Intruducing.

Faba Ltd is a community-owned VC Fund startup based on the blockchain. As a tokenized (STO) Venture Capital, investors and holders of the Faba tokens will have the opportunity to decide what project or enterprise Faba Ltd can invest into for collective gains.

(FABA) is the first venture capital token with positive impact on our lives. Decentralized voting system enables shared decision making when selecting projects.

(FABA) is the first venture capital token with positive impact on our lives. Decentralized voting system enables shared decision making when selecting projects.

We connect traditional venture capital market economy with the crypto world bringing new opportunities to both.

We connect traditional venture capital market economy with the crypto world bringing new opportunities to both.

FABA LTD invests in those projects that passed through professional due diligence process, where it becomes an equity shareholder.

FABA LTD invests in those projects that passed through professional due diligence process, where it becomes an equity shareholder.

Due to our professional approach, financial investment and the time commitment of the mentors and (FABA) token holders, the valuation of companies raises. Our investments are then exited at their peak to return multiples of initial investment to our token holders.

Due to our professional approach, financial investment and the time commitment of the mentors and (FABA) token holders, the valuation of companies raises. Our investments are then exited at their peak to return multiples of initial investment to our token holders.

Faba was founded by a group of experienced people, whose interest is to support projects and teams of people with ambition to influence the world.

Faba was founded by a group of experienced people, whose interest is to support projects and teams of people with ambition to influence the world.

Faba was founded by a group of experienced people, whose interest is to support projects and teams of people with ambition to influence the world.

Faba was founded by a group of experienced people, whose interest is to support projects and teams of people with ambition to influence the world.

The Common Vision has helped to define the target segments and future megatrends which are changing the environment today and are contributing to further development :

The Common Vision has helped to define the target segments and future megatrends which are changing the environment today and are contributing to further development :

🍃 Foodtech,

🍃 Biotech,

🍃 AI,

🍃 Robotics and other sector agnostic opportunities

The investment horizon is set at 8 years. (FABA) token holders will be rewarded throughout the course of investment based on the dividend strategy of each company and actual exit time.

The investment horizon is set at 8 years. (FABA) token holders will be rewarded throughout the course of investment based on the dividend strategy of each company and actual exit time.

The main goal of Faba is to become the largest venture capital company that supports game-changing projects with the positive impact on our environment.

The main goal of Faba is to become the largest venture capital company that supports game-changing projects with the positive impact on our environment.

Faba Token Mechanism.

In the first round of investment, FABA LTD together with (FABA) token holders, aim to support a maximum of 110 projects with the outlook of 11-17 successful projects that will reach target valuation of 10-30 multiples of the initial investment. It is common that up to 60% of average VC portfolio companies will fail with ROI lower than 1 and the remaining companies will generate ROI between 1 to 5.

FABA will eliminate the fail rate by execution of comprehensive due diligence process and implementation of tranching mechanism binded to the agreed key milestones of the invested project. It is expected to execute all the Seed investments in the first 1 - 2 years and private equity investments within the 1st year for ensuring enough time to achieve significant increase in value before exiting the shares which will be happening continually.

FABA token has voting rights. Each holder of min. 2000 FABA) tokens has a voting right and can have own input on short listed projects.

The FABA is an evergreen VC company so the FABA Token is issued and listed on crypto stock exchange for infinite period. When successful acquisition of any of the portfolio companies comes, then FABA use 70 % of the sum that was successfully generated over initial investment for re-investing and 30 % of the sum will be distributed among the FABA token holders on pro rata basis The distribution of funds/ dividends will be following :

🍃 Acquisition Income – Initial Investment = Success Funds.

🍃 Success Funds * 0,7 = Amount to be distributed on pro rata basis among FABA token holders.

🍃 Success Funds * 0,3 = Amount from Success Funds to be reinvested in FABA portfolio.

🍃 Initial investment + Amount from Success funds to be reinvested in FABA portfolio = amount that will be used for further investing.

If the Acquisition Income is lower than Initial Investment, FABA will use the whole amount for further investments only, By the constant re-investing of 30 % from each success we ensure growth of FABA token by increasing the investment capital and value of equities in prospective startups being held.

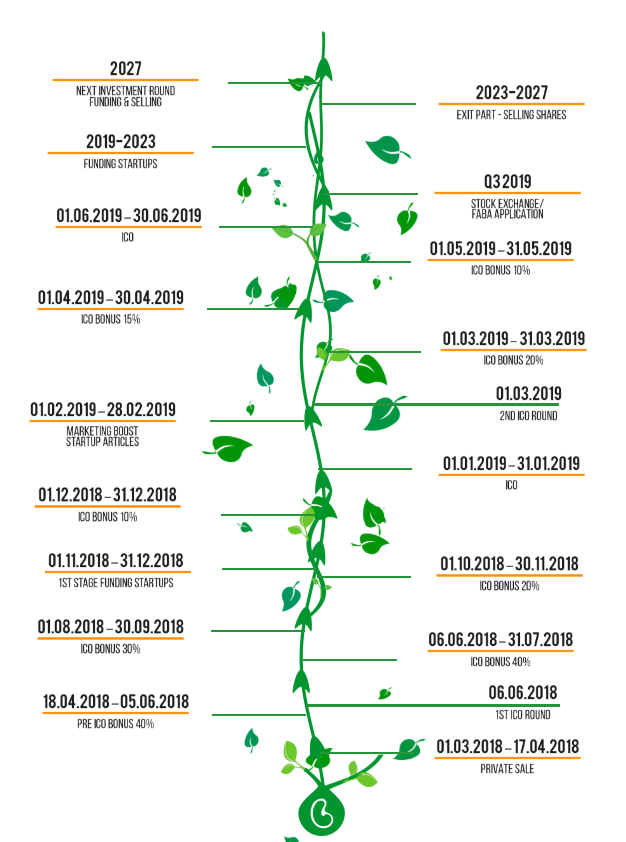

Roadmap.

Faba Team.

FABA Core Team :

Robert Flocius - CEO

I'm the Financial Executive with broad experience in all aspects of equity investments. Former shareholder and Co-founder of UB Networks Benelux NV - a US based data communications company and first world partner of Cisco systems Inc. later sold to Newbridge for $ 260 million. I served as senior Adviser to Madge Networks (fastest growing UK company in 1996). My focus: M&A, Equity, IPO's, Structured Finance, Consulting.

Alexander Nakonechny - CTO

I focus primarily on the field of crisis management and business models set ups, which is essential in the implementation of business projects in different stages and sizes.

Julia Zajacova - CFO

I graduated from Economics with specialisation on production management and logistics. I have 12 years of international experience in supply chain management working for the large corporates, specifically in planning and forecasting positions. I'd love to use my wide experience in order to support the new ideas, technologies and turn them into fresh energy.

Radek Zejda - CSO

In my career I have worked mainly on sales positions. For the last 5 years, I have been working with people in the field of coaching and mentoring. Business, Management, HR and Marketing are areas that I understand and in which I see my value add.

FABA Mentor Team :

Jonathan Todd, I have 10 years of experience in founding some of the largest media brands on the web today. I specialise in building teams, marketing, UX and customer retention. I have had 3 successful exits in this time. I am looking to add value as a mentor to any web/mobile based projects.

Blake Wittman, I've spent my 18-year career spreading my passion for people and purpose. My experience was gleaned across a broad spectrum of companies – from internet startups to Fortune100 companies. I currently serve as shareholder and CEO of GoodCall, an innovative disrupter in the recruitment space, and I run European strategic sales for two other HR startups.

Philip Staehelin, I have more than 25 years of experience in the corporate and consulting world. I served as CEO of a $500m payments company, I was a Managing Partner for Roland Berger, as well as holding executive roles in T-Mobile, Accenture, A.T. Kearney and CA-IB Investment Bank. I'm also a co-owner of Startup Yard (CEE's oldest startup accelerator).

Robert Breadon, I have over 25 years of international business experience with startups in 9 different countries and 30 locations. The last ten years I have become a licence NLP trainer and use the techniques to accelerate development to maximum capacity. In Prague my training centre www.breadon.cz offers professional coaching services to corporate and domestic clients

ICO FABA Token Concept.

🍃 (FABA) token value in 1st ICO round : $1

🍃 (FABA) token value in 2nd ICO round : $1.3

🍃 Total number of Faba tokens : 160M (FABA) tokens.

🍃 PRE ICO + ICO sale : 80M (FABA) tokens.

🍃 ICO Hardcap $67,5M

🍃 ICO Softcap $4M

🍃 Investment to startups : $60.95M.

🍃 Min. investment: $200 – 1 st round, $1300 – 2 nd round.

🍃 Number of projects : 110

🍃 Duration of ICO raising : 12 months, 2 rounds.

🍃 Pessimistic ROI : 35 % p.a. (excl. unicorn)

🍃 Optimistic ROI : 138 % p.a. (incl. unicorn)

🍃 Exit 110 startups : $0.172 - 0.672B

🍃 Investor‘s voting right : 2000 (FABA) tokens = 1 vote

🍃 First investment horizon : 8 years

🍃 Project regions : Europe, USA, India.

🍃 FABA LTD domicile : London, Great Britain.

More Information :

Website : https://vc.fabainvest.com/

Whitepaper : https://www.faba-white-paper.com/FABA.pdf

Facebook : https://www.facebook.com/fabainvest/

Twitter : https://twitter.com/FabaInvest

Youtube : https://www.youtube.com/channel/UCMfeTjZWPjPfN5fb2slWPng

Reddit : https://www.reddit.com/user/Fabainvest/

Vimeo : https://vimeo.com/fabainvest

Telegram : http://t.me/fabaventurecapital

Github : https://twitter.com/FabaInvest

Linkedin : https://www.linkedin.com/company/fabainvest/

Bitcointalk Username : Rifai245

Bitcointalk Profile Link : https://bitcointalk.org/index.php?action=profile;u=2507650

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://faba-white-paper.com/FABA.pdf

@marfi2405, thank you for supporting @steemitboard as a witness.

Click on the badge to view your Board of Honor.

Once again, thanks for your support!

The FABA team decides after the implementation of the comprehensive due diligence process, whether the investment is made and the success or failure rate is calculated depending on the milestones of the investment project.

#Faba #Tokensale #Crypto #Blockchain #Venture #Capital