TokenCard is a centralized project that aims at Ethereum backers and plans to offer a multitoken wallet for ERC20 tokens chosen by its users with a card option. The competitive advantage of the product in the current market is not clear. However, the team includes experienced professionals, the token contract is now available on Github, and a demand for ERC20 user-friendly wallet could be high.

About

TokenCard is a depositless Visa debit card and a platform powered by smart contracts that allows to spend Ethereum tokens. The first 500 cards will be issued in mid September 2017 for top 500 ICO contributors. The beta version is expected in November this year.

Potential market

At first stage, the project targets current holders of Ethereum tokens, but is eventually intended for all who seek a secure and accessible alternative to a bank account. TokenCard will be used wherever Visa payments are accepted or VISA ATMs are available. At first, no cards will be issued in US and India. The team’s separate target are Chinese users.

Use-cases

- management and spending of one’s cryptocurrency earnings not resorting to banks;

- international remittances: quick (blockchain), reasonable fees (up to 1,5% on each card swipe), money directly available for use;

- securing one’s savings outside a bank: easy accessible application and know-your-customer service are to be offered;

- management of diversified portfolios and user-set spending; e.g. users can set spending limits, or enable portfolio spending so that payments are split between multiple assets and a share of each asset in the portfolio is maintained;

- token-to-token and fiat-to-token exchange option

Not all of those features will be available at Minimum Viable Product (MVP) phase.

Competitors

TokenCard has no direct equivalents, but it is not the first on the cryptocurrency debit cards market. Most of its competitors are Bitcoin-focused or support different cryptocurrencies without a specific focus on ERC20 tokens: Xapo and Coinbase support Bitcoin; CoinsBank — Bitcoin and Litecoin; in Wirex you can send various cryptocurrencies to your account, but can only store in Bitcoin; Uquid supports Ether among many other cryptocurrencies. In contrast to them, TokenCard will support a (gradually increasing) number of ERC20 tokens, and will also introduce its own TKN token that represents the diversity of all tokens held by the user. Another difference is that the TokenCard is depositless leaving full control of the funds to the users. Finally, TokenCard plans to let users define a wide range of settings regarding funds spending and management on their own.

Main features

- TokenCard includes three components: Token Contract Wallet, Token App and physical TokenCard.

- Users create personal Ethereum smart contracts to ensure security of their funds.

- Token Contract Wallet can be accessed via Token App (Android & iOS) or via Blockchain Browser (third party Ethereum browsers like Mist, Parity and MetaMask).

- TokenCard will work with any ERC20 Contract Wallet.

- A list of supported ERC20 tokens will be elected by the community.

- At launch the system will support 1,000 transactions per minute with maximum lag of 1 second at load, and “Four Nines” reliability (4 minutes per month or less of downtime).

- TKN, a TokenCard token, will be an asset backed ERC20 token; the underlying assets represent the user’s accumulation of different ERC20 tokens over time.

- Licensing fee of 1 % (besides about 0,5% of VISA fees) is charged on every card swipe and is used to fund the TKN Asset Contract; payments in TKN are exempt from a licensing fee.

- Cash and Burn option: TKN holders can receive their pro-rata share of assets by burning their TKN; burning leaves remaining TKN holders with a proportionally larger claim on future assets.

- MVP (500 cards for 500 top contributors) to be ready by mid September and will include Token Contract Wallet, VISA debit card and payment support for ETH and up to five of these tokens:REP, MKR, DGD, ICN, MLN, GNT, 1ST, SNGLS.

- The 1.0 release with more features to be launched in 240 days (according to the whitepaper); the website schedules a beta release for November.

- Main Github repository is here, but there is also one at New Alchemy’s Github and and one at Mel Gelderman’s Github (currently empty)

Team

TokenCard is the first product of Monolith Studio, a Web3 venture production company established to develop Ethereum’s potential by making Ethereum powered products for the end-user. Six of the eight TokenCard team members also work for Monolith, including Monolith founders Mel Gelderman (Project Leader at TokenCard) and David Hoggard (Partnerships and Finance).

Mel Gelderman is said to have consulted various banks and software companies in East Asia on blockchain. His LinkedIn profile is not very informative though. Peter Vessenes (Technology at TokenCard) is a more well-known figure: co-founder and former Chairman of the Bitcoin Foundation, with a background in consultancy on blockchain for such entities as the US Department of Treasury, FinCEN, Deloitte, PWC and some major Venture Capital firms. Abib Bocresion (Business and Finance) worked at J.P. Morgan and is now a head of Market Risk at Barclays International. Marketing (which will get the largest share of funds raised at ICO) is done by Paige Freeman, also known as BitPay founding member.

Next to partnering with Wavecrest for MVP launch, TokenCard partners with Digix Global to enable support of Digix Gold for its debit card. The project has also been using the services of New Alchemy, a software company founded by Peter Vessenes to support the development of blockchain projects. New Alchemy is mainly in charge of TokenCard’s technological and strategic development, and marketing (recall Paige Freeman).

ICO

- Starts on May 2, 16:00 GMT

- ETH, fiat and seven other ERC20 tokens will be accepted

- Certain ERC20 tokens will receive bonus TKN (the list is daily updated, see “partner announcements” on the website)

- TKN will be created and issued to contributors during a seven day period

- Soft max cap is $4,5 M: if it is reached earlier than in 7 days, ICO will be prolonged for 24 hours; if the hard max cap of $12,5 M is reached, ICO will stop immediately

- After ICO additional not-for-sale TKN will be created (see token distribution); after that no more TKN will ever be created

- Tokens will have a per-token cap based on the trading volumes and value of the token (details to be announced later)

- TKN becomes transferable immediately after ICO

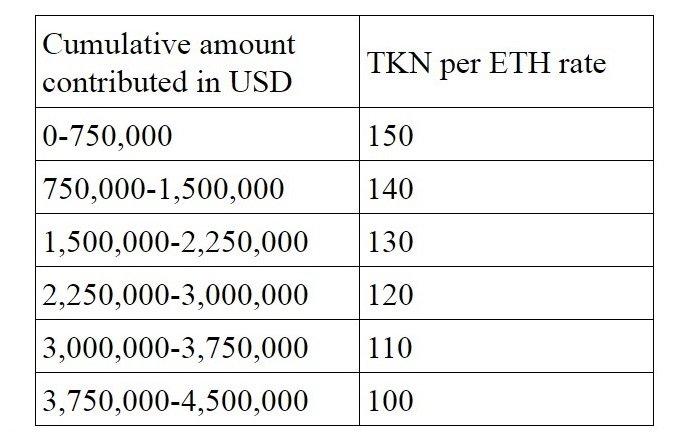

- Bonuses for early contributors:

- Top 500 contributors will receive the first 500 TokenCards for free in September 2017

- The crowdsale contract and its audit by New Alchemy available on Github

Token distribution

- 60% (all tokens created during ICO) go to contributors

- 20% — to Monolith Studio (the team); the amount will be locked in a smart contract for 18 months and will be released if the project is operationally successful

- 5% — to advisors

- 15% — to a Capital Reserve, locked in a smart contract, to be used only in the exceptional case when more tokens need to be sold for extra fundraising

Funds distribution

- 30% — core development

- 25% — operational costs

- 40% — marketing (15% for partnerships and ecosystem integration, 25% for direct consumer marketing)

- 5% — legal costs and compliance

Summary

- Ethereum ecosystem has been growing while more or more applications appear, and TokenCard might fit well into this trend

- Giving users full control of their funds and ability to define an array of spending settings are an advantage

- Little about core technology in the whitepaper

- The ICO contract audit cannot be considered purely external: the team is saying the code has been developed and audited by different people, still both activities have been implemented by one and the same New Alchemy team

- TKN distribution is far from perfect in terms of decentralization, although the lock-up period of the team’s TKN is long (18 months)

- 45% of funds for marketing looks somewhat exaggerated

- Not the best coverage prior to ICO: a single source of information is absent, no official thread on Bitcointalk, main updates appear on Slack, while website updates and the blog lag behind or do not contain all answers

Useful links

For more details on the project, check their website, whitepaper, or Slack channel.

For all useful links, check the project’s profile on Cyber•Fund.

“From their whitepaper it is not clear what part of a product will be decentralized and what will be centralized, — underlines Konstantin Lomashuk, CEO of Satoshi•Fund. — We see a lot of interesting things that they want to implement form KYC to exchange, and it is really a lot of work. It is not clear who will be working full time. The business model is questionable too, their competitors can offer a card without 1% licensing fee that goes to TKN holders. So as I understand, an investor in TKN invests in a promise of a centralized company Tokencard to cashback the fees to token holders.“

Satoshi•Fund — blockchain investment company. Invest only in blockchain assets since 2014.