.png)

INTRODUCTION

In the last couple of years or thereabout, there's been a massive paradigm shift in the way and manner people view the digital currencies otherwise known as Crypto currencies. From a sceptical spectre of imagination to an unthinkable realism andOwi finally now, Crypto currencies are almost a way of life for so many people globally. OwOwing to the border less, super fast and ease of transactions of crypto currencies, not to mention the cheap transaction costs, it has become a formidable adversary to fiat currency transactions. Another fact about Crypto currencies is the high volatility rate. In fact, the unstable nature of crypto currencies are the major reasons why governments and most financial organizations like banks are so disapproving of them. Major financial institutions are unwilling to aknowledge crypto currencies as viable means of exchanges because of the threat it poses to their centralized fiat currency world and their fears are aided by the unstable nature of these digital currencies. On the other hand, the high volatility of crypto currencies makes it quite attractive to so many investors as it promises quick and satisfying returns on investments within a twinkle of an eye, so to speak.

Whichever way it's looked at, there is no denying the fact that crypto currencies have revolutionized the financial sector by putting more power in the masses hands and making transactions infinitely easier and safer for them.

The Blockchain technology can be said to be the driving force of crypto currencies and grants decentralized and anonymous status to transactions and users alike. The blockchain technology ensures that third parties and intermediaries are rendered obsolete in the scheme of things, creating a direct line of contact between the parties involved in the transaction. This means more profit to both parties, lesser time and resources consumed and a trust less transaction ecosystem governed by smart contracts that are self executing and immutable.

Despite all the advantages of crypto currencies, there is still that underlying mistrust especially from financial institutions such that crypto currencies are still not accepted as forms of collateral for fiat or stable currency loans. This poses a big challenge to crypto investors as it makes it doubly hard to diversify or properly utilize their digital currencies outside of the cryptosystem.

CHALLENGES FACING CRYPTO CURRENCIES IN THE CONTEMPORARY FINANCIAL WORLD

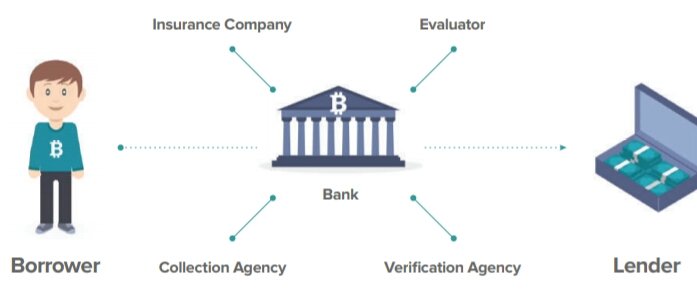

Traditional finacial institutions give out loans to individuals and organizations in lieu of collaterals and by assigning values to the collateral, they're able to minimize their loss risk in cases of payment default. The loan processes are often long and tedious, plus the unreasonable requirements needed from the applicant which in effect, often times makes it impossible for those who actually need the loan to get it.

For a crypto investor with lots of different crypto currencies, getting a fiat currency loan with the digital assets as collateral is next to impossible. So the crypto investor is left with the option of selling or converting his crypto currencies permanently into fiat to raise the needed funds. Now, this wouldn't be so bad accept for the fact that most crypto currencies are more of investment portfolios than mere currency for exchange. This is due to their ability to appreciate in leaps and bounds over time, hence crypto holders are inclined to hold their digital "assets" in their digital wallets and even physical safe storages specially designed to hold them.

So, having a platform where crypto currencies can be deposited as collateral in lieu of fiat currency or stablecoins such that the borrower can have complete access to his crypto currencies again once the loan is completely paid for, will be a welcome development for crypto investors. The success of such a platform will also go a long way in assuring the mainstream adoption of crypto currencies in the nearest future.

This is what the MoneyToken platform is all about.

THE MONEYTOKEN PLATFORM

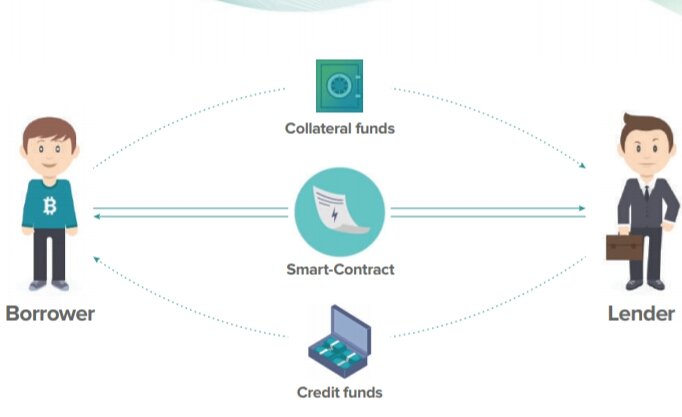

The MoneyToken platform is a decentralized platform powered by the blockchain and designed to open up fiat loan options to crypto investors so that they can have access to fiat currencies to take care of their businesses without having to give up their crypto investment positions.

Simply put, a crypto investor can deposit a specified amount of crypto currency in the MoneyToken platform account and then borrow a certain amount of fiat currency and on repaying the borrowed funds, his crypto assets are returned to his wallet regardless of whatever appreciations the assets may have accrued as collateral.

Because its powered by the blockchain technology, there is no long waiting time for the processes to be through and no verification of the borrower assets needed and the transaction costs are quite minimal.

To provide automated loan services,the MoneyToken platform utilizes Amanda, a deep learning, AI algorithm loan assistance that provides human like services for seamless operations on the platform. This takes care of all the operations done by an intermediary in the traditional loan service thereby cutting off need for intermediaries which also ensures costs remain minimal.

MONEYTOKEN PLATFORM ECOSYSTEM

For starters, the MoneyToken platform will accept bitcoin and Ethereum as forms of collateral with other good crypto currencies like dash, litecoin, dogecoin and others added as time goes on.

One good feature that guides against volatility of the collateral crypto currencies on the MoneyToken platform is that a borrower can deposit collaterals in different Crypto currencies so that the more stable ones can compensate for others in case of coin depreciation.

Lending funds are gotten from a pool of funds realized from the token sales and can be awarded in dollars, Euros, Jpy or any other fiat currency and even stablecoins, depending on the needs of the borrower.

Loan repayment can be done instalmentally or at the end of the loan term as specified in the Ethereum smart contract and once payment is completed, the deposited collateral is unlocked and returned to the borrower's e-wallet.

MULTIPLE SIGNATURE ADDRESSSES IMPLEMENTATION

The MoneyToken platform resolves the issue of trust on its platform by not relying solely on smart contracts but also by implementing multiple signatory addresses. Here are the signatories needed:

1signature from the borrower

1 signature from the lender

2 signatures from MoneyToken acting as escrow agents.

3 signatures out of the listed 4 are required for every loan processing. This ensures that no single person can create multiple accounts as lender and borrower for the purpose of cheating on the platform.

INITIAL MONEY TOKEN (IMT)

The Initial Money Token, IMT, is the native token designed for use on the platform to minimize risks for both users and the platform itself. It has a number and further mining is not allowed. It has some specific functions which include:

- Privileged terms for users who deposit IMT for borrowers membership application

- Users depositig IMT for lenders membership become lenders easily

- About 60% platform fees discount on borrower membership

And other functions.

Here's the project's road map:

For more information, visit the website

https://moneytoken.com/

And read the whitepaper

https://moneytoken.com/doc/MoneyTokenWP_ENG.pdf

Written by: Ebykamsiokoro

BTT profile link:

https://bitcointalk.org/index.php?action=profile;u=2047938;sa=summary

Wow this is a great project, i hope the project managers wont run away with our crypto collaterals?

Of course not. Please do check out the team on their social media profile. They are seasoned veterans