INTRODUCTION

CRYPTOCOIN INSURANCE: Project Overview

Trading on the cryptocurrency market has already passed several development stages: from the first centralized exchanges where there were almost no volumes up to several hundred exchanges where the leaders have a turnover that exceeds one billion dollars a day. Recently the US Securities and Exchange Commission has authorized trading of Bitcoin futures at the largest US stock exchanges.

About Project Cryptocoin Insurance

Choices are a money related subsidiary sold by a choice author to a choice purchaser. The agreement offers the purchaser the right, yet not the commitment, to purchase (call alternative) or offer (put choice) the hidden resource at a settled upon cost amid a specific timeframe or on a particular date. The settled upon cost is known as the strike cost. There are numerous alternative sorts. One choices can be practiced whenever before the termination date of the choice, while different choices must be practiced on the lapse date (practice date). Practicing implies using the privilege to purchase or the offer the fundamental security.

CRYPTOCOIN INSURANCE launches the first crypto option in the world.

CRYPTOCOIN INSURANCE creates an insurance company, provides insured insurance options and hedges its risks on the options exchange.

In most cases, the first company becomes a market leader and still takes the largest share. Today, CRYPTOCOIN INSURANCE has no competition and occupies the entire market.

CRYPTOCOIN INSURANCE has two main sources of income

Option Exchange

The profit is generated as a trade commission from each operation on purchasing or selling options. It is 0.5% per transaction or 1% per circle for each of the transaction parties.

Options enable short sales

Problem: There is still no short selling opportunity in the cryptocurrency market. Nobody can sell a cryptocurrency that is physically absent on the account within a short period of time. This reduces the speculators’ ability to smooth price fluctuations in other markets. In its turn it causes the volatility increase and consequences enumerated in cl. 1 and 2 above.

Solution: Without having physical Bitcoin or Ethereum, it is possible to get an option for their falling, and actually carry out uncovered sale. This opportunity brings to the market a lot of new traders, investors and speculators, as well as hedge funds who put money not only on the growth but also on the fall of markets. #ico #whitepaper #exchange #options #ccin#insurance

CRYPTOCOIN INSURANCE allows you to ensure falling prices or growth risks for major cryptocurrency.

Problem: There is no solution to ensure deposits on Bitcoin or Ethereum do not fall. At the same time in this market there is an increase in volatility that makes people afraid to save large funds in cryptocurrency. On the other hand, large companies are slow to enter the market (for example, to receive payments in cryptocurrency) for the same reason.

Solution: Exchange will begin to operate with 5 cryptocurrency that has a maximum market. Furthermore, as demand and turnover increases, we will add other crypto currencies. CRYPTOCOIN INSURANCE sells both the growth of Bitcoin or Ethereum and insurance falls. Thus, it protects the risk. There is no competition in the market which allows maintaining a significant margin at the level of 20%. INSURANCE CRYPTOCOIN repackages and sells / buys its own risk as an option in its own exchange.

CCIN Token Growth Potential

The CRYPTOCOIN INSURANCE Company has developed a simple and understandable model for the increase in the CCIN token value. 30% of each commission obtained by the option exchange will be directed to the liquidity fund. Within the next month CRYPTOCOIN INSURANCE sends these funds to purchase CCIN tokens from the market and burns them.

This business model is adopted solely in the interests of our investors. The promise to buy tokens from the future profits cannot be transparent. Moreover, the exchange or the platform may never have the profit physically. In case of CRYPTOCOIN INSURANCE tokens, investors know exactly that each option purchase/sell transaction generates the cash flow used to buy tokens.

This allows constantly shifting the market balance and increase the demand for CCIN tokens.

If the turnover is $50 million per day, the commission for both sides of the transaction will be $500,000 or $15 million a month. 30% of this amount or $5 million are sent monthly to buy CCIN tokens from the market.

ICO Structure

Coins Price: 3,000 CCIN coins = 1 ETH

ICO's Date: November 1, 2018 - December 27, 2018

Minimum collection amount: 0.5 million M

ICO main goal: 5 USD

Maximum collection amount: $ 10

When placed, all symbols that are not purchased are destroyed. The CCIN coin is purchased using Bitcoins or Ethereum.

Token Allocation

75% - ICO

18% - Reserved for the project team

5% - Mentors

2% - Bounty program

Allocation of the collected funds

50% - Development and launch of the option

25% - Reserve fund

15% - Marketing

5% - Legal services

5% - Operating expenses

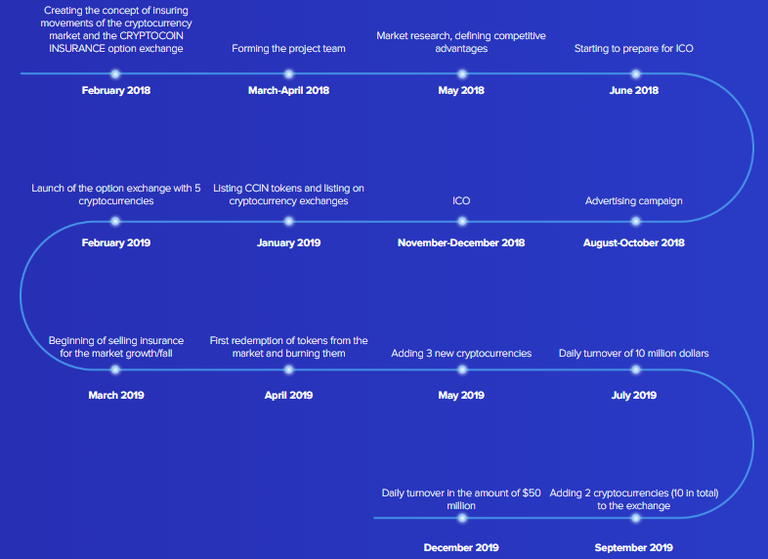

Roadmap

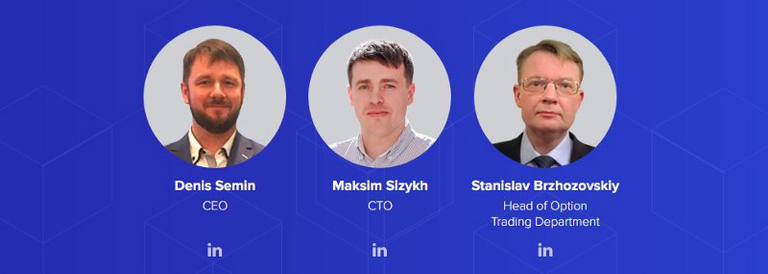

Team Project

growth potential

CRYPTOCOIN INSURANCE has developed a simple and understandable model to increase the cost of the CCIN token. 30% of each commission received from the stock market enters the liquidity fund. Over the next month, CRYPTOCOIN INSURANCE is sending these funds to buy CCIN tokens on the market and burn them.

This business model is used exclusively for the benefit of investors. The promise to buy chips on future profits can not be transparent. In addition, a stock market or platform can never benefit physically. In the case of CRYPTOCOIN INSURANCE, investors know exactly what each buy / sell transaction generates for a transaction that generates the cash flow used to purchase tokens.

This allows you to constantly change the market equilibrium and increase the demand for CCIN tokens.

If the income is $ 50 million a day, the commission on both sides is $ 500,000 or $ 15 million a month. 30% of this amount, or $ 5 million a month, will be sent to the market to purchase CCIN tokens.

For more information, you can visit the following links:

WEBSITE: https://ccin.io/

WHITEPAPER: https://ccin.io/doc/Whitepapereng.pdf

ANN TREAD: https://bitcointalk.org/index.php?topic=4948618

BOUNTY THREAD: https://bitcointalk.org/index.php?topic=4969375.0

TWITTER: https://twitter.com/ccin_official

FACEBOOK: https://web.facebook.com/ccinofficial/

TELEGRAM: https://t.me/ccin_official

Author:

Bitcointalk Username: menoharrison

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1734340

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://ccin.io/