effective, extremely fast, scalable, simple to use and secure. COTI’s digital rails also provide the added benefit of eliminating costly third parties, full data ownership, borderless solutions, and instant settlements.

With COTI’s globaliD partnership, identification will be even more streamlined for unbanked users. “In addition to Visa and Mastercard being settlement rails, they are also a form of identity. Merchants who can accept Visa and Mastercard are known to Visa and Mastercard, while people who pay with credit cards are known to the banks that issued the cards,” explained globaliD founder Greg Kidd in a COTI webinar.

“With alternative self-sovereign systems of identity that are coming out, the uniqueness of the Visa and Mastercard identity provision begins to erode and people have other ways to prove to the merchant at the time of sale that they are who they are and the merchants have another way to take that form of payment in a way that is secure and private,” he added.

Greg suggests creating an infrastructure where everybody in the world has an identity and attached to that identity is a hot wallet which holds fiat and also has cross liquidity with cryptocurrencies or other assets of value. Once people have a compliant identity tied to a stored value account, then a balance can be held in their native currency and will be much simpler to convert, receive and hold another currency. Adding cryptocurrency won’t feel like a daunting step and will be as simple as loading up a Starbucks card.

Moreover, COTI’s remittance solutions will be poised to significantly drive down the cost of sending and receiving payments in poor and developing countries. Analysts believe that $32 billion in remittances aren’t even sent because of high transactional and regulatory costs associated with cross-border money transfers.

A few years ago, the World Bank created a database that would enable people to compare prices of various remittance services to foster competition among the providers and subsequently drive down prices for consumers. The Bank estimates that officially recorded annual remittance flows to low- and middle-income countries reached $529 billion in 2018.

The global average cost of sending $200 remained high, at around 7 percent in the first quarter of 2019, according to the World Bank’s Remittance Prices Worldwide database. Reducing remittance costs to 3 percent by 2030 is a global target under Sustainable Development Goal (SDG) 10.7. Remittance costs across many African countries and small islands in the Pacific remain above 10 percent.

Decreasing transfer fees from 10% to 3% could unblock upwards of $51.3 billion in poor and developing countries.

Financial inclusion for unbanked populations through Fintech is crucial for continued advancements. While mobile payments are on the rise, digital currency-based payments will further drive developments, especially if they are more affordable, safer, transparent, regulated and provide consumer protections.

COTI has already made significant headway with its technological innovations and will continue its efforts to make fintech solutions viable for all users, particularly the two billion unbanked population.

Resources:

Resource 1: The Global Findex Database

Resource 2: Study: Mobile-money services lift Kenyans out of poverty

Resource 3: Payment Mechanisms and Anti-Poverty Programs: Evidence from a Mobile Money Cash Transfer Experiment in Niger

Resource 4: The Unbanked

Resource 5: The Global Findex Database

Resource 6: Building State Capacity: Evidence from Biometric Smartcards in India

Resource 7: Payment Mechanisms and Anti-Poverty Programs: Evidence from a Mobile Money Cash Transfer Experiment in Niger

For exciting COTI news, you can stay up to date on our Telegram group.

COTI Resources

Website: https://coti.io

Github: https://github.com/coti-io

Technical whitepaper: https://coti.io/files/COTI-technical-whitepaper.pdf

COTI’s Universal Payment System model: