CRYPTOASSETS AND THE NEXT-GENERATION WEB

THE BLOCKCHAIN

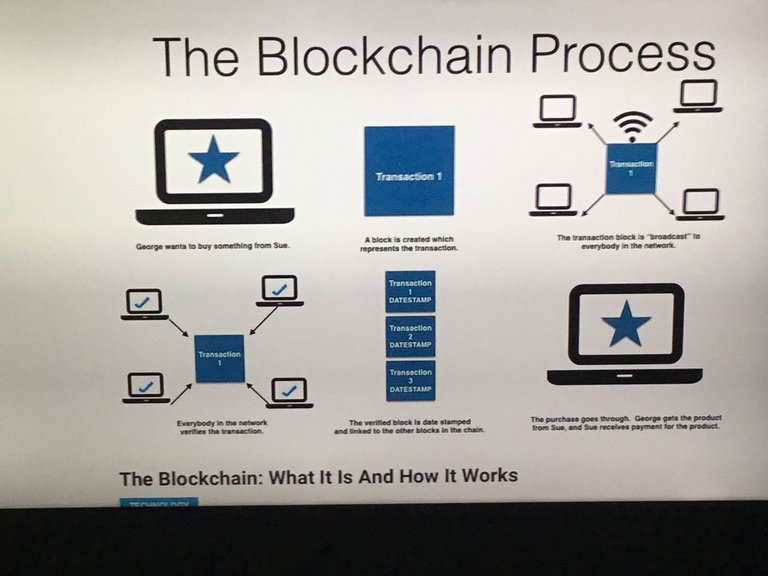

In the previous articles, we have had a general overview of Trustless Decentralised Ledger Technology and how it allows peer to peer transferring of assets. Now it’s time to delve into the first practical realisation of that technology, which is the Blockchain. How does it work?

Let’s find out by following a hypothetical transaction. Anyone who wishes to send or receive bitcoin must first have a wallet (we’ll get into what that is in the context of cryptoassets in another essay). When you instruct your wallet to send bitcoin to somebody else’s wallet, that pending transaction is broadcast to the network of computers that collectively make up the Trustless, Decentralised Ledger. Along with broadcasting the pending transaction, other important information is also broadcast, such as the two parties’ assigned wallet addresses, a unique transaction code and a date and time stamp.

At this point, as a pending transaction, the bitcoin you wish to send is one of many awaiting inclusion in the blockchain. It is so-called because it takes groups (or ‘blocks’) of transactions and arranges those blocks in chronological order. It is that chronological order that helps guard against malpractice like double spending, because it provides an historical ledger of accounting balances with which to verify the legitimacy of each new transaction. As Paul Vigna and Michael J. Casey explained, “by creating a time-stamped sequence of expenditures and receipts among every participant in the Bitcoin economy, the system keeps track of where everybody's balances are at any given moment, as well as the identifying information attached to every Bitcoin-and fraction of Bitcoin-ever created, spent, or received”.

(Image from infocelltechnology)

Each group or ‘block’ of transactions can only become added (or ‘chained’) to the Blockchain ledger once the miners (to be covered in another essay) have done what’s necessary to confirm the legitimacy of the transaction. Once that work is done, a new block is added to the blockchain that establishes the transaction as authenticated and irreversible. Specifics like what the money was intended for or the names of those involved in the transaction are of no concern to the Blockchain. All it requires are the special passwords (private and public keys) and the identifying addresses of each participants’ wallet.

The Blockchain- a chronologically-arranged group of transactions-makes up Bitcoin’s protocol. In other words, the set of programming instructions that let computers talk to one another. This protocol provides the network with the necessary operating instructions and information with which to keep track of and verify transactions, laying out the steps that must be performed before consensus can be reached, and a new block added to the chain to become the base on which further blocks can be chained.

When somebody receives bitcoin, what are they actually receiving? Often, when cryptocurrencies are discussed, they are often depicted as being actual tokens, gold coins stamped with the Bitcoin B. This is something of a misrepresentation, as this is a purely digital currency that really has no existence beyond the ever-shifting accounting of credits and debts that is the Blockchain. Your wallet’s balance is “a net value of the spending power based on an accounting of the incoming and outgoing transactions. Your right to bitcoin is defined as the balance that the ledger recognises as yours” (according to Paul Vigna and Michael J. Casey).

(Not what bitcoin really is. Image from wikimedia commons)

When people lose bitcoin or have it stolen, what has actually happened is that they have lost their ability to exploit those balances and transfer them, most likely because they have either lost their private key or had it stolen. No bitcoins are ever literally lost because, since they don’t constitute documents or digital files, they don’t actually exist. But the public ledger of ever-lengthening chains of blocks certainly does exist, so there are real credits and debts being transferred. At all times, anyone can see all transactions occurring between bitcoin addresses, but you only have the ability to request to change those parts of the blockchain that are accessible via your private key.

So that’s the blockchain, basically a consensus view regarding which transactions are legitimate and which are not, which thereby confers upon the public ledger irrefutable proof of what you and every participant owns and what has been spent or received.

Ok, so we have outlined the mechanism for publicly displaying and maintaining a public ledger. But what about providing the incentive to ensure enough individuals provide the resources to ensure the integrity of the blockhain? That’s where the ‘Miners’ come in, but that is a topic for next time.

REFERENCES

“Cryptoassets” by Chris Burniske and Jack Tatar

“Cryptocurrency: The Future Of Money?” By Paul Vigna and Micheal J Casey

“Hidden Secrets Of Money” by Mike Maloney

Oh yeah, the blockchain must be transparent and your gear is a great idea! Thank you @extie-dasilva

"Future Real Money"

Handing over everyone increase the demand ...That's why the value increase...as like as a "Jogan"

Thanks for sharing a good content,sir @extie-dasilva @upvoted

hay your article is very good, I've follow you, please follow back @obicryptos and we can help each other. thank you