.jpg)

tl;dr: when non-fungible assets can easily be used to secure loans of fungible assets, value gets liberated.

One of the less obvious elements about the coming Age of Blockchains is how the concept of an “asset” is going to be expanded.

Personal data, our attention, our behavioral….those are all assets that we each have, but which currently provide us little in the way of direct value in the digital world.

Not only will the concept of an asset get expanded, but we will have more options about how to use the value that our assets create.

Fungible and Non-Fungible

In the crypto world, like in the non-crypto world, there are “fungible” and “non-fungible” assets.

Fungible can be exchanged with no obvious differences. My $20 bill and yours are fungible.

A “non-fungible” asset doesn’t have an obviously equal opposite.

The diamond on a finger, the Picasso painting, the baseball card in mint condition, the rare stamp. These are all assets, but each has unique properties which can affect and impact its value.

Markets Lack Transparency

Because of those unique elements, it’s not always easy to figure out what the value is.

So, we rely on appraisers, who are a form of trust brokers. In theory, these appraisers have a better sense of the market and can give an individual buyer a “truer” sense of what something is worth.

In the absence of a market that is big enough where we can do “price discovery,” we have to trust these intermediaries.

Or, we can go out on our own, and risk being placed in a position of information asymmetry where others, with greater knowledge about the state of the market, can take advantage of us.

Shows like American Pickers, Storage Wars, and Auction Hunters are all about the opportunity that exists when some people are not aware of the market value of a non-fungible item and some people are.

Crypto Markets and Non-Fungible Assets

In the crypto world, the non-fungible assets are called NFT’s..Non-Fungible Tokens. Makes sense, at least to me. 😉

Just like in the “real world,” there are assets, like Bitcoin and Ether, which are interchangeable and there are assets, like Crypto Kitties which are digital and provably unique…like a Picasso or a diamond.

However, unlike in the “real world,” the markets for non-fungible tokens have transparency.

Or, I should say, they WILL have transparency when they are mature. Today, they are just immature.

Using a protocol like 0x, you will be able to list your NFT and get bids on it. Those bids may come in the form of fungible assets, like a token, or in the form of other NFTs, which can be anything like digital art or collectibles.

In short, at any time, you will have a much better sense of the market value of all of the non-fungible assets (well, digital ones) that you currently own.

Non-Fungible Collateral

Once you have a good sense of what the market price is for your NFT, you can, of course sell it for another fungible or non-fungible asset.

Or, you can use it as collateral to get a loan.

First, however, let’s compare it to the existing system

Imagine going down to the bank with a painting that your grandmother gave you and saying,

“This painting is worth $10,000. I’d like to use it to secure a loan in that amount please.”

The banker would just stare at you with a blank face.

There’s a ton of friction in that process which makes it impossible.

The banker needs to verify your claim that it has a market value of $10k.

Even if he did that, he would refuse because the bank doesn’t want to take on the custodian risk of holding art in its vault. Plus, the bank would constantly have to reappraise the art to make sure that the collateral:loan ratio is healthy.

They will never do this.

The consequence is that the value that is yours remains locked up in the painting and you can’t use it to build, buy, invest, or do whatever you want.

NFTs as Collateral in the future

However, with an NFT, this is precisely what you can do.

You know the market value and, equally importantly, thanks to blockchain’s transparency, everyone else knows the fair market value as well.

So, you can go to a crypto-lender and say, “I have this CryptoKitty that is worth 5 Ether. I want to hold onto it for the long-term, but in the short-term, I’d like to use it to secure a loan.”

The crypto-bank, which is a smart contract, basically says, “yep, ok, we can verify that the price is what you say it is. We’ll do it. Here’s your money.”

They don’t need to take custody of the asset, it’s locked in a smart contract.

It will only get liquidated if you fail to pay back your loan or if the value of your NFT drops and you are under-collateralized.

I think this is ridiculously cool and will open up an entirely new path for value to get liberated.

And it’s not fantasy. It is reality.

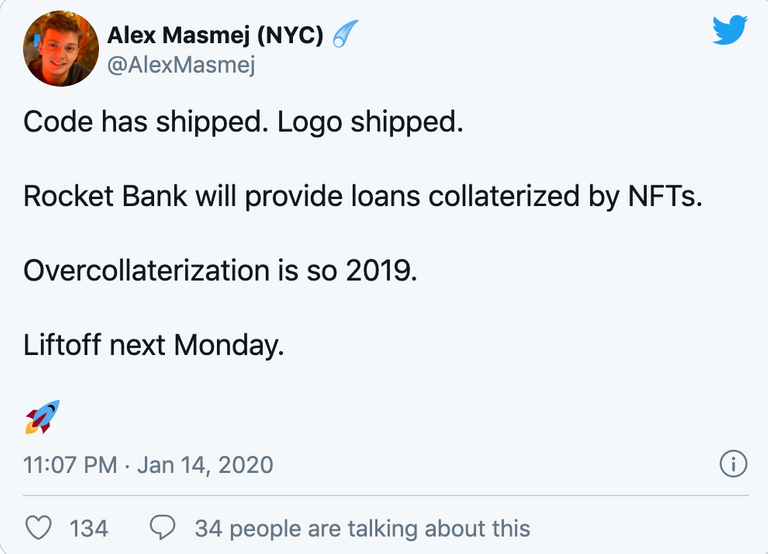

Keeping mind that this isn’t an endorsement of the project, this is precisely what Rocket Bank is going to let people do.