Looking back on footprints of the cryptocurrencies, you may notice that people around the world are enthusiastic about these secure, decentralized and hard-to-track assets. With their total market value skyrocketed to over $300 billion, cryptocurrencies are in fact an emblem of the booming new economy.

That said, the world’s most cryptocurrency exchanges are centralized, not secure or anonymous, and in the grasp of a few entities. Over the past decade, we have seen exchanges hacked and cryptocurrencies robbed from time to time; and waves of exchanges rose and fell.

Facing the harsh reality, we must stay awake and understand that there is a long long way lying ahead before the bright future of cryptocurrency. It’s not that good as we imagined, at least for now.

Hearing those ‘decentralized exchanges’ crowing about their safer, faster and cheaper stuff, are you sure that they are ‘decentralized’? Large exchanges rarely accept their programs, giving a clear signal that they need improvement. Generally speaking, most centralized exchanges today are way beyond acceptable when it comes to reliability, speed and rate.

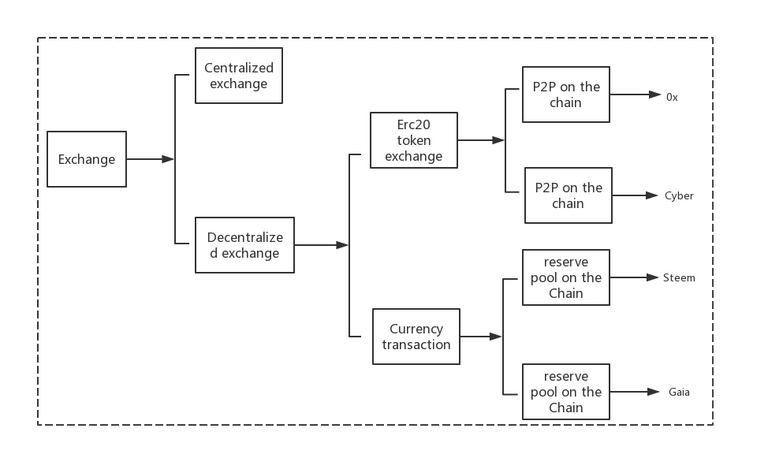

Shocked by numerous ‘conceptual products’ of decentralized exchange? They simply fall into four categories:

Type I:

On-chain P2P trading of ERC20 tokens, e.g. 0x;

Type II:

On-chain trading of ERC20 tokens involving reserve pools, e.g. cyber;

Type III:

Centralized exchanger-dependent coin trading, e.g. steem; and

Type IV:

Coin trading independent of centralized exchanger. This represents the future of cryptocurrency exchange.

Types I and II are not good because they are trading ERC20 tokens, not coins. They are secondary token exchanges based on Ethereum. You cannot find true virtual coins there. Still not clear about ERC20 trading? Let’s put it more bluntly — none of these exchanges supports the trading of Bitcoin and Ethercoin.

Rather than call them decentralized exchange, we do think ‘ERC20 exchange’ is a more suitable term. You can easily distinguish these exchanges by checking if they are “using the 0x protocol”, or “based on Ethereum smart contract”, or using some other fancy concepts.

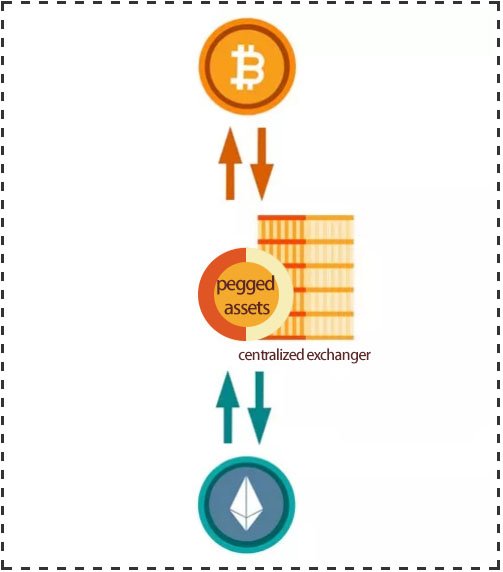

If the centralized exchange is bad, then the exchanger-dependent type III, a largely distorted concept of decentralization, is horrible. You are not trading your Ethercoins or Bitcoins on a type III exchange, such as STEEM. Instead, you convert your Ethercoins or Bitcoins into ‘pegged assets’ forged by the centralized exchanger, and trade the pegged asset. Yes, the centralized exchanger promised you 1:1 exchange rate between the Bitcoin (or Ethercoins) and the so called pegged asset, which is not worth a straw once the exchanger slinked off or in case of a run on the exchange. The truth is, when you exchange a Bitcoin for 10 Ethercoins, you actually get 10 ‘fake’ Ethercoins that are recognized by no one expect the exchanger. It turns out at last that you guys are trading fake Bitcoins and Ethercoins on the platform. This is obviously ridiculous.

Type IV is a truly decentralized exchange that supports trading of genuine Bitcoin and Ethercoin. This type of exchange further split into two classes represented by Polkadot and GaiaWorld, respectively. Polkadot builds a standard exchange layer on each and every blockchain to shape a heterogeneous multi-chain framework; while GaiaWorld establishes a decentralized mid-layer, which functions as a medium of exchange. GaiaWorld’s decentralized exchange comprises 5 elements, namely client, service provider, deposit system, Gaia Shield Protocol and self-management committee. GaiaWorld blockchain allows creation of numerous small reserve pools, which help the client with cryptocurrency exchange as service providers after they have paid sufficient deposit. With the assistance of Gaia Shield Protocol, the service provider ensures successful exchange and earns its profits. In case of any dispute, the client may appeal to the on-chain self-management committee, claiming return of token and compensation.

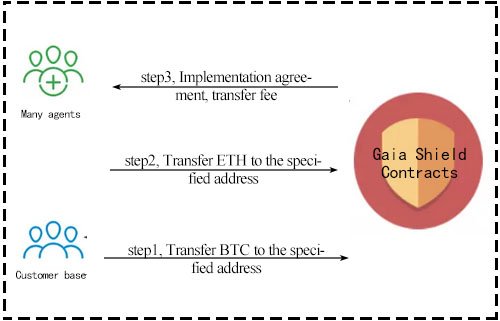

A typical cryptocurrency exchange process can be described as follows:

- Agents P1/P2/P3/Pn build Gaia Shield links and upload their well-developed Gaia Shield contracts to the blockchain, in order to provide Bitcoin/Ethercoin exchange service;

- Agents fully pay their respective GAIA deposit to become a valid service entity;

- Alice transfers Bitcoins to a specific Bitcoin address by using Gaia Shield Contracts of several service providers;

- The agent transfers Ethercoins to the address specified by Alice by using Gaia Shield Contracts;

- The agent confirms successful transfer by using Gaia Shield Contracts;

- After verification by Gaia Shield Contracts, the Gaia processing fee is transferred to an address specified by the agent;

- Alice may appeal to the self-managed committee if she thought the transfer failed. However, under the protection of Gaia Shield Contracts, it is virtually impossible for the agent to play tricks;

- If the committee makes a judgment in Alice’s favor, as a penalty, the agent’s deposit is transferred to Alice.

Decentralized exchange is a promising application of blockchain technology. That said, most exchanges today are centralized ones, which stands on the opposite of this inherently decentralized technology. But it’s true that tons of questions are awaiting answers: less complicated methods, underlying technologies, to name a few. We are confident, however, that better solutions are on their way.

gud

Coins mentioned in post: