The underlying value in IoT is the transfer of data, and the financial sector relies heavily on gathering and analyzing data. It is hard not to imagine IoT disrupting the financial services industry. Financial institutions, especially retail banks, have invested increasing amounts of resources into developing both their internal infrastructure and consumer-facing technology capabilities. IDC Financial Insights predicts that retail banks will spend over $16 billion on digital information technology initiatives, and this spending will continue to increase. In fact, according to PWC’s 6th annual digital IQ survey, financial services is one of the top 10 industries that has been investing in sensors for potential IoT innovations.

The power of IoT is to make static, physical objects engaging and smart. This experience can also be taken outside of the retail banking outlet to the point of purchase, like when financing a new car. With banks competitively providing low interest rates, consumers will typically go with the financial institution that they’ve been recommended or exposed to the most. With IoT, when a consumer enters the dealership, it may be possible for retail banks to alert the consumer on how much financing they’ve been approved for or deliver customized loan proposals in a timely manner.

Banks can use sensors and analytics to gather more information about customers and offer more personalized services. Insurers and commercial banks can also use sensors attached to assets to track shipments.

There are numerous ways IoT sensors can help banks, which tend to deal with intangible assets, especially in the world of online finance. Banks will have a more vivid picture of the consumer, understanding how they move and where they spend money. This will allow banks to make more accurate lending decisions and deliver more real-time, personalized offers.

BANKEX has developed a solution for the financial problems by creating of the Proof-of-Asset Protocol with the mission to obtain an instant audit of the asset. BANKEX is Bank-as-a-Service on blockchain, building the Proof-of-asset-Protocol. BANKEX stand for Bank exchange, to describe a platform where banks can exchange their products. Through this platform, the market will force certain businesses to change (lawyers, accounting, auditors, and in separate cases banks and collectors). This is the modernization of the mechanisms of assigning and validating ratings where the cash flow recorded on the blockchain using the Proof-of-Asset protocol as transparent and understandable as possible. In the same time, it will be faster and accessible as price.

With BANKEX Proof of Asset, anyone can use real-time biometrics and positional sensors to continually assess the well-being of anything from office space, property or monitor the location of car and its historical data. For example, banks can start introducing mortgage offers via real estate websites, or segment their customer base to generate targeted adverts for home or car loans.

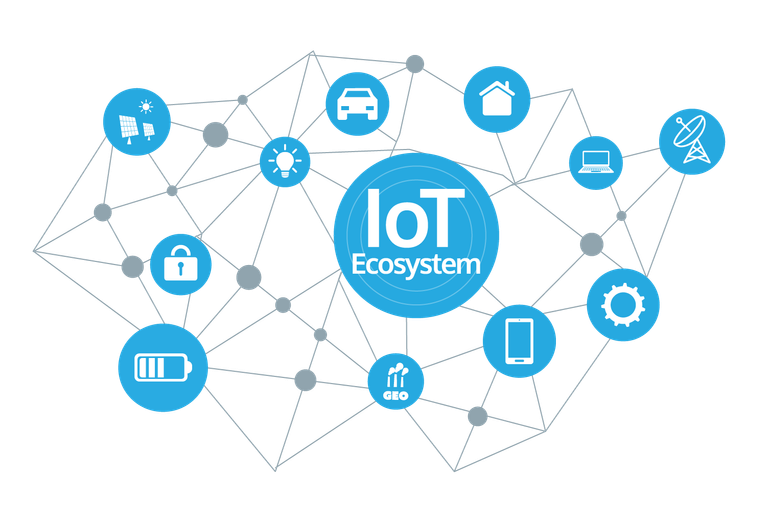

The concept is that all of our devices and things are connected. With connected devices, it will be possible to collect more data than ever before, which can then be mined for trends offering insight into aspects of the business like customer purchasing habits and inventory. BANKEX is creating a powerful computing technology with machine learning capabilities to detect patterns and trends within that data.

BANKEX has the potential to bring about renewed trust in the advantages of globalisation, and to speed up economic development worldwide.

Learn more about BankEx at https://bankex.com/en/, join the token sale and discover the benefit of BKX token.

Very good article, very complete ! I will follow Bankex now ! Thanks :)