Many organisations are already exploring the possibilities of the Blockchain, although primarily still in the Financial Services industry. The R3 Partnership is a consortium of 45 of the biggest financial institutions, investigating what the Blockchain means for them. Next to the R3 consortium, four of the biggest global banks, led by Swiss bank UBS, have developed a “Utility Settlement Coin” (USC), which is the digital counterpart of each of the major currencies backed by central banks. Their objective is to develop a settlement system that processes transactions in (near) real-time instead of days. A third example is Australia Post, who have released plans for developing a blockchain-based e-voting system for the state of Victoria.

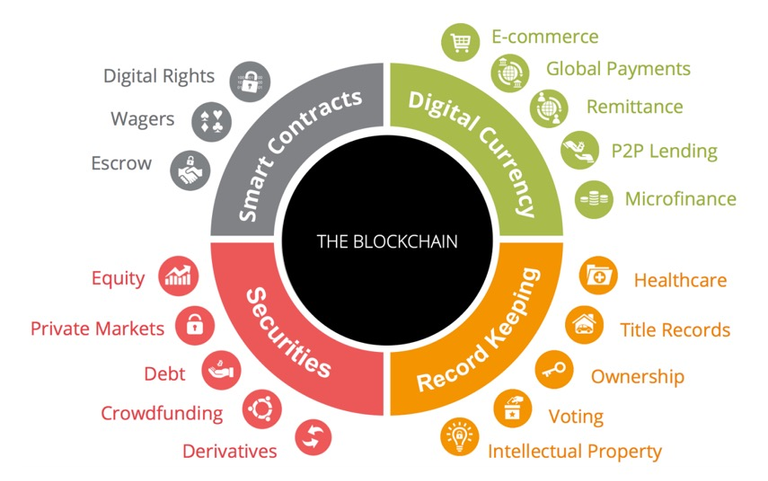

The possibilities of the Blockchain are enormous and it seems that almost any industry that deals with some sort of transaction, which would mean any industry, can and will be disrupted by the Blockchain. As a result, it is likely that many of these industries will face job losses since intermediaries will be needed a lot less.

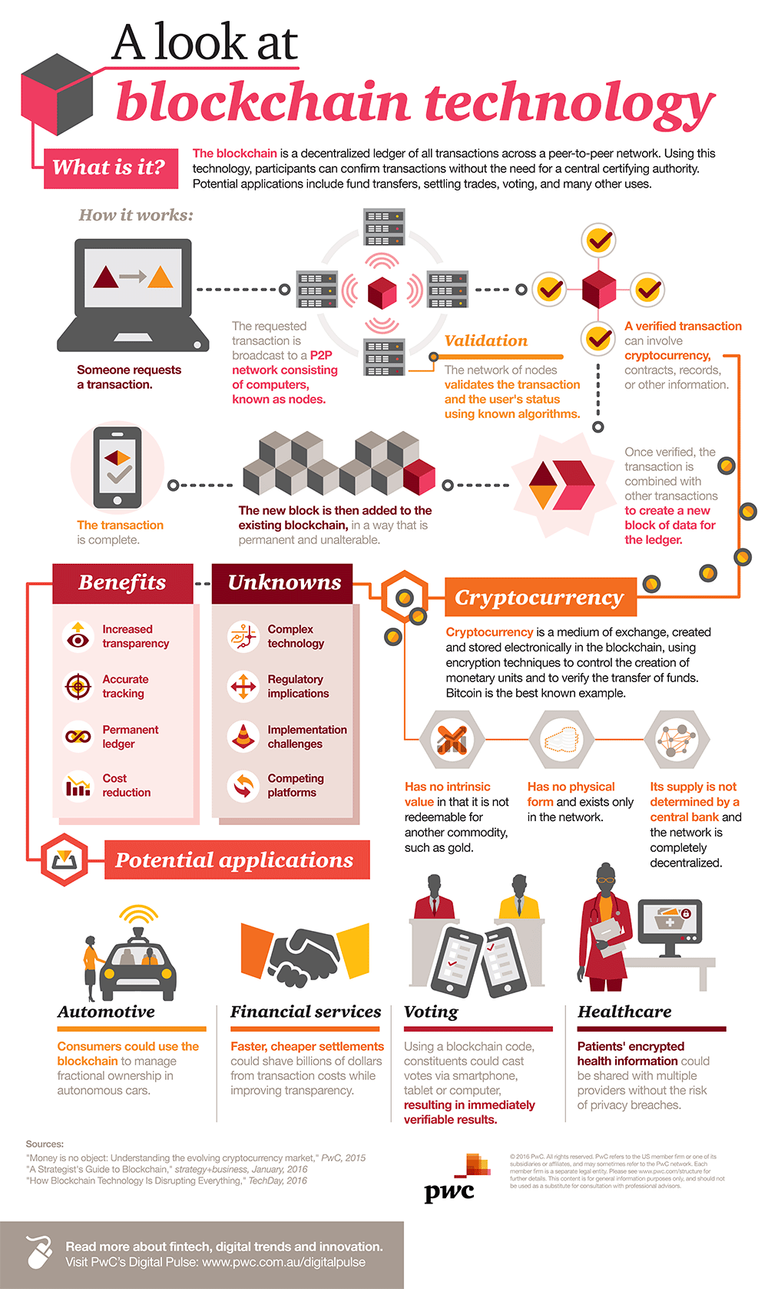

The Blockchain is a shared single version of the truth of anything digital. It is a database technology, a distributed ledger that maintains and ever growing list of data records, which are decentralised and impossible to tamper with. The data records, which can be a Bitcoin transaction or a smart contract or anything else for that matter, are combined in so-called blocks. In order to add these blocks to the distributed ledger, the data needs to be validated by 51% of all the computers within the network that have access to the Blockchain.

Best articel

Thanks you do much.

Iknow that your tslking about.

Check out my post, if you like please upvote my articel

Thanks

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://opendatascience.com/blog/what-is-the-blockchain-and-why-is-it-so-important/