This is a sneak preview of my coming Medium post about Dash's launch. The Medium post features clickable links to back up the findings of my video documentary.

The digital currency Dash was launched in 2014 as X-coin. The circumstances surrounding the launch were not conventional, and many irregularities occurred. Because of this, many assumptions (mostly negative) exist about the methods and intentions of the founder.

The founder of X-coin, Evan Duffield, was a scholar of finance and coding. He took pride in running complex algorithms, machine learning and data analysis in various industries such as social media. Later in life, he would study for his Series 65 certification which would allow him to become a licensed financial advisor. The melding of these two fields made him fall head over heels for the blockchain space.

He began to become drawn to Bitcoin, and the whitepaper produced by the anonymous lead developer Satoshi Nakamoto. While he had an appreciation for Bitcoin, his analytical and financial mind began seeing flaws in its system, and he began bouncing ideas off of thought leaders in the Bitcoin space in the "Let's Talk Bitcoin" online forum. His ideas for decentralized fully-private transactions and incentivized full nodes for Bitcoin were met with deaf ears and muted results. After a period of attempting to convince Bitcoin's thought leaders to implement his ideas, he felt that the perfect way to leave an impression on the blockchain industry would be to start his own project.

This project would begin as X-coin, then Darkcoin, and finally Dash.

The Dash digital currency project

Dash is a major competitor in the blockchain space. It is responsible for many innovations, with a majority of those being personally attributable to Evan Duffield. These innovations include but are not limited to:

The X-11 hashing algorithm, which mimicked Bitcoin's early mining schedule in a shorter time frame, with CPU mining graduating to GPU mining followed by ASICs

Dark Gravity Wave, which is a revolutionary block difficulty algorithm which adjusts after every block, refining the adjustment formula of Bitcoin

The second-tier masternode network, which are collateralized, incentivized full nodes that allow for many functionalities in Dash, such as:

PrivateSend, a decentralized mixing technology that renders transactions untraceable while remaining completely transparent

InstantSend, a transaction-locking technology which uses a quorum of masternodes to lock a transaction so it cannot be double-spent, a problem that Bitcoin is exposed to

A decentralized treasury, which allows the decentralized second-tier masternodes to vote on governance issues and funding directly from the Dash blockchain, allowing it to fund its own development

While the present of the Dash project can be considered to be technologically and organizationally successful, its past could be considered to be holding back its progress somewhat. Why?

As I mentioned earlier, the launch of Dash as X-coin in 2014 was far from exemplary. In the first 24 hours, a problem with the code led to over 1.8 million X-coins being mined. After this "fastmine" (which also happened in another popular coin named Litecoin), a series of adjustments to the project's difficulty and block reward formulas led to the original maximum number of coins being lowered from an assumed 84 million to a range of 18–21 million.

Because of these rocky beginnings, some individuals or groups with unknown motivations began examining the circumstances around it. They took some raw facts about what happened, missed quite a few others, added some negative assumptions and concluded negative intent.

From this point, I will refer to these conclusions as "conclusions of the researchers".

After they had established a story that to them may have seemed factual, they proceeded to post and share their actually less-than-factual conclusions everywhere and any time they could. A summary of the conclusions of the researchers can also be found in the YouTube video entitled "Could Dash be a Scam? | A Brief History" which was created by Decentralized Thought in 2017.

Over time, they succeeded in convincing themselves and many others in the blockchain industry that Dash was a scam, not worthy of investment or support.

Dash's strategy in response to this was to kind of sweep it under the rug. Their philosophy was that it didn't matter what some in the blockchain industry thought about Dash, there was a much larger group of non-blockchain folks that would not have known about the circumstances surrounding Dash's launch. It happened long ago, they figured, and the more distance they put between them and it would allow it to fade away.

I went along with this strategy for quite some time, years in fact. However, I finally reached a point where I could not anymore stand to see Dash's name dragged through the mud by individuals within the blockchain industry. I made up my mind that it would be best to have passionate blockchain industry participants friendly to Dash. This would lead to more investment, more development, and an all-round more friendly and productive environment to work in.

The narrative of the researchers had to be challenged.

As a result of that thinking, I took it upon myself to investigate the launch of Dash. I wanted to see if the conclusions that were drawn by the research team were based on reality or negative assumptions.

In this blog post, I will summarize my findings about the circumstances around the Dash "fastmine" and invite you to watch the full documentary that I have posted under the title above. Let's begin.

Circumstances surrounding the pre-launch of X-coin

Facts:

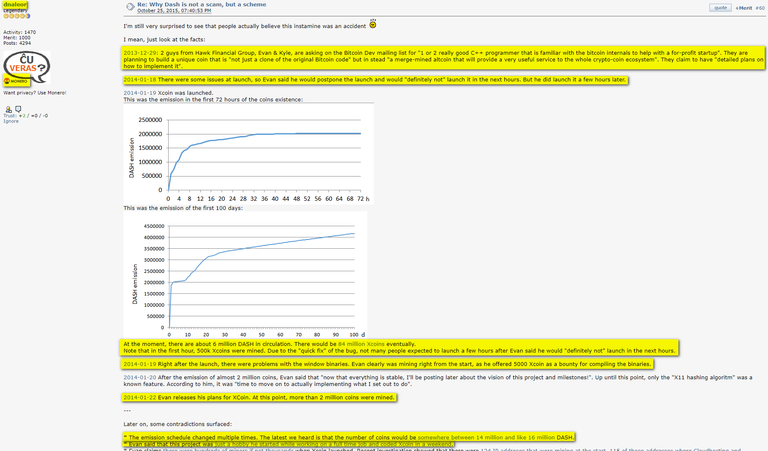

In late 2013, Evan Duffield and his partner Kyle Hagan wrote a letter to the Bitcoin developer mailing list, enlisting C+ devs for a blockchain "for-profit" startup, that they had detailed plans for.

Three weeks after that, X-coin was launched.

Evan claims that work on X-coin was a hobby as he had a full-time job, and he coded it in one weekend.

A first attempt to launch X-coin failed.

Between the first attempt and second final launch, there was an interaction between a BitcoinTalk user and Evan Duffield about the delay period between the two launches.

The BitcoinTalk user's post contains an extremely vague and ambiguous sentence asking about how long the delay should be, which Evan then responds to.

Conclusions made by the researchers:

The fact that Evan and Kyle posted that e-mail to the Bitcoin developers attempting to hire them for a "for profit" startup meant that there's no way that coding X-coin could be a hobby, and there's no way he could have coded it in one weekend. They assert that Evan's explanation of the circumstances was not a valid one: him and his partner likely planned the fastmine, due to the presence of a detailed plan. They also maintain, due to the ambiguous interaction with the BitcoinTalk user posted above, that Evan explicitly stated he would not launch the coin within the next hours/days. They accuse Evan of intentionally misdirecting potential miners.

My take:

There is nothing in the facts as stated above that can refute Evan's explanation of coding being a hobby. The researchers conflate the fact that Evan and Kyle had detailed plans for the project with them planning the fastmine. It's not known what plans Evan and Kyle had, and it's not known whether they were long term or short term plans. The only fact that is provable is that Evan did have a full-time job, which lends credence to his claim about X-coin being a hobby. He could only code in his spare time. That pre-launch interaction with the BitcoinTalk user has so many moving parts in it that it's impossible to ascertain a desired time frame for the new launch. As such, it's also impossible to quantify Evan's response to this post. As it turned out, X-coin was launched over 5 hours after this post.

Verdict:

Ambiguous, not enough evidence exists to support the conclusions of the researchers.

Circumstances around the launch of X-coin

Facts:

Bitcoin's explosion in value in late 2013, coupled with its "open source" nature saw many altcoins created in late 2013/early 2014.

There is evidence of multiple miners around at the launch of X-coin. Posts to Bitcointalk, and rising hash rate after launch support this.

The digital currency Litecoin's launch featured a fastmine because of its enherited slow Bitcoin difficulty adjustment formula and high hash rate, with over half a million Litecoin produced between block 3 and block 10,091, less than 24 hours later.

The first X-coin client was a Litecoin fork, with some modifications and aspects from other coins. It featured an approximately 75% more responsive difficulty adjustment formula than Litecoin (adjusting every 576 blocks as compared to every 2016), a variable block reward formula inspired by Primecoin, and the X-11 hashing algorithm inspired by Quarkcoin.

The current blockchain was initiated with the second launch of X-coin. This second launch was announced in advance, more than two hours before.

There was no Windows miner provided by the X-coin development team at the launch, however a Windows binary was provided by an independent user within 4 hours of launch.

Due to an improved but still slow difficulty adjustment formula, a bad implementation of the Primecoin block reward adjustment formula, and high hash rate directed at the coin, 1.8 million coins were "fastmined" in the first 24 hours.

Hash rate remained relatively steady for the first 500 blocks, and began to increase in the next 600 blocks. After a code update, the hash rate steadily increased and ended the fastmine many times more powerful than the launch hash rate.

Conclusions made by the researchers:

The researchers either did not have access to this full list of facts or chose to ignore some of them. They get the raw statistics about the launch right, but draw conclusions presumably based on flawed assumptions. They assert that the launch was not announced fairly, no other miners were around at the launch, and a Windows miner did not exist during the fastmine. They maintain that the faulty coding leading to the high emission at launch was intentional, missing the fact that others enjoyed this high emission as well. The common conclusion that they draw from all of this is that the launch of X-coin was an "instamine" scam perpetrated by Mr. Duffield.

My take:

No one can know what was going on in the minds of the two founders before and during launch. Any attempts to convince others that you know this is a fool's errand. I observed and drew my own conclusions, which have the benefit of a more extensive list of facts.

Those facts are that X-coin was launched fairly with notice for any interested parties to partake (which many miners and pools did) and a Windows miner was provided and used within 4 hours of launch. X-coin did suffer a similar fastmine as Litecoin, though, due to an improved but still slow difficulty adjustment formula, a faulty implementation of the Primecoin block reward formula, and the presence of a high hash rate at launch. The rewards were also likely more evenly split then the researchers surmise.

Verdict:

On the surface, while being far from perfect technically, it appears to have been a somewhat fair launch. The launch was announced in advance, so anyone interested could have partook in mining X-coin with the exception of the first few hours when there was no Windows binary. All miners present providing hash rate also benefited from the slow difficulty adjustment formula and faulty implementation of the variable block reward. Due to this, I conclude that the far from perfect launch was likely a mistake. Occam's razor would suggest the cause was a rushed launch by the developers, with not enough testing done beforehand. No way to know for sure, but the raw facts can't support any negative intent.

The X-coin accumulation of the founders during the fastmine

Facts:

There is evidence of multiple miners and mining pools around at the launch of X-coin.

The faulty implementation of the Primecoin block reward formula, the slow difficulty adjustment formula and high hash rate caused 1.8 million X-coins to be produced in the first 24 hours.

The coins were not instantly created, as the term "instamine" would suggest. They were emitted steadily, while being subjected to an ever-increasing hash rate output over that 24 hour period.

There was no Windows miner provided by the X-coin development team at the launch, however a Windows binary was provided by an independent user within 4 hours of launch.

There were multiple cloud servers present mining X-coin at launch, as can be proven by searching the whois of IP addresses (full nodes) posted by a user shortly after launch. These cloud servers were hosted at a few different providers, although mostly Amazon Web Services, and Microsoft Azure.

Hash rate remained relatively steady for the first 500 blocks, and began to increase in the next 600 blocks. After a code update, the hash rate steadily increased and ended the fastmine many times more powerful than the launch hash rate.

Conclusions made by the researchers:

The researchers assert that a majority to the entirety of the 24 hour fastmine's 1.8 million X-coin rewards went to Evan and Kyle. They base this on a series of flawed assumptions. They maintain that there was intentional misdirection about the launch time, and there weren't many other miners or mining pools around. They claim a Windows binary did not exist for the entire fastmine. They assert that the developers knew about the bug in the code, and that the cloud servers at the launch belonged mainly to the two founders. They then surmise that these cloud servers led to a dominant portion of the hash rate throughout the fastmine.

My take:

Through my research I came to a number of discoveries. First of all, the claims that the launch was not announced fairly and there were no other participants at launch are not factual, and have been sufficiently proven otherwise. There was a Windows binary provided and used within 4 hours of the coin's existence, which is also at odds with the researchers assumptions.

As for the cloud servers, apart from Kyle's admission of running some of them, it can't be determined who owned each one that was mining X-coin at launch. These cloud servers did look to have a majority of the hash rate at the launch and shortly after. However, they were soon joined by other mining rigs and mining pools possessing much larger hash rate than the output of the cloud servers.

Through his independent hash rate research, now Dash Core Group CEO Ryan Taylor found that it is very likely that the founders accumulated somewhere in the neighborhood of 518,000 X-coin between them. This is definitely a huge amount, but it's only a quarter of the fastmine output, and less than three percent of the total Dash that will ever be mined.

Verdict:

It's impossible for the researchers or myself to come up with an exact number of coins accumulated by Evan and Kyle during the fastmine. However, the researchers simply point to the existence of cloud servers and erroneous premises about the launch to claim that the founders mined a majority of the coins in that time. Actual analysis of the hash rate output over the course of the fastmine, combined with the presence of other miners and pools would suggest that the rewards were split much more fairly among the participants. Again, no way to know for sure, but the data discovered does not support the claim of monopolization of rewards.

Adjustments made to the project's difficulty and reward formulas

Facts:

Dash's initially posted max coin supply figure was 84 million. This was based on Litecoin's emission schedule, as X-coin was a fork of Litecoin.

The Dash code contains formulas to regulate difficulty and block rewards. High hash rate leads to high difficulty and low rewards, while low hash rate leads to low difficulty and high rewards. Due to this, Dash's maximum coin supply was designed to fluctuate.

Dash is very popular with miners, going from beyond GPU mining to ASICs. Due to the extremely high hash rate securing it, Dash's minimum block reward has been in effect for quite some time.

In a quest to develop refined difficulty and block reward formulas for Dash, these formulas were adjusted seven times in the first two months. A full link list to these changes can be found in the description section of my documentary.

The first fix to to X-coin's variable block reward formula, ending the fastmine, was performed at block 4500.

A situation beyond the developer's control led to another of the adjustments (implementation of Kimoto Gravity Well)One of the adjustments led to halving restrictions on coin supply being completely removed.

Conclusions of the researchers:

The researchers are aware that the emission schedule was adjusted multiple times in the first two months. They accuse Evan of doing this intentionally to make his fastmine stack more valuable and restrict the potential earnings of new miners. They also maintain that Evan performed the re-branding changes of X-coin to Darkcoin, and subsequently Darkcoin to Dash in an attempt to obfuscate those changes.

My take:

Once again, I have the benefit of a more extensive fact pool. For starters, the re-branding efforts do not line up with the adjustments to Dash's difficulty and block reward adjustment code. The first (X-coin to Darkcoin) was performed well before those adjustments were finished, while the other (Darkcoin to Dash) was performed a year after they were completed.

Dash's initial supply figure of 84 million was based on the Litecoin emission schedule. X-coin (later Dash), however, was born with a variable block reward formula based on network hash rate. After the initial fastmine fix, assuming no further formula adjustments were performed, if Dash had ever reached 84 million coins it would be because no one cared about it and hash rate remained low throughout its existence. Dash has since become quite popular with miners, going from beyond GPU miners to ASICs. Dash's minimum block reward has been in effect for quite some time. As such, even without formula adjustments, Dash would not have come close to 84 million coins. This fact was lost on the researchers.

Evan had an early quest for a refined and responsive difficulty and block reward formula for X-coin which he tinkered with for the first two months. As such, the expected maximum Dash coin supply varied from a low of around 10 million to a high of around 84 million coins during this time. It's also proven that Evan listened to his community about coin direction on multiple occasions. One particular adjustment was interesting as it removed all halving restrictions from the code, flying in the face of claims by the researchers that Evan was simply trying to make his stack more valuable.

In the end, Evan reached his goal and Dash now has quite responsive difficulty and block reward adjustment formulas. The expected final supply of Dash rests at between 18 to 21 million, similar to Bitcoin.

Verdict:

Refining the project's variable difficulty and block reward formulas was a painstaking process, with adjustments leading to the expected total coin supply moving both down and up. The community's wishes were listened to and taken into account. The rebranding dates also do not line up with the code adjustments. Based on these facts, I conclude that this was another case of not doing enough private testing of the desired coding before introducing it to the public. Evan's desire to please his community shown through once communication improved later in the process.

The facts can't support the narrative of the researchers.

Reality Check: The Truth about Dash's Launch!

I invite you to watch my documentary about Dash's beginnings and its inner workings. I discuss more Dash topics in a relaxing and fun way. There is even a discovery that proves that these "researchers" did not do much research at all!

If you would like to comment or add something to this post, I can be reached here or on the following forums:

Twitter: https://twitter.com/TaoOfSatoshi

Instagram: https://www.instagram.com/taoofsatoshi/

Reddit: https://www.reddit.com/user/TaoOfSatoshi

Dash Nation on Discord (@TaoOfSatoshi) https://discord.dashnation.com

Thanks for reading!

Christopher Carruthers (Tao Of Satoshi)

Amazing post. Excellent Work Taoofsaoshi.

Thank you! I will post the Medium link here after posting.

Here is the link to the final Medium post version:

https://medium.com/@taoofsatoshi/reality-check-the-truth-about-dashs-launch-7265d98f1c0c

Resteem. Dash needs some more exposure. Best crypto IMHO.

Posted using Partiko Android