Preliminary: a video version is available HERE.

Introduction

What is Blockchain, and how does it function? These are two essential questions that Blockchain stakeholders need to master to start building on top of these foundations. This “Blockchain intro in 1 slide” gives a non-technical analysis of what Blockchain is and how a Bitcoin-like Blockchain functions.What is Blockchain?

In its very essence, Blockchain is quite simple. It is a transaction journal, a transaction database. So you can imagine it as an excel sheet in which you have on each line a transaction in which it is written that the ownership of a certain asset is transferred from a certain individual, or entity, to another individual or entity.

2.1 Context of transaction journals

Transaction journals can hold transactions on anything: physical assets, intangible assets, data, rights (it could be cars, houses, personal identifications, diplomas, computers, money, personal data, voting rights, etc.). Thus, everything we have ownership of in our economy and our society is somehow written somewhere in a transaction database.

Why are these transaction journals so important? They are actually fundamental in our society and economy as they are the absolute reference to prove our ownership of goods, rights and data.

Traditionally, these transaction journals are maintained by Trusted Third Parties. These Trusted Third Parties could be governments, cities, companies, banks, notaries … you name it. When you buy, for example, a computer or a car, then that transfer of ownership from the selling company to you is written as a transaction in the transaction journal at that company.

2.2 The Blockchain transaction journal

Here comes the big difference between the traditional transaction journals and Blockchain transaction journals: the difference is that the maintenance of a Blockchain transaction journal is done by you and me, or at least by your and my computers. So, you have our computers connected to the internet and, over the internet, to each other in a Blockchain network. All these computers together maintain collectively that Blockchain transaction journal. Each computer can take on one or more of three different roles: 1) the role of a user; 2) the role of a transaction and Blockchain verifier; 3) the role of a block creator. For each specific role, you download specific software that enables your computer to fulfil that role.

- How does Blockchain function?

3.1 Public permissionless Blockchain

As a preliminary, let’s note that we are talking about a specific type of Blockchain, which is the public permissionless Blockchain created by Satoshi Nakamoto with the first application, which was Bitcoin. Permissionless means that anyone can join and can -without permission- participate in the use and maintenance of that Blockchain. Public means that the transaction database, the transaction journal, is accessible for anyone in the network.

3.2 Consensus rule

This public permissionless Blockchain has one fundamental rule, which is the consensus rule. By this rule, all these computers on the network succeed in agreeing on the Blockchain state. In the public permissionless Blockchain that supports Bitcoin, that consensus rule says that the only valid chain is the longest chain generated by Proof-of-Work. This chain is the only chain that holds the truth on the transactions that happened on the network.

3.3 Economical, information and verification flow

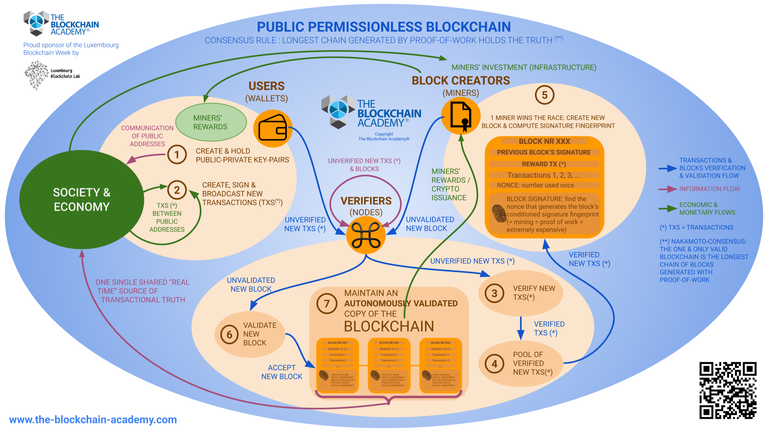

A Bitcoin-like Blockchain integrates 3 types of software/actors in its protocol: the users (wallets), the verifiers (nodes) and the block creators (miners). The interactions between these actors are visualised in the above schematics by three types of flows. The blue flows indicate transactions and blocks verification and validation flows. The purple flows indicate information flows. And the green flows indicate economic and monetary flows.

3.4 The real economy & miners’ investments

This Blockchain system doesn’t exist independently from our society and the real economy. The first interaction of the Blockchain system with the real economy is represented by the green arrow that goes from the economy towards the block creators / the miners. What is happening here is that the miners make an important monetary investment in infrastructure. To become a miner or a block creator, these participants need to buy heavy computing material, and they need to invest in energy to make these computers function.

3.5 Three types of participants & their functionalities (1/2)

3.5.1 Users (Wallets)

Let’s focus now on the user’s software or the wallet, with a first functionality that allows users to create and hold public-private key pairs. What are public-private key pairs? These are actually our identity on the Blockchain. The public key is the equivalent of our bank account number. The private key is the equivalent of our password and allows us to access our data and authorise transactions on our ownership. So the public key is kind of -as mentioned- the equivalent of a bank account number and thus needs to be communicated to interested parties in the real economy to write transactions towards us. So, we can publish the public key on our website or insert it directly in a message to someone who needs to transfer an asset to us.

A second functionality of the wallet allows the user to create and sign transactions. Important to note here is that it will be the private key that allows us to sign transactions. The transactions are, of course, transactions that happen between public addresses that are available from actors in our society and economy. When the asset owner has signed a transaction, well then that transaction is broadcasted, published towards the network of participants, that global network of participants connected over the internet.

3.5.2 Verifiers of transactions (Nodes)

The new unverified transaction arrives at the nearest node in the network, the nearest verifier. And, the first thing that that nearest verifier, that nearest node will do is forward that transaction to its neighbouring verifiers, neighbouring nodes, and then these neighbouring nodes will do the same thing: they will send the transaction to their neighbouring nodes. So, in this way, new transactions ripple in fractions of seconds all over the world, and all the nodes on the global Blockchain network will receive the unverified new transactions in fractions of seconds.

Next, these verifiers will start verifying, all simultaneously, that new transaction. They will verify that new transaction for three elements. First, the transaction’s authenticity is verified to validate that the transaction has been signed by the private key attached to the public key that appears in the transaction. Second, the transaction’s integrity is verified to validate that its content remained unchanged since its creation. And lastly, the transaction is verified for the absence of double spending to validate that the asset hasn’t been transferred previously. For the first and the second verification, the Blockchain system has cryptographic tools at its availability that verify and validate the transaction’s authenticity and integrity. The third verification for the absence of double spending or presence of accounting coherence is done by verifying all the historical transactions that are already written and available in the transaction journal of the Blockchain.

When the verifier considers that the transaction is correct, this transaction is temporarily put in a mem-pool, a waiting room. It’s here that the miners -or at least their computers- will pick up transactions that they will insert in a new block.

3.5.3 Block creators (Miners)

Let’s have a look at the block creators or miners. To understand the miners, we have to understand the importance of the Blockchain protocol by which these miners operate. That Blockchain protocol has one objective: to realise the consensus rule that says that the longest Blockchain is the only true Blockchain. And as we will see in the coming paragraphs, it’s mining or Proof-of-Work that realises this objective.

Let’s first break down this objective to realise the consensus rule in its components. For a Blockchain to be accepted by the community, it needs to comply with the following requirements: it has to hold one single, truthful, unchangeable transaction history supported by a majority of the participants in the Blockchain ecosystem.

Before continuing the analysis of the realisation of the components of the consensus rule, let’s first take a step back and look at how Block creators practically create blocks and realise the Proof-of-Work, a.k.a. mining.

Block signature of the previous block: Besides the block number, the first thing a block creator inserts in a new block is the signature or digital fingerprint of the previous block. The signature is critical because it is a fingerprint of the entire content of a block and thus a reference for a block’s integrity. If a block’s content is changed, then that will be immediately visible in a change of the block’s digital fingerprint. By inserting in a new block the digital fingerprint of the previous block, you effectively create a final digital fingerprint that represents the entire content of all the previous blocks. Consequently, if some content is changed in previous blocks, then that is immediately visible in a change in the final digital fingerprint.

Reward: The next element a miner inserts in a block is the reward transaction addressed to the miner. It’s important to note that the amount of that transaction is determined in the Blockchain protocol and will be verified, later on, by the verifiers, by the nodes. The reward transaction creates out of nothing new cryptocurrency and transfers it to the public address of the miner.

Transactions: Next, a block creator inserts transactions in a block from the pool of verified transactions. To be noted here is that when a user creates a transaction, the user can insert freely a fee that goes to the miner as a secondary reward. Logically, the miner will pick the transactions that maximise his returns. To be noted here is that, for example, in the Bitcoin Blockchain, the number of transactions that a miner can insert in a block is limited by the block size limit of 1 Mb. If the block size reaches 1 Mb, then a miner can insert no further transactions in that block. It’s here that, possibly, a zero-transaction fee condemns a transaction to exclusion from execution because it is never inserted in a block by a miner.

Nonce & block signature: Next, the miner inserts the nonce field, which is the abbreviation of NUMBER USED ONCE. It is a field that is necessary for the execution of the mining or Proof-of-Work activity.

Block signature: The last element that the miner inserts in a block is the block signature. It is a large alpha-numeric string that serves as a digital fingerprint of the entire content of the block. An example could be the following: 000000000001a28c4338e9ce47f4c2ccf3669ab00a9cfe084f78de00

3.6 Proof-of-Work (a.k.a. mining), nonce & block signature

Let’s take a minute to explain this epicentre of the Blockchain. We talked about the block signature, which is the digital fingerprint of the content of a block, and we know that that block signature is a large alpha-numeric string that serves as the digital fingerprint of a block. Now, if you impose a predefined format on that signature – for example, it should start with 10 zeros – and if a miner can realise that predefined format by changing the content of the nonce field, well then you just created a challenge, namely to find the content for the nonce field that results in a block signature that complies with the predetermined signature format. Practically, a miner engages in a trial-an-error procedure trying out different numbers in the nonce field and checking, for each number, if the resulting block signature complies with the required format. And so a miner does this until a nonce number is found that yields a correct Block signature.

This is what is called mining or Proof-of-Work (PoW). It’s called mining because you go through a large number of trials to find that one single “golden” number that results in a correct format for the block’s signature. It’s also called Proof-of-Work because when the miner finds that golden number, it also proves that a lot of work and a lot of investment has been delivered to create that block.

3.7 Miners’ business model

Before coming back to the consensus rule and how Proof-of-Work or mining is at the core of its realisation, let’s have a look at the miner’s motivations: Miners are here for business reasons: they made a heavy investment in computing material to be capable of executing the Proof-of-Work or mining activity. And they want to realise a return on investment through the collection of rewards. For an individual miner to collect this reward, its block needs to become part of the longest Blockchain.

3.8 Proof-of-Work and the realisation of the consensus rule

Let’s come back to the consensus rule and its components and link its realisation to the mining activity or the Proof-of-Work activity. Let’s recall that the consensus rule says that the only valid Blockchain is the longest chain generated by Proof-of-Work. That rule needed the following elements to be realised: first, to have one single transaction history; second, to have a truthful transaction history; third, to have a transaction history that is unchangeable and immutable and last but not least, to have a transaction history that is supported by the majority of the participants in the Blockchain system. What is important to note is that Proof-of-Work, a.k.a. mining, realises each of these objectives. Let’s have a look at each of these elements and how Proof-of-Work solves the issue.

3.8.1 One single transaction history

The first component of the consensus rule requires one single transaction history. Given that the longest chain is the only valid chain, that also implies that in a mining round, only 1 block can create a new longest Blockchain. How is this linked to Proof-of-Work (PoW)? Well, PoW allows creating a competition between all the miners: the miner that solves as first the PoW will be the one that proposes the next block for the new longest Blockchain.

3.8.2 A Truthful transaction history

Let’s look at the second element in the realisation of the consensus rule: the issue that requires that the Blockchain be truthful. The element here is that the block proposed by the miner will be verified by the nodes, by the verifiers. If any content in the proposed block does not conform to the protocol requirements, the verifiers will reject that block. How is this linked to Proof-of-Work or mining? Well, you certainly understood that Proof-of-Work is a costly activity because of the miner’s investment in computing material and energy. Thus if the miner’s block is rejected, the miner will not realise a return on investment and will be hurting itself economically. This is the game-theoretical element that states that a rational actor will not hurt itself economically on purpose.

3.8.3 An unchangeable and immutable transaction history

Let’s move on to the third element in the realisation of the consensus rule: the element that requires that the Blockchain be unchangeable and immutable. How does Proof-of-Work (PoW) or mining make the Blockchain unchangeable and immutable? First, let’s recall that PoW is about this burdensome computing-intensive search for the golden nonce number that results in a block signature that complies with the imposed format. Let’s also recall that each block contains the signature of the previous block. If any content in one of the previous blocks is changed, then that change is visible in its block signature, invalidated because it doesn’t comply with the required format. Additionally, that non-compliant block signature ripples all through the following blocks and invalidates their signatures and eventually the signature of the last block. So, any change in any block anywhere in the history of the Blockchain will be immediately visible as a non-compliant final block signature. To remediate, each block needs to be submitted again to the PoW. Its signature needs to be recomputed, and for that new reality to be accepted by the Blockchain community, that reworked and recomputed Blockchain also needs to become the longest Blockchain, implying that the party intending to impose a new Blockchain reality would need more than 50% of the aggregate network computing power, which is an impossibility for a rational actor, who would use that kind of computing power in the first place to participate honestly and collect honest rewards.

3.8.4 A majority-supported transaction history

Let’s move on to the last component of the consensus rule that requires that the majority of participants support the Blockchain content. Proof-of-Work also solves the issue. Let’s explain: a traditional voting system with 1 person = 1 vote wouldn’t be possible in a public permissionless environment in which participants exist as virtual entities and in which participants can create multiple entities at will. Proof-of-Work solves this by using computing power / CPU power as a voting entity that can’t be multiplied at will. We just spoke about the aggregate Proof-of-Work computing power in the Blockchain network. Well, here you have your voting system: the Blockchain community votes by the aggregate Proof-of-Work computing power that it puts behind a specific Blockchain. And 51% or more of that aggregate computing power is faster than 49% or less and thus generates the longest Blockchain … which, as stated by the consensus rule, is the only valid Blockchain.

3.9 Satoshi Nakamoto’s invention

This is the ingenious invention by Satoshi Nakamoto: the combination of mining or Proof-of-Work with the longest-chain-rule results in a Blockchain of which exists only one version that is truthful, immutable and unchangeable and is supported by the majority of the Blockchain participants. This system is also called the Nakamoto-consensus-mechanism.

3.10 Three types of participants & their functionalities (2/2)

Let’s move on to the next step in the process. When a miner wins the race, its block is broadcasted/published to the network of verifiers, with the nearest verifier receiving the block and forwarding it to its neighbouring nodes or verifiers, who will forward the block to their neighbouring nodes and so on. Identical as for new transactions, new blocks ripple in this way in fractions of seconds all over the world. Then, all these nodes start verifying -simultaneously- that new block.

To validate a new block, the verifiers/nodes will re-verify every element in that new block. They don’t take for granted what the miner proposed, and each node verifies everything before accepting anything. All the nodes verify and validate the new block using the same verification and validation rules written in the Blockchain protocol. They all re-verify all the transactions in the block for authenticity, for integrity, and for the absence of double spending, they all verify the reward transaction and check if the amount is in line with the amount written in the protocol, they all verify the correctness of the previous block signature and finally, they all verify if the nonce published by the miner really yields a new block signature that complies with the signature format requirements.

The ultimate functionality, the ultimate objective of a node, is to maintain an independently and autonomously verified and validated copy of the Blockchain. We saw that all the nodes received that one new block and independently verified and validated that block according to the shared protocol rules. If a new block doesn’t violate the protocol rules, it will pass all the nodes’ individual verification-and-validation-process and become the next block in all these identical but independently maintained copies of the longest Blockchain.

3.11 Crypto issuance

The last step in this process is actually the creation of new cryptocurrencies. The reward transaction mints new cryptocurrencies but becomes only a reality when a miner’s block becomes part of the new longest Blockchain. With the block that becomes part of the new reality, the miner’s reward becomes part of the miner’s public address. Thus, the newly minted cryptocurrencies are available to be spent or used for transactions in the real economy through the miner’s wallet. In this way, newly minted cryptocurrency finds its entrance into the real economy and society.

3.12 Blockchain as a shared source of transactional truth

The last point to note is that this Blockchain becomes an absolute transactional truth shared with everyone who participates in the system. Thus, all the economic transactions through the Blockchain system become one single shared truth on what happened transaction-wise and who owns what. That, of course, is a source for efficiency gains, a source for cost reduction and, potentially, a source for innovation in business and societal processes and models.

- Conclusion

Satoshi Nakamoto invented the Satoshi Consensus Mechanism, a procedure that allows for a network of participants that don’t know and don’t trust each other, to collectively use and maintain a shared transaction journal and transaction system. The paradigm-shifting consequence is that, for the first time in history, people can own their goods, rights and data within the fabric of the internet and transact directly between them, from person to person, without the need for the intervention of a trusted third party.