Startups' Challenges

Convincing investors and receiving initial backing with funding is always a daunting task for startups, however, it doesn't mean that there is dearth of avenues for seeking funds. The current startup' financing model or the VC model is heavily centralized and out-of-reach for 1st time entrepreneurs. Further, this model is unable to cater to the capital requirements of the tech ecosystem required during the growth phase, in order to keep up with the innovation curve.

Moreover, there are operating costs such as loan and transaction fees attached with the capital raised through the existing model, thereby increasing the overall cost of the capital. Apart from that, in the existing financing model, a substantive amount of time is lost in formalizing the client agreement.

Adoption of Blockchain Technology helps in resolving both these challenges.

- Through a decentralized approach, startups can secure capital from investors across the world

- Blockchain through 'Smart Contracts' fully automates the approval process, thereby speeding up the client agreement process.

However, there are some drawbacks in raising funds through ICOs. One of the major ICO drawbacks is that they don't offer equity ownership of the Company issuing the tokens to the token holders.

Corl (the company) by issuing CORL tokens, aims to resolve this by providing equity ownership in the company 'Corl', which would invest directly in startups and private companies. Further, the CORL tokens would issue dividends to token holders on a quarterly basis on the basis of the revenue agreements with the startups and private companies. Through this model, investors from around the world can invest in startups with unique innovative ideas during the early-growth stage, thereby avoiding the hassles involved with traditional investment approach such as cross-border restrictions.

Corl offers to integrate 'equity ownership' with 'blockchain', thereby invoking transparency and reducing transaction costs while offering legally compliant Securities Token Offerings (STOs).

What is CORL

Corl Financial Technologies Inc. is a Canadian registered LLC corporation and the company behind the development of CORL Tokens.

Brief About The CORL Project

The CORL project aims to bring the world’s 1st securities based token while meeting the following objectives: -

- support and accelerate the growth of early growth companies by leveraging the blockchain technology through revenue-sharing investments;

- achieve regulatory compliance requirements;

- provide 100% equity ownership in the parent company ‘Corl Financial Technologies Inc.’;

- make dividend payments to investors in ETH [10% of quarterly net profits, distributed over the number of outstanding token holdings]

CORL Tokens

CORL Tokens will be developed on the Ethereum blockchain network (ERC-20 compatibility) and Polymath (ST-20 standard protocol).

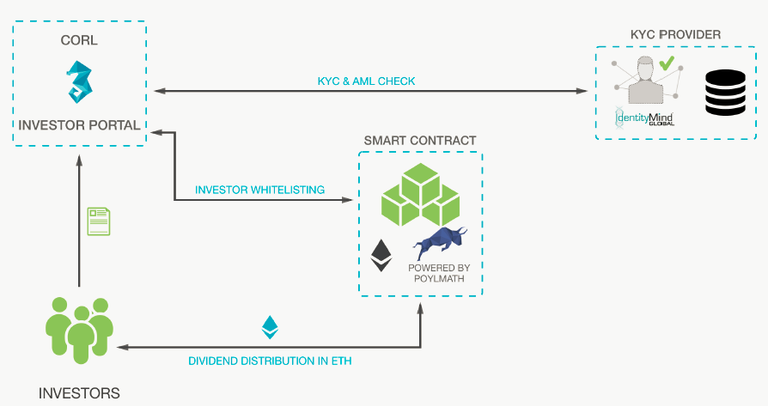

Polymath’s ST-20 protocol is a decentralized securities token standard which simplifies the process of creating and investing in security tokens. It provides the mechanism which enables participants to ensure regulatory compliance with securities laws by authenticating their identity and accreditation status and fulfilling the KYC norms. This would allow the participants to join the security token offerings (STOs) in a much faster way.

CORL Ecosystem

The Corl Ecosystem allows to bring the 'companies' [Corl Business Platform] and 'investors' [Corl Investor Platform] on a common platform by applying the power of blockchain technology.

Companies requiring funding can submit application directly on the Corl Business Platform. Corl will conduct a stringent due diligence process before committing any funds to the companies applying for funding. Once a funding is approved, as per the revenue agreement between the company and Corl, the payment due to Corl is automatically deducted from the company’s bank account.

The investor on-boarding will be managed by the Corl Investor Platform while the compliance management (including, AML, KYC etc.), token management [i.e. issuance, distribution and allied tasks] will be governed by the Corl and Polymath smart contracts.

*Website: https://corl.io/

*Whitepaper: https://corl.io/whitepaper

*Join The Corl Telegram Channel: https://t.me/corltoken

*Follow on Twitter:- https://www.twitter.com/getcorl

*Join on Facebook:- https://www.facebook.com/getcorl

*Follow on Medium:- https://medium.com/@corl

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Published by 'Sameer S'

Btalk Profile ID:- samdude

https://bitcointalk.org/index.php?action=profile;u=1978491

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Disclaimer:-

Nothing written in this article should be considered as legal or investment advice.

Published By: - 'Sameer S'

Bounty0x User Name: - samdude [Sameer]