Most of the world still remembers the devastating consequences of the recent financial crises that hit the global economy hard. Governments and populations struggled to recover and the disruptive waves of economic stagnation still threaten the welfare of the world’s population.

Add to this that an astonishing number of people across the planet do not have access to financial and banking services. At the same time, those who do struggle to keep up with the rules and regulations, paperwork and unnecessary mediums.

Is it surprising, then, that cryptocurrencies, blockchain technology and artificial intelligence in the banking sector are gaining traction worldwide?

In this post, let’s take a closer look at Cashaa, one of the blockchain startups that aims to become the new generation banking system.

How does Cashaa work?

Key principles & objectives

Cashaa claims to pursue the following goals:

- providing banking products for people from all walks of life – both those who have access to global financial infrastructure and those who don’t, which in total equals about 3 billion people globally;

- fostering global investments that would overcome physical borders;

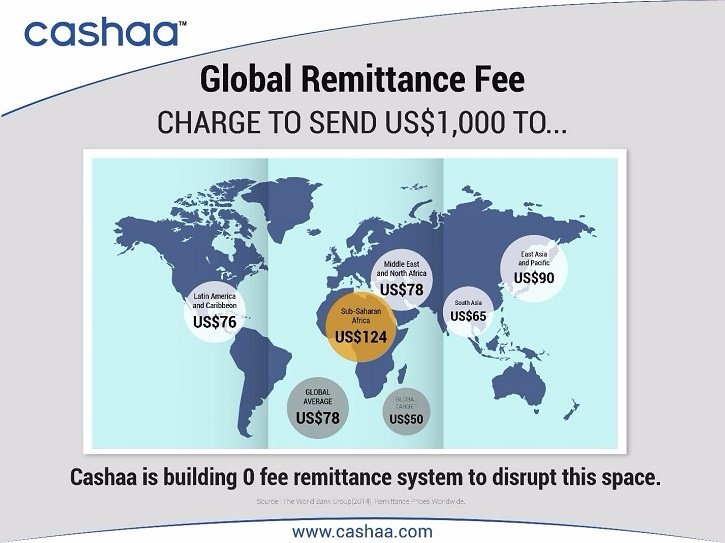

- opting in for low currency exchange rates that would enable its users to make transactions for an average fee of 7%;

- providing open API to speed up the pace of innovation in the financial sector.

It’s worth noting that Cashaa’s team is truly outstanding and incorporates world’s top blockchain influencers, university professors and renowned blockchain experts.

Beta

Cashaa’s beta platform was tested in 141 countries, covered 97 fiat and cryptocurrencies, engaged with 12,500 traders and resulted in the total of $10 million of transactions.

What products does Cashaa offer?

1. Cashaa Wallet

Cashaa Wallet is meant to provide access to a wide array of global banking services via one’s smartphone. Working under the no-fee policy, the app will promote the adoption of the cryptocurrency in a legal and licensed environment (it works with government institutions of building the legal infrastructure).

2. Cashaa physical and virtual cards

Prepaid cards will be issued to users together with a Wallet. These cards will be accepted at the POS devices, will automatically convert cryptocurrency to the local currency as well as enable its owner to withdraw cash from ATMs.

3. Micro-lending

The concept of peer-to-peer lending can transform the way people start and do their businesses. Given that an overwhelming amount of people worldwide do not have access to credit resources, micro-lending options will empower both individuals and businesses who can’t get credit funds at the bank, get them from the Cashaa users, even from the other country.

4. Peer-to-peer exchange

Cashaa’s users will be able to buy and sell cryptocurrencies as well as have access to market intel and analysis, exchange data and trading forecasts. Even more, peer-to-peer exchange will allow users to acquire currency which is not available in their local institutions.

5. Peer-to-peer insurance

The aim Cashaa pursues is to provide cheaper and clearer insurance options for people to help them out in various situations, be it travel, legal expenditure or health. The idea is to get insurance for small claims using Cashaa platform while the large claims covered by insurance companies will soon be offered via the platform too.

Congratulations @medvedja! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP