Hi, crypto-guys! All statements by critics that bitcoin is a bubble, crumble. one of the confirmation of this project Globitex. Its chairman is Jon Matonis - Monetary Economist. Founding Director at Bitcoin Foundation. CEO of Hushmail. Startup Team at RSA's VeriSign. Chief Currency Dealer at VISA. For many, distrust of bitcoin was caused by the fact that it does not have any real value. But Globitex is designed to bring bitcoin to commodity markets and make it a settlement facility on its stock exchange platform. For this, a four-stage plan was developed.

Bitcoin Spot Exchange

Globitex is an institutional grade Bitcoin exchange, with unrivalled API capabilities for direct market access. The project has received over EUR 1,000,000 in venture capital funding with the aim of building a Bitcoin exchange that reflected the team’s vision of how an exchange should work in terms of connectivity, matching, settlement and reporting. Today you can trade Bitcoin and Bitcoin Cash against Euros on the Globitex exchange.

GBX token sale is organised in order to scale the existing Globitex exchange infrastructure to the necessary industrial trading level, with a capacity to accommodate standardised money markets and commodities listings. The token sale is interned for the business development goals divided into three parts, enabling the team to use the proceeds in order to achieve the goals set forth.

Spot FX and REPO

This will involve business development efforts for establishing additional banking relationships with bank partners around the globe and across the currency spectrum. This will also involve the undertaking of a thorough security and business evaluation, including development of extensions for the payment system based on the highest security standards before adding other cryptocurrencies as trading instruments on Globitex.

By allowing Globitex clients to lend to each other with REPO, or standardised maturities repurchase agreement based instruments, Globitex clients will be able to use the borrowed funds for leveraging their trading; the loans will be made available as collateralised debt instruments, which can also be used for purposes outside of the exchange. This, in turn, will create a money market for Bitcoin and other cryptocurrencies, and thereby establish market based interest rates. Globitex will expand its core system level functionality to implement FX margin trading based on the peer-to-peer lending principle. Furthermore, to allow currency REPO instruments, a new risk module will also need to be implemented.

Globitex will introduce commodities trading in bitcoin, starting with deliverable spot gold. Gold is an obvious choice to begin with, as Bitcoin itself is dubbed “digi- tal gold”. Globitex will develop order book and distribution channels for gold bought on Globitex against bitcoin.

Scale spot FX, where Bitcoin can be traded vs. major fiat and other cryptocurrencies

Implement FX margin trading ability - REPO

List precious metals spot contracts

Money Markets and Derivatives

Aggregate the leading interest rate markets for Bitcoin margin lending, including the one developed by Globitex at stage I, in order to form a tradable interest rate product. Name it “BIBOR” (Bitcoin Inter-Broker Offered Rate) and offer BIBOR futures trading, thereby setting the standard reference rate for the Bitcoin economy capital markets. Furthermore, expanding to money markets in other cryptocurrencies based on market appetite.

At this stage, business development and various partnerships will have positioned Globitex to reference the existing USD based markets. By using traditional futures markets pricing in commodities, we shall begin using Bitcoin at the scale needed for global trade by synthetically forming derivative instruments in commodities, paired with FX market developed in Stage I. These instruments will be listed in standardised maturities and settled in Bitcoin. We will begin by implementing precious metals cash settled futures trading and follow up with other commodities. By further developing IT infrastructure and risk management, the Globitex exchange will be able to accommodate options listings in commodities, FX and money markets thereby linking Bitcoin to global trade at all levels of derivatives.

Create cryptocurrency-to-fiat and cryptocurrency-to-cryptocurrency based futures, swaps and options to be used as financial instruments for hedging, investing and speculating purposes.

Develop Bitcoin money markets - BIBOR

List cash settled commodity futures and options

List cryptocurrency futures, swaps and options

Deliverable Commodity Derivatives

Aggregate various groups of commodities, listed in the previous stage, as cash settled futures, such as energy, grains, industrial metals, precious metals, softs, livestock, into a Bitcoin priced index. Such index would reflect Globitex and other exchange listed commodities value in Bitcoin. The index would have a specific weight for each commodity group. The index would first serve the purpose of a reference price, and may later form the bases for a tradable index futures product. Name the index Globitex Commodity index “GCOM” and prepare to offer GCOM futures trading.

The previously established Bitcoin settled derivatives need to be made deliverable physically in kind. Futures will become available for physical delivery. Starting with a precious metals spot market and integrating in existing precious metals distribution channels, we shall allow a standard commodity kind to be delivered and deliverable in exchange as a collateral in some pre-agreed form. Globitex will work on specific form for certificates of ownership - warehouse receipts in the form of tokens, which may be tracked and verified on a public blockchain.

For commodities such as non-perishable energy products or industrial metals, which can be stored in warehouses for long time periods, we shall rely on the existing warehouse infrastructure, be it the established warehouses used by existing exchanges or other private warehouses complying with the common delivery standards, to allow other liquid derivative instruments to be physically deliverable. Similarly for consumables, we shall partner with existing wholesalers offering FOB (free on board) or CIF (cost insurance freight) commodities for purchase with Bitcoin and delivery in kind at designated ports and warehouses.

List Bitcoin priced Globitex commodity index - GCOM

Enable precious metals futures contracts to be physically deliverable

Further develop warehousing infrastructure and expand spot commodities

All that we have been dreaming about for so long is attracting the money supply from the largest financial institutions, creating a commodity base,financial instruments using bitcoin as metrics and unit of account.

And directly about the sale of the token that will be used in this system.

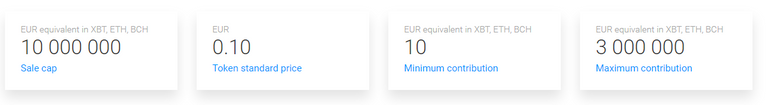

GBX Token Specs:

The time of globalization, the time to join!

For more information, please visit Link:

· Web-site: https://www.globitexico.com/

· ANN bitcointalk: https://bitcointalk.org/index.php?topic=2257519.0

· Facebook: https://www.facebook.com/globitex/

· Twitter: https://twitter.com/globitex_

· Telegram: https://t.me/globitex

· WhitePaper: https://www.globitexico.com/wp.pdf

This article was created by Tktktk: https://bitcointalk.org/index.php?action=profile;u=1119627

The article is published for participation in the marketing program. Investments in the crypto currency are high-risk. Never buy cryptocurrency for the amount you are not ready to lose.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.globitexico.com/

Congratulations @tkkt! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIs this correct? Minimum investment 10 ETH?

No, it says minimum investment 10 Euro equivalent in XBT, ETH, BCH .