Before we can talk about mainstream adoption of cryptocurrencies and the implementation of blockchain technology in all economic aspects of our lives, we first must take a better look at its challenges, limitations, problems and obstacles. This article will describe the main problems that bitcoin and blockchain both face before fulfilling their prophecy.

Complexity is one of the first stumble rocks when you try to get involved in the cryptocurrency world. Blockchain technology is based on cryptography. Cryptography is actually a field that studies techniques for secure communication using complex mathematical models combined with computer science. Only a few people really understand the mechanics of these complex protocols. Furthermore, the creation of an entire new economic area has created its own vocabulary. Luckily, more and more courses, reviews, articles, and so on are published every day to make all of this more understandable for the general public. All the software is still not 100% user friendly. Most people know how to use bitcoin but do not have a clue how to properly use a wallet, let alone using the blockchain itself. All the software must be adapted to be as user friendly as possible. This was also the case with e-mail and the use of internet in the early years. Websites and operating systems had to be changed in a way that the end-user almost did not see the technology he was using.

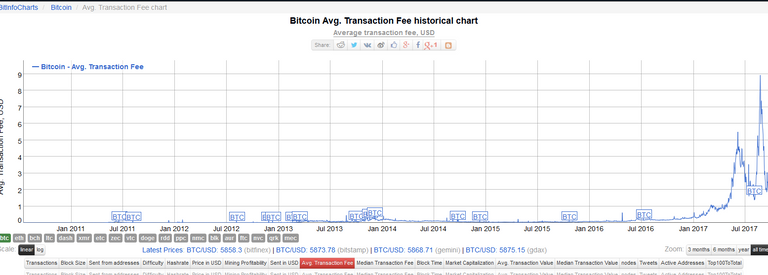

Transaction costs have increased so much that they have become a real problem that has to be dealt with as quickly as possible. One of the main advantages of bitcoin during its early years was that transactions were almost free. Nowadays a transaction can quickly run up to several dollars. A few solutions have been proposed but no consensus is achieved yet.

Litecoin has plans to implement the lightening network. This new technology could potentially increase transaction speed and lower the transaction costs significally. This project is still in alpha-phase and it aims to tackle the bitcoin scalability problem by scaling “off-chain”. Transaction speed on the bitcoin network is about 20 minutes at the time of writing. Although it is still faster than ordinary bank payments, it still is not fast enough. Many altcoins have much faster confirmation times.

The graph below shows clearly the immense increase in transaction cost on the bitcoin network.

Scalability is a hot topic when talking about bitcoin and cryptocurrencies. The blocksize in the bitcoin network is still set at 1Mb. Due to the big growth of the bitcoin network but the still 1Mb large blocks, bitcoin now faces high transaction costs and slow transaction speed because not all transaction fit In a block. in order to address this problem several hard and soft forks are proposed by the community. The ‘New York Agreement’ tries to solve this problem. The first half of this implementation was the segregated witness in august, 2017. The second half of this agreement would have been the Segwit2X hard fork planned in November. This hard fork would have increased the blocksize to 2 Mb. This hard fork was suspended less than a week before the fork was planned.

Immutability is the characteristic that once a transaction is recorded on the ledger, it never can be changed or deleted. This prevents a correction in case a mistake was made. Immutability is a charachterisitc that set blockchains apart from ordinary databases.

Human error is also still a big problem in the blockchain. A blockchain is essentially an immense database. So the data that gets stored in this database must be of high quality. Many security measures have to be taken to prevent human error. In the crypto-space you often hear people complaining about losing their funds due to incorrect address, incorrect altcoins or even forgetting their passwords. These are real problems that have to be tackled in order to convince more people to put their funds in bitcoin.

Unavoidable security flaw. Let me explain this one. In order to confirm a transaction 51% of the nodes in the network must agree that this is the truth before putting the transaction in the blockchain. If more than 51% of the nodes tell a lie, this lie will become the truth. This is what is referred to as a ‘51% attack’. This danger was firstly highlighted by the creator of bitcoin, Satoshi Nakamoto. To ensure that this never occurs bitcoin mining pools are monitored by the community.

This new way of organizing ourselves, communicating with each other and transacting has brought a new form of politics with it. In these decentralized communities there can sometimes occur public disagreements between different sectors of the community. People with different visions don’t agree on the future development of the project. In these situations, several proposals are made and if there is no real consensus often, a fork is proposed. This is a way to solve differences in crypto communities. After these forks, the general public will decide, through market mechanisms, which one the best option was.

There must sufficient adoption to fulfill the promise of blockchain. The network effect which is nothing more than the increase in value due to the worldwide adoption of an invention. We already witnessed this with google, youtube, snapchat, and so many others. To become worldwide-adopted bitcoin and blockchain must surpass a certain level of adoption before blockchain can be called a success.

A last argument that regularly comes to attention when researching blockchain is that this technology is a ‘solution looking for a problem’. Since its inception, many proponents are figuring out what blockchains can be used for. Even governments are studying this new technology to determine in which sector this technology can have the most positive impact. Many ideas and initiatives still remain idea’s. The future will tell us if these statements were true or false. Blockchain can be compared to a shiny new tool in our toolbox. All we need to do now is to figure out what this tool is best used for.

Author: Felich

https://www.coindesk.com/information/blockchains-issues-limitations/

https://www.forbes.com/sites/jasonbloomberg/2017/05/31/eight-reasons-to-be-skeptical-about-blockchain/#131973825eb1

https://www.coindesk.com/blockchain-immutability-myth/

https://hackernoon.com/beginners-guide-to-bitcoin-s-scalability-debate-66060f3799e5

https://en.wikipedia.org/wiki/Bitcoin_scalability_problem

https://themarketmogul.com/bithumb-hacked/

https://www.coindesk.com/dumb-mistakes-costly-bitcoin-losses/

https://learncryptography.com/cryptocurrency/51-attack

https://blockgeeks.com/blockchain-voting/