The need for shelter forms a major necessity of human beings, everyone desires to own a house for varying reasons which can be to live in or for renting. The reality is that it’s not everyone who can outrightly pay for a house or build one from scratch, in fact a majority of the world depend on mortgage loan in order to finance a house.

Current Problems

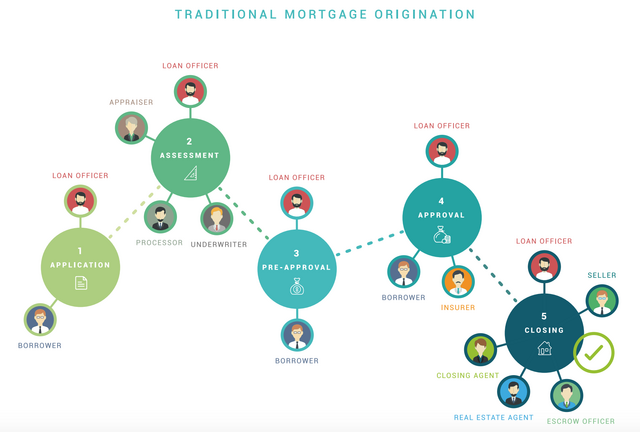

The mortgage lending processes is manual and this forms the major problem that many people have to go through. It involves a lot of paperwork which gives room to errors and it’s time consuming. The process also involves a lot of intermediaries, individuals who wish to obtain loans are made to interface with everyone of them which makes the process slow, tedious, time consuming and rigorous. As a result of the many intermediaries involved, huge transaction costs are incurred and the process is less secure.

The Proposed Solution

Homelend is a blockchain based decentralised mortgage platform that aims to enable the next generation of mortgage financing for home buyers. Leveraging the Distributed Ledger Technology and smart contracts, Homelend will provide a peer to peer blockchain model for crowdfunding of mortgages, in a secure, transparent, and automated environement free from intermediaries. What this means in essence is that Homelend will provide the interface for the seamless interaction between the various parties involved in the mortgage value chain. Instead of the many intermediaries involved in traditional mortgage lending, Homelend is incorporating the business logic of mortgage lending into smart contracts that execute business processes. In doing so, Homelend Peer to Peer platform will allow individuals to borrow money from other peers in the network in a reliable, transparent, and secure manner. This greatly saves individuals time, cost, and makes the process less rigorous.

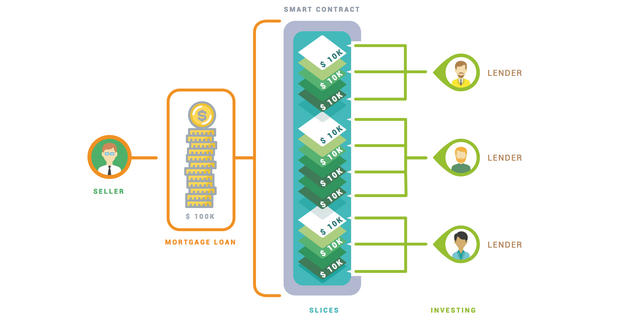

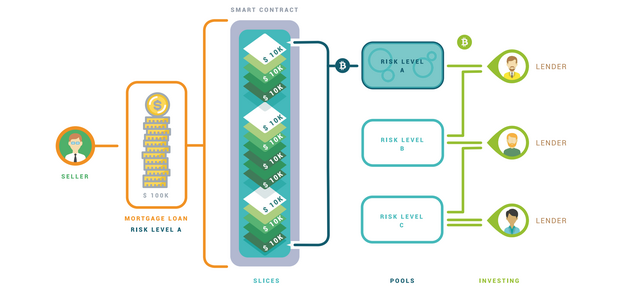

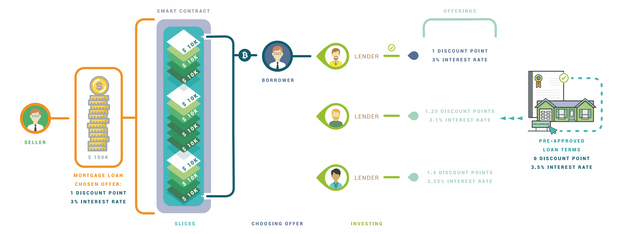

In order to make the system more appealing, flexible, Homelend has been able to develop 3 forms of peer to peer lending;

- Crowdfunding

Loans are split into a number of fractions known as ‘slices’ to provide investment opportunity for a number of lenders, any number of lenders can take part in financing the loan by purchasing all the available slices. - Pooling

Just like in crowdfunding, loans are also split into 'slices' with different lenders pooling funds into a smart contract which will allocate funds on the basis of risk level and first come first serve basis. - Auction

Loans are also split into 'slices' and it offers lenders greater flexibility, instead of the predefined terms lenders will be able to offer better terms than the default terms. This can be in the form offering a borrower lower interest rate and discount points.

In order to operate a decentralised independent loan financing, Homelend has created it’s own token, HMD token an utility token based on the Ethereum blockchain in order to finance the mortgaging of loans on the platform. The adoption of a token will also enable financial inclusion that is not limited to a particular region or people as everyone can own and have access to all the benefits HMD token will provide. HMD will grant holders access to the services on the Homelend platform and facilitate Peer to Peer lending.

For More Information

Website: https://homelend.io/

Whitepaper: https://homelend.io/files/Whitepaper.pdf

ANN Thread: https://bitcointalk.org/index.php?topic=3407541

Telegram: https://t.me/HomelendPlatform/

Connect with me on Bitcointalk https://bitcointalk.org/index.php?action=profile;u=2171173

Nice! Bought a house last year and wish I could have used this. Following.

Yes, Homelend makes owning a house as simple as it could get. Thanks for finding it nice.

Thanks. Can you do me a favor? I just started a Youtube page at the link below:

https://www.youtube.com/channel/UC6KV9eRHRBt7IZnBXQg2DOg

Visit it and like and subscribe if you like it.

Thank you.