For a modern person, loans and various loans have become almost a part of everyday life. I think that each of you has a friend who took something on credit. Perhaps you yourself have faced loans personally. We talk about a variety of things, for example, took a phone on credit, or a car, or maybe the whole house.

At the moment, loans have become one of the pillars of the financial system of the whole world, in fact thanks to him all the different banks and can exist and successfully develop. The history of loans has its origin in the very distant past, even at a time when money in their current understanding only entered into the habitual way of life of people. The first creditors of that time were still called money-lenders, they actually traded in the fact that they gave people money in debt at a small percentage, and to secure a guarantee they asked for some property.

A certain difference between past creditors and the current ones is the possibility to give credit not in a whole amount, but in parts. So the credit system was created. Now, of course, loans are basically the prerogative of various banks or credit organizations, but usurers exist to this day.

What are the problems with the modern credit system?

Perhaps more than half of the current population is now in the so-called "credit slavery", they take the basic loan, after borrowing money to pay interest, they re-take from friends, relatives, other unfamiliar people, however, the amount of their loan does not decrease, grow like a soap bubble, which can burst overnight and the person will remain with nothing. This problem is not only private persons, but also various state. organizations, business, etc. However, there are always 2 sides of the same coin, as well as loans provide an opportunity for the development of society, funding for various research and development.

In addition to global problems, there are a number of small problems, such as:

Many credit institutions face such a problem as refusing to pay the debt, purely legally if you look at this problem, then if a person does not have any property, then the creditor will not have anything to repay his debt from. Thus, we have to somehow compensate for the losses, for example, increasing the loan rate, which is not particularly welcome by all other borrowers, or use the services of collectors, which in itself is not a particularly legal method.

Processing a request for a loan often takes a very long time, in this regard, organizations lose customers.

At the moment, the centralized credit model forces credit institutions to increase the lending rate, which clients are not very happy with.

As we see the entire financial and credit sphere requires a thorough restructuring and upgrade. One of the ways to solve problems can be the use of Blockchain-technologies. And today I will present you one project that will just satisfy this condition. And this is the company Distributed Credit Chain, or abbreviated DCC.

Features

DCC owns a global ecosystem of banking, which will allow it, under ideal conditions, to destroy the oligopoly of the largest fin. institutions. At the same time, users and providers of financial services can finally get their income.

DCC is based on a decentralized model, thanks to Blockchain, it will allow an equal system of cooperation between all users in all spheres.

For business, DCC has also prepared its own scheme for turning a tree-based SU into a flat one, which will allow creating a standard of standards with an emphasis on the specifics of the organization, which will significantly improve the efficiency and productivity of the business.

As you know, Blockchain is a new level of technology that is distinguished by exceptional reliability and transparency, which means that any data that was once entered into the database can no longer be forged. Similarly, regulators can always quickly check all their assets.

Distributed Credit Chain plans to acquire a wide range of various lending services (installments, mortgages, loans, Banking Blockchain cards and much more)

Principle of operation

The project issues its own internal token with the same name DCC. The token will be used in all transactions related to finance, they will also be able to pay for various internal services of a distributed credit system. Of course, all conditions of transactions are stipulated in a smart contract DCCpayment

If someone has dealt with loans and tried to get them through the websites of credit institutions, then some are already familiar with the procedure. To start, you need to create an account on the DCC website, download all the data needed to provide credit and send a request. In addition, the borrower will also have to buy tokens in order to pay an initial fee when sending the application.

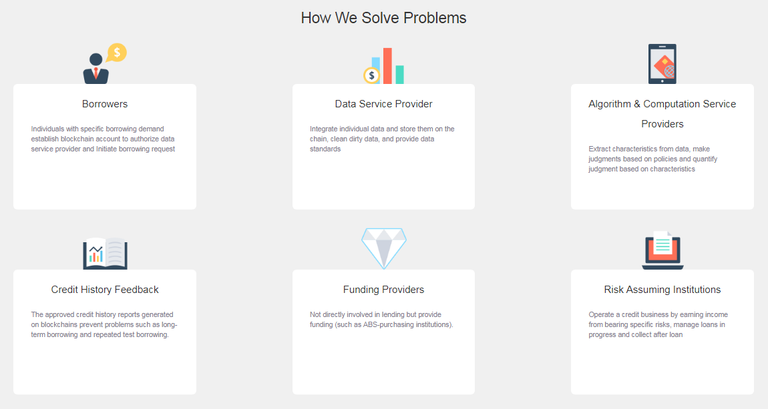

Borrowers: In order to get a loan, you will need to register your account on the site, transfer the data to the system and create a request for a loan. Also for the borrower, you must purchase tokens in DCC to pay the initial installment when applying for a loan.

As for lending organizations, they will also have to make some efforts to join a single network, or more precisely, connect to the DCC network and buy tokens to pay the first installment to the certification bodies.

Undoubted plus for both borrowers and creditors is that they can set the maximum and minimum accordingly the amount of personal contribution. After that, credit companies review and process all applications and approve or disapprove them. Of course, the priority will be those applications in which the initial payment is the highest.

It is also very pleasant that even in this project there is an incentive program. Some of the tokens will be formed into daily pools, which will be paid as a reward for the timely repayment of the loan. This will create a positive impression for all borrowers, which will be the reason for their new appeals. Creditors have also not been spared, they will receive a pool for accepted applications.

Conclusion

Distributed Credit Chain was created with the goal of uniting all credit institutions into a single network in order to provide the most convenient conditions for both creditors and borrowers. Using Blockchain will exclude suspicious manipulations within organizations and increase the processing speed of applications. And the incentive system in the form of incentive payments of DCC tokens will increase the number of transactions with early repayments and increase the number of applications received from credit institutions.

Project information

Website: http://dcc.finance/

Whitepaper: http://dcc.finance/file/DCCwhitepaper.pdf

Telegram: https://t.me/DccOfficial

Facebook: https://facebook.com/DccOfficial2018/

Twitter: https://twitter.com/DccOfficial2018/

Author: https://bitcointalk.org/index.php?action=profile;u=2211755;sa=showPosts