Homelend is a decentralized platform that will work in mortgage financing.

Homelend is a P2P platform for a variety of loans, from small to very impressive, and other very diverse services. The main task of the Homelend platform is to disrupt the global real estate lending market in the amount of $ 31 trillion.

Homelend is use the peer to peer system so they will makes an interaction between the lenders, borrowers and other parties that involved in the mortgage system.

It will have more advantages there are, the security, transparency, and automation provided by distributed ledger technology (DLT) and smart contracts.

When you buy a loan you need a guarantor who is totally delicate and the process needs a financier, collector, etc.

It’s a high percentage cost and banks are taking funds from customer deposits to give you the credit you want… And they will also handle the mortgage on this one for the term of the loan made.

And in many new cases the mortgages are being sold to a third party and the owner is left in the lurch. So today Homelend wants to revolutionize this.

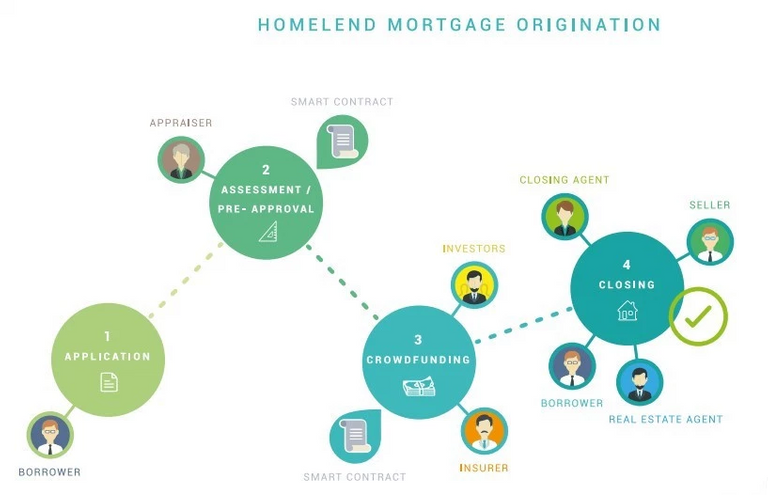

How Does It Work?

I found that this project will bring together the borrowers and the lenders without the 3rd parties people and will meet them in the Homelend Platform and will automate the entire mortgage origination process.from the website of homelend ( https://www.homelend.io )

How to Homelend platform

Homelend connects borrowers and lenders in a unique way, controlled by smart contracts, without involving intermediaries. The borrower will apply for a mortgage loan through Homelend’s platform. This app will be checked and approved (or not) with the help of machine learning and artificial intelligence technology.

Then, each lender will be able to finance the pre-approved loan by buying “Iris” from them. All processes will be controlled by the intelligent protocol of the contract, not by humans. In the Homelend platform, information gathering is done in an “all digital” way. Even data in paper-based documents should be transferred to a ledger based digital repository storage technology. This data is provided by the user and checked through a professional verification provider.

Financial flows in Homelend, the flow of financial resources from lenders to borrowers (and, finally, to sellers) run purely by smart contracts. There are financial services, controls or decision-making by Homelend Once the buyer receives pre-approval from the system, regarding certain properties, the mortgage loan is “registered” on the Homelend platform. Thus, the borrower has made a certain face, and the amount of credit is determined.

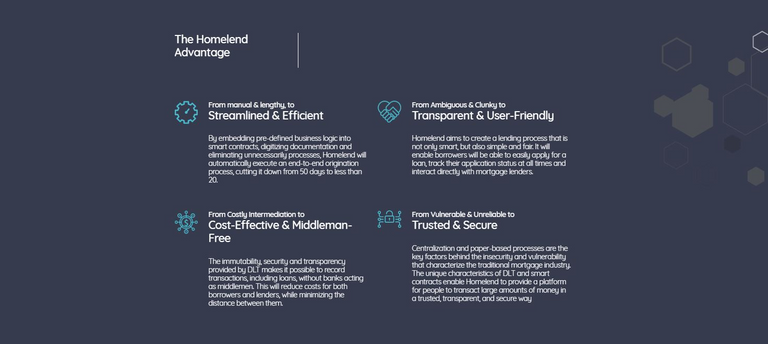

Benefits The Homelend Advantage

Streamlined & Efficient

By embedding pre-defined business logic into smart contracts, digitizing documentation and eliminating unnecessarily processes, Homelend will automatically execute an end-to-end origination process, cutting it down from 50 days to less than 20.

Transparent & User-Friendly

Homelend aims to create a lending process that is not only smart, but also simple and fair. It will enable borrowers will be able to easily apply for a loan, track their application status at all times and interact directly with mortgage lenders.

Cost-Effective & Middleman-Free

The immutability, security and transparency provided by DLT makes it possible to record transactions, including loans, without banks acting as middlemen. This will reduce costs for both borrowers and lenders, while minimizing the distance between them.

Trusted & Secure

Centralization and paper-based processes are the key factors behind the insecurity and vulnerability that characterize the traditional mortgage industry. The unique characteristics of DLT and smart contracts enable Homelend to provide a platform for people to transact large amounts of money in a trusted, transparent, and secure way

Homelend Token

The HMD Token is a fuel that feeds the Peel-to-Peer platform for Homelend lending. The main function is to provide access to the Homelend platform.

Token This utility also plays an important role in providing a fast, smooth, user-friendly, unified workflow and secure.

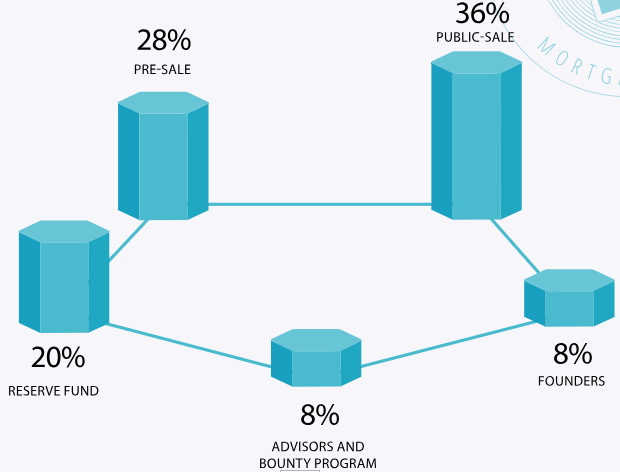

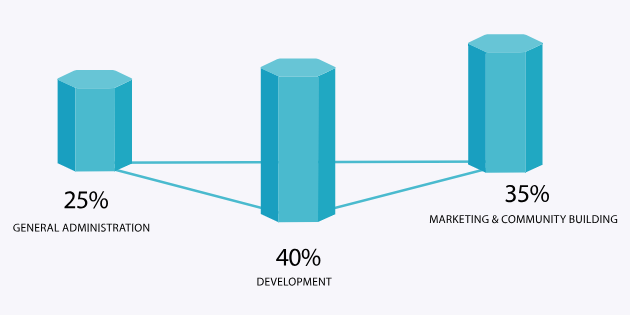

Token Allocation

Token Details

Symbol: HMD

Presale: March 1, 2018

Start Token Sale: TBD

End Token Sale: TBD

ICO Price: 1 ETH= 1,600 HMD

Soft Cap: 5,000,000 USD

Hard Cap: 30.000.000 USD

Ethereum ERC20 Platform

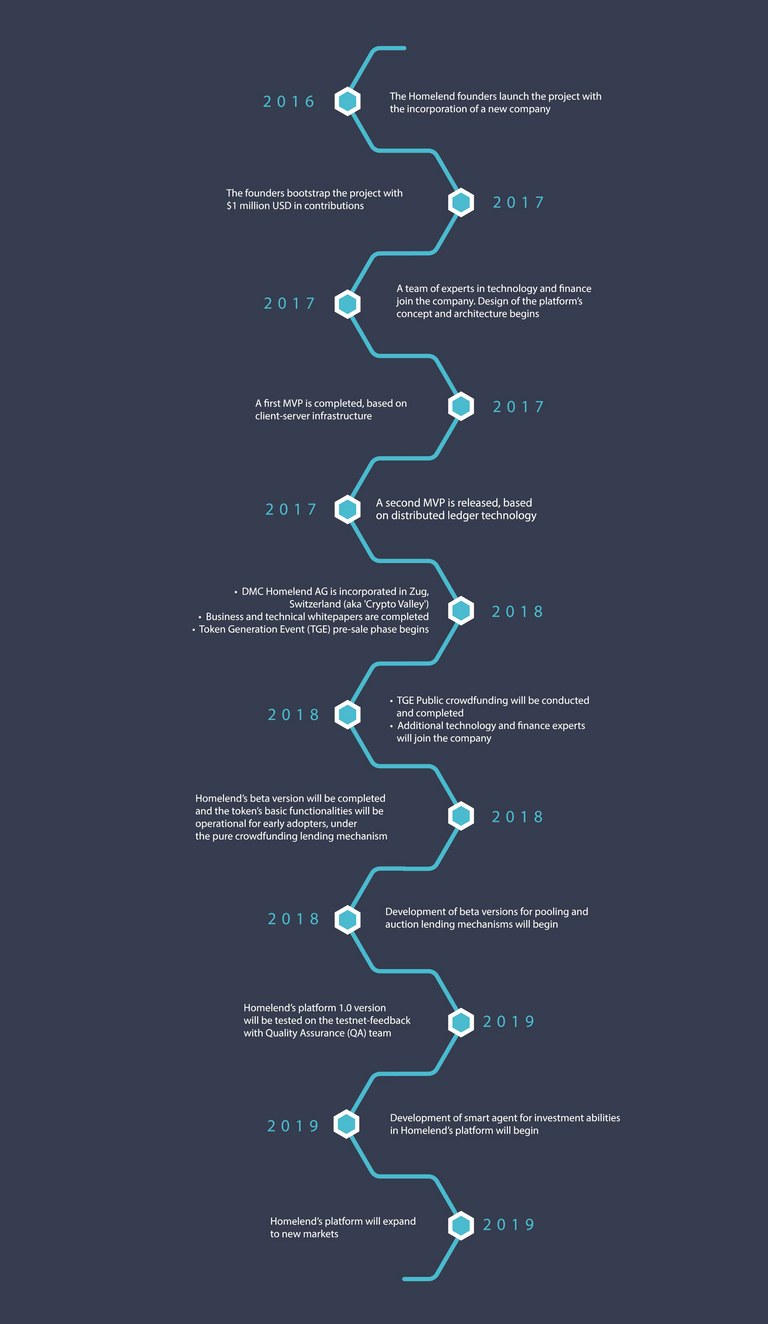

RoadMaps

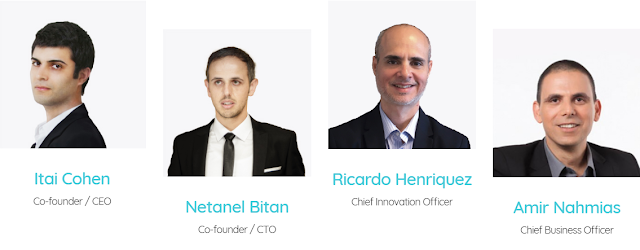

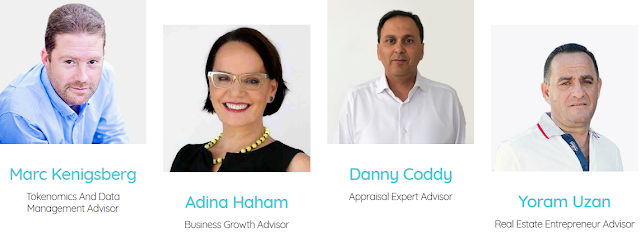

TEAM HOMELEND

Executive Team Itay Cohen: Chief Executive Officer

Netanel Bitan: Chief Technical Officer

Ricardo Henriquez: Chief Innovation Specialist

Amir Nahmias: Business Development Manager

Michael Tanfilov: Strategic Planning Director

Kanat Tulbasiyev: Lead Developer of

Ram Stivi Blockbacks Backend: developer

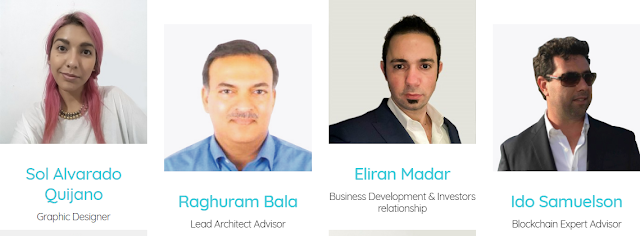

Sol Alvarado Quijano: Graphic designer / Community assistant

Vinod Morquile: Blockade DeveloperAdvisory Board

Eliran Madar: Business development / investor relations

Entrepreneur Joram Uzan

Moti Friedman: consultant ant on marketing

Evaluation of Danny Coddy

Raghuram Bala; Head of Analytical Technology

Ido Samuelson: Blockchain expert

Mark Koenigsberg: Tokenomics and data management

counselor

Adina Haham: Business Growth Advisor

Finally, I can say that this is a huge potential of this company. The comprehensive ICO is very impressive. This is an excellent open road to enter the world of ICO.

If you know how to improve our community.

If you know how to spread information about us in this world.

If you have ideas for other improvements, it's a privilege.

If you all participate in our generosity.

For More your Information link below :

Web Site: https://homelend.io/

Whitepaper https://www.homelend.io/files/Whitepaper.pdf

Twitter https://twitter.com/HomelendHMD

Facebook https://www.facebook.com/HMDHomelend/

Reddit https://www.reddit.com/r/Homelend

Github https://github.com/HomeLend

Medium https://medium.com/homelendblog

Telegram https://t.me/HomelendPlatform

Ann https://bitcointalk.org/index.php?topic=3407541.0

Author : hantu coin

ETH : 0xF1238e3a8F341b123e8Dd884DBFD1cE65496681C

Bitcointalk profile : https://bitcointalk.org/index.php?action=profile;u=2010241

Telegram : @hantu coin