Over the past couple weeks, the Blockchain market has had some consistent and noticeable dips. There were constant mentions of blood on the streets as CoinMarketCap filled with red. As many of my friends, who are new to Cryptocurrencies, started to notice their investments taking a hit, panic settled in.

"What is the Segwit2x doomsday thing I keep hearing about in Bitcoin?"

"Is Aug 1st really going to crash the market?"

"Is Bitcoin really going to split into two?"

Most of the new money that are entering the market are still very green and they are chasing charts and promises of riches without asking the important questions. They aren't understanding exactly what they are buying into or trying to think about the potential of the long term distruption this technology has, and I think that's why we are experiencing consistent dips. The market manipulators understand this and they try to cause self-benefiting panic.

We are all speculating on the success of Blockchain technologies, however, I believe we can no longer put the genie back in the bottle. The value of Blockchain is very apparent, the smart people just need to figure out undeniable use cases that will hit hard enough to gain mainstream attention -- Steemit is a very good one :). We're getting close. Every day that Blockchain hasn't disappeared is another day to work out this solution.

A fool and his money are soon parted.

So how do you survive in a market that is as turbulent and volatile as the Cryptocurrency market?

But what do you buy?

Tip #1: Don't invest in the shiny new ICOs.

The ICOs (Initial Coin Offering) can be thought of as Ethereum's first killer app. The ability to invest in kickstarter projects with extreme convenience and without rules or restrictions was initially very enticing. I participated in a few of these when they first came out (Golem, Augur, Iconomi). However, the difference between the projects from that era and the ones that are coming out today are quite stark in their differences. Many of the ICOs coming out today are obvious cash grabs with their lack of team member details, technical specs, and strange distributions. You may get lucky and pick up a unicorn, but the aggressive landscape of pump and dumps are more likely to hurt than help you in this field.

Tip #2: Accumulate the battle-tested coins

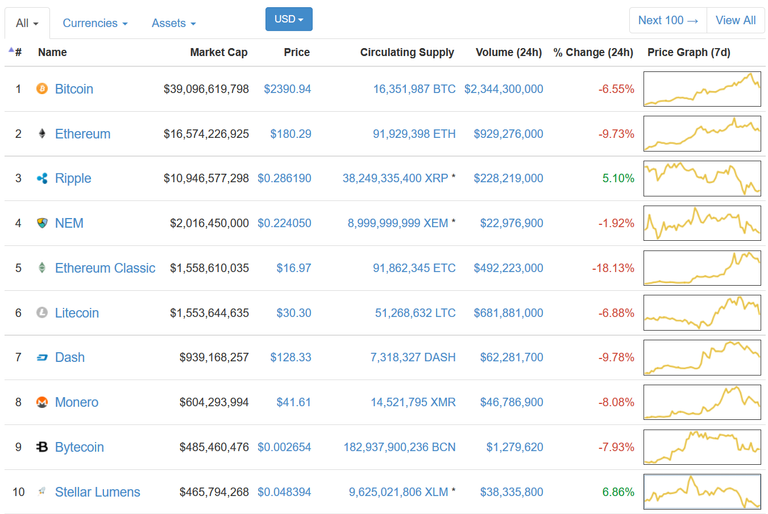

These are the coins that have proven their worth, security, and longevity over time. These are the old guards and these are the ones that will most likely emerge as the cornerstones of Crypto once all the storms blow over. I'm talking about Bitcoin, Litecoin and maybe Ripple.

Tip #3: Understand what a coin is trying to solve, research and trust your instincts

There are many, many coins now in the market. It's extremely hard to keep up with a couple of coins in this rapid market, let alone the hundreds that are out there. I came across this post about coin summaries. This is one of the best coin summary blogs I've seen that lays out the problems and the coins that are trying to solve these issues. I recommend a read through it and to note all of the interesting ones you feel resonates loudly with your ideals. After that, research the technology, research the team, and research the community that supports it. If they all check out, buy the dips.

Tip #4: Buy the dips

From now until Bitcoin resolves their issues, there will be much uncertainty in the market. The people who aren't deep diving the issues will be shaken when the market takes these turbulent dives. However, If you understand the fundamentals for the coins you're investing in, you should be able to separate the FUD (fear, uncertainty and doubt) claims against the truth, and that the Cryptospace should continue to march forward regardless of what's thrown its way. There will be speed bumps along the way which may slow progression, but in the long run, the Blockchain technology will prevail.

So buy the dips.

Use this website , TaiFu Index, to quickly check the pulse of the market. If it falls 5% on a given day, it's a good time to buy a bit of the coins you like. Doing this in the long run will average out the bottom purchases and you should come out heavily on top when the market eventually makes that bull run once more.

I agree with your post, another important tip is to never sell at a loss. You're not making any losses as long as you don't sell.

good point! great way to look at it

I agree. In the long run, all the good coins will rise together.

just dont panic, and hodl, this market will be worth i shit ton in the next couple of years

A good TL;DR lol

Thank you its realy very usefull to me :3

Glad it helps!

This post received a 2.6% upvote from @randowhale thanks to @elowin! For more information, click here!

i like your posts my friend