We all have probably read or heard this before: The rich continue amassing more wealth and the poor keep struggling. This difference becomes starker when we look at the data point below:

82% of wealth generated in 2017 went to the richest 1% of the global population, while the 3.7bn poor half of humanity couldn’t improve their condition by an inch.

It takes just four days for a CEO from one of the top five global fashion brands to earn what a Bangladeshi garment worker will earn in her lifetime

While we could look at multiple reasons for this, is there a strong co-relation between the rich growing richer and real estate markets?

There is also a saying which goes like this: “99% of millionaires got there by doing real estate”

While there are debates about whether this statement is 100% correct, let’s first look at the real estate market size globally.

Going by the above infographic, we can see that Real Estate contributes to >50% of all the world’s assets and is the most valuable asset class.

This clearly depicts how much capital globally has flown into real estate and what value it commands. Even if it is not responsible for creating 99% millionaires, we all can agree that real estate as an asset has historically performed across business cycles and has stood the test of time in creating wealth for many.

Now this is not a secret, people all over the world are familiar with real estate as an asset class. Real estate has attracted the rich and poor alike. Some see it as a safe haven for investment, other see it as a get quick rich scheme or as a means of diversifying your investments. It is also a strong visual symbol of power and sophistication.

However, how many people do you know, who have made it big in real estate? And what has differentiated these guys from other folks who are also in real estate but haven’t struck gold.

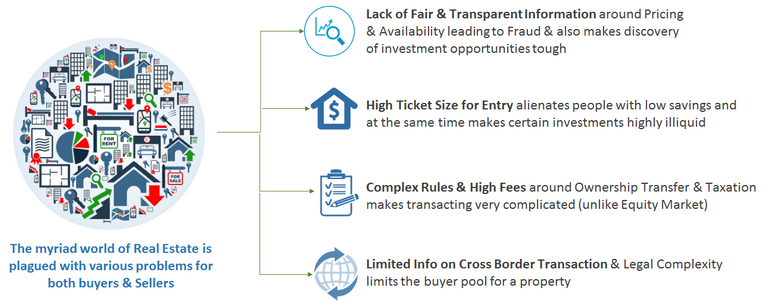

Let’s closely look at the key pain points in the Real Estate for both Buyers & Sellers alike

Alt.Estate aims to address these issues by Tokenization

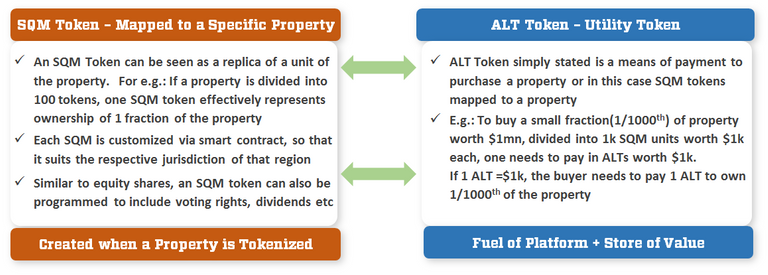

In simple words, the crux of Tokenization revolves around the fact that we can break down a property in multiple tradable & buyable fractions. This inherently makes the platform more liquid than traditional real estate markets. However, there is much more to it.

Let's look at how Alt.Estate is trying to address all the core issues via its unique platform

1. Problem: High Ticket Size -> Solution: Tokenizing

What's in it for Buyers?

This unique solution opens up the real estate market to a whole new class of investors i.e. the Middle class or people with low disposable income to afford large ticket real estate investments. Imagine, what If just like equity shares traded in the public market, wherein you can own a small % of the Company (no matter how small that share is), you can buy a piece of land or a house anywhere in the world.

It also helps address the issue of wealth concentration, wherein a totally new economic section of the society can participate and monetize gains from an asset, which was out of reach for them so far.

What's in it for Sellers & Investors?

This gives Sellers & Investors a unique platform to market their portfolio to a whole new breed of investors. Instead of trying to close a high ticket deal to a single buyer, an investor can now float a property to multiple investors at the same time. This gives him protection from high deal failure rates and also helps him navigate tough market cycles.

2. Problem: Fraud -> Solution: Transparency backed by Blockchain

How many times, have you heard that someone bought a property for x and few days later someone else spent 20% more for a similar property in the neighbourhood, for apparently no sound reason. In these scenarios, the buyer tends to lose the most as they don't have access to transparent information on pricing and probably there is no way to find out the actual market price.

Lack of a transparent marketplace also tilts the market in favour of professional investors, who are neck deep in the market. A normal retail investor, usually lags behind market trends.

This is where blockchain backed by proof of stake algorithm comes to the rescue. With all the transactions & pricing info publicly available on the platform, both buyers & sellers have access to this information at their fingertips. There is no opaque premium pricing due to lack of transparent information in the market.

3. Problem: Complex Transactions -> Solution: Faster & Cheaper Transactions

Traditional real estate market has always relied on government bodies for certifying and registering a property and conclude transactions. With such high ticket transactions, it becomes all the more important for a central authority to be a party to transactions. What if, we can maintain an even higher level of security, without undergoing the hassle and fees to conclude such transactions.

Alt.Estate will register all transactions in a single public blockchain, which would eliminate any possibility of a fraud and also minimize registration fees to almost NIL. This will be a boon for buyers in certain markets, where registering a property itself takes a heavy toll on the buyer.

Such a unique platform not only minimizes costs for registration but also empowers the buyers and sellers by eliminating third party brokers or alternatively making them part of the platform. A typical real estate transaction usually takes upto 2 months to conclude, whereas a transaction can take less than 10 days on Alt.Estate platform.

4. Problem: Cross Border Transactions -> Solution:Accessible & Tokenized Global Investment & Trading Platform

Every country has its own set of rules and regulations applicable for the real estate market. This makes it virtually impossible for a normal retail investor to even consider investing in markets outside his home country.

With Alt.Estate a buyer can research properties all around the globe and chose an investment option, which suits his/her needs. All of this could be possible, without breaking one's head on restrictions or huge transaction fees.

Alt.Estate's Two Layer Token Model

Let's do a quick review of the tech and product model powering the platform.

The first set of ALTs will be distributed via a crowdsale with this rate: 100,000 ALT per 1 ETH

ALT tokens are ERC20 compliant. The crowdsale has a target of $15mn with a soft cap of $1mn and a hard cap of $30mn.

- 80% of the ALT tokens will be distributed to the public, with 60% during crowdsale, followed by 20% during the network growth phase.

- 20% of the tokens will be granted to the team, with a lock in period of 1 year, wherein the tokens would be non tradable, to avoid any conflict of interest.

Summary

The Real Estate sector despite commanding >50% of the world's assets has undergone the least amount of disruption in the last few decades. Alt.Estate's unique tokenized platform powered by blockchain (proof of stake) identifies the key pain points and presents a targeted and practical framework to address these issues. There is a solid team behind Alt.Estate with a fine mix of domain & tech experts, who bring $400mn worth of real estate deal experience to the table. Apart from a solid tech platform, the team has a practical yet aggressive go to market strategy, which already has a live project to showcase.

This sets up the Company on the right path to execute and deliver on their roadmap in 2018.

For more details, you can go through the below links:

Website: https://alt.estate/

Telegram: https://t.me/altestate

Whitepaper: https://alt.estate/upload/files/altestate_whitepaper.pdf

Author: maxxxks

BountyhiveID: eykis

Alt.Estate addresses the intrinsic issues which comes bundled with sale or purchase of real estate assets. Tokenization does address the issues for a retail investor and makes the real estate market more accessible

Good analysis of the project.

I am really keen to see how these guys add more live projects to their platform. To start with, they should focus on countries with less legal framework and test the model out. Once it is successful on a decent scale, they can try and add more locations

Thanks buddy. I agree, legality of the whole thing is also crucial. Its important that they first target countries with flexible legal framework and gradually move to countries with more complex framework.