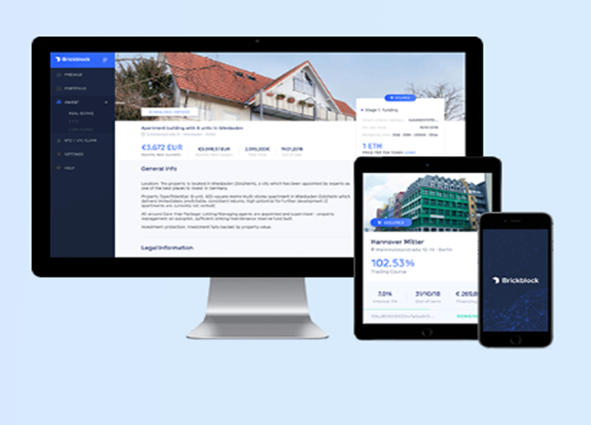

Brickblock Platform

Brickblok is a platform based on blockchain technology that will provide solutions in Real-Estate investments inclusively financially in all income classes, no artificial geographic trade restrictions, including the need for eliminated bank accounts, investment risk reductions, and costs ordering becomes lighter in comparison with traditional investment platforms.

Brickblock invites all investments in real estate funds (REFs), exchange-traded funds (ETF), passive coin-traded funds (CTF) and active coin-managed funds (CMF) through an efficient and significantly lower cost process than traditional investment. The Brickblock infrastructure system will be implemented in a decentralized Application (Dapp) running on the Ethereum network making it easier for brokers, traders and investment managers to see investment opportunities on the Brickblock platform.

Differences Brickblock with other platforms

- In contrast to direct investment and trust-based fund managers, this adds an additional layer of security to investors. On the Brickblock platform, every investment manager has direct obligations to investors, which can be enforced through legal action.

- In the investment market now Contract Fund Difference (CFD) and other derivatives rely too heavily on confidence and moderate price trends. So Brickblock considers CDF is not a suitable instrument for medium and long term investment. Thus, Brickblock only allows physical shares, commodities, and currencies rather than betting on derivatives.

- Through Brickblock's smart contracts, investors can deposit their investment funds then the funds are released for viewing by all brokers and dealers through decentralized apps. Through automatic smart contracts, broker-dealers receive investor funds immediately after transmitting assets. Initially, until a new broker-dealer trusts Brick-block's first smart-asset contract, Brickblock will deposit investor funds in escrow as collateral. Therefore, if the smart contract is inactive, the broker-dealer can claim escrow.

- Brickblock utilizes the existing infrastructure to enable the adoption of new investment systems faster, so Brickblock has bridged the world of traditional investment into the digital world. All Brickblock transactions are legally accepted and can be executed in court.

Users of Brickblock Investment Infrastructure

- Private Investor. Brickblock's infrastructure system will help private investors diversify their portfolios beyond cryptocurrency and tokens, reducing overall risk.

- Institutional Investors. The Brickblock system will help investment finance institutions to invest funds in differentiated digital currency portfolios without having to worry about holding a lot of wallets and handling multiple exchange platforms.

- Fund Manager. The brickblock infrastructure system will enable immediate global distribution, reduce funding costs, improve profitability, lower the fund manager's workload and overall, level the playing field. Brickblock's Brickblock system is then interested in a productive professional relationship and will help fund managers build an initial management structure. Brickblock will work with third parties to proactively reduce the potential for cyber law and security risks associated with responsibility as a fund manager.

- Brokers and Dealers. Brickblock acts as a sole broker-dealer partner. This simplifies compliance and the preparation process for broker-dealers. Brickblock will help broker-dealers with customized e-wallet application programming API (API) application interfaces.

- Commercial paper publishers. Brickblock will bridge and help issuers enter the krypto market by integrating existing asset management asset infrastructure and messaging standards for both publishing and distribution. Brickblock will provide incentives for conventional paper publishing to move toward a lower cost distribution model and reach the international market.

Assets Traded in Brickblock

The smart contract will manage all costs, minimum investment pool, exchange rate, holding period, net asset value, dividends, or other payouts after the investor selects the asset fund provided by Brickblock and deposits into the smart contract. Here are the services provided in Brickblock.

- Real Estate Fund (REFs). REFs are actively managed by investment managers. Depending on the underlying focus, investment managers acquire certain real estate in certain cities, countries, or continents around the world. Brickblock will allow fund managers to list real estate projects with high potential and help users to find interesting opportunities with ease. Each project will be carefully audited by an independent party to minimize fraud.

- Exchange Traded Funds (ETFs). Brickblock provides exchange-traded fund services as an attractive value deposit. Stock traded funds can also track commodities such as gold and silver and have the advantage of being offered at close wholesale prices without minimum purchase amount. Exchange-traded funds outperform the yields of the most actively managed funds that invest in the company's shares and allow investors to invest in folios, even with very little capital. By choosing their preferred ETF, investors can actively decide on which markets to invest and spread their risk across different geographic and industrial locations.

- Coin Managed Funds (CMF). CMF is a funding service from Bricblock that is actively managed by fund managers when investors have deposited their funds specifically into the form of cryptocurrency coins.

- Coin Traded Funds (CTF). Brickblock offers passively managed CTFs and tracks rule-based indexes designed by fund managers and community members. One is to be CTF Top 10 cryptocurrency. This index will include Top 10 cryptocurrencies weighed by market capitalization. Because there is no passive CTF at this time, Brickblock introduced the system based on a passive ETF.

Development Project

Brickblock Partners

ICO Structure Brickblock

Project development will always be implemented by each platform and the subject requires funds to be prepared through the ICO period. One of the platforms implementing the ICO period is Brickblock which has created and developed Brickblock tokens (BBK). This token is created only in the ICO period running on the ERC20 ethereum network in order to raise funds for the development of the Brickblock project. The BBK Token was launched in the ICO period on May 9, 2018, for 7 days. You may contribute to that period on the https://brickblock.io/ link The terms and conditions of payment of the BBK token are specified by the Brickblock team.

Website > https://brickblock.io/

ANN Tread > https://bitcointalk.org/index.php?topic=3345519.0

Telegram > https://t.me/joinchat/AAAAAERj-_1p8AktrkESlQ

Twitter > https://twitter.com/brickblock_io

Facebook > https://www.facebook.com/brickblock.io/

Hello! We do one thing. I followed you, I hope you will follow me. Let's develop the power of steemit together and improve your blogs.