Posting the link to my latest blog post here, with STEEM covered in the examples.

Teaser opening

Initial Cryptocurrency Offerings (ICOs) are the flavor du jour in the sprawling Crypto-Tech market. I’ve been following and analyzing their development early on, in addition to being in private conversations with several entrepreneurs who are planning or have done them already.

http://startupmanagement.org/2016/11/24/how-to-evaluate-an-initial-cryptocurrency-offering-ico/

At their essence, they represent a fundamental shift into how companies get funded, when compared to the traditional Venture Capital driven methods, as I described these differences in How Cryptocurrencies and Blockchain-based Startups Are Turning The Traditional Venture Capital Model on Its Head. What I inferred from that post is that the way forward is a clever combination of both worlds, the old and the new, a point that Zenel Batagelj from ICONOMI picked-up in ICO 2.0 – what is the ideal ICO?, a good post that I recommend you read.

For background, I’ve already described the Best Practices in Transparency and Reporting for Cryptocurrency Crowdsales in a lengthy post, about two years ago. Re-read it, because much of it still applies increasingly so, and for a new reason: there are several more ICOs today than in early 2015.

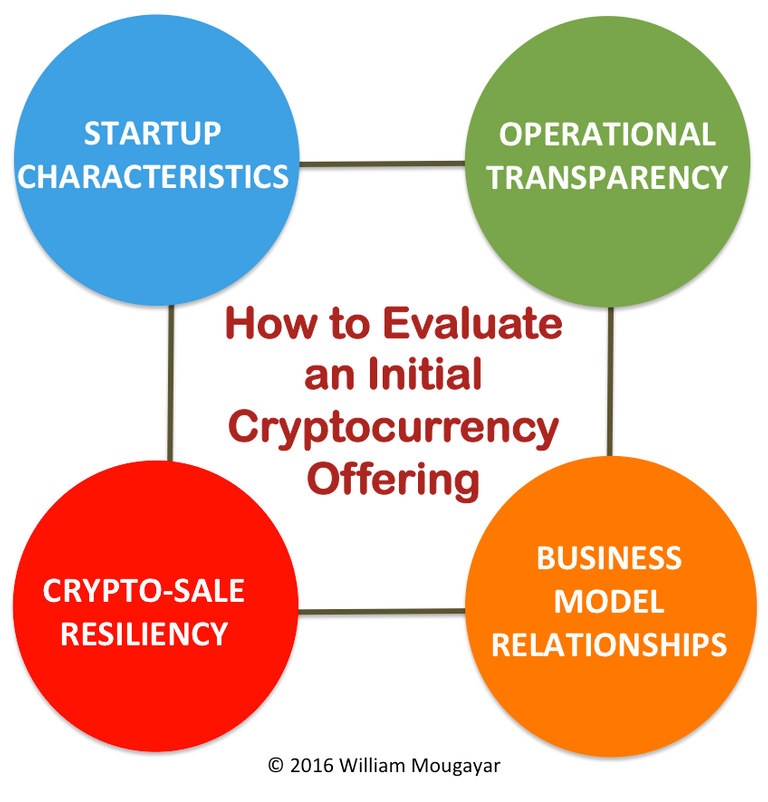

I’d like to expand my own thoughts on how to evaluate an ICO by categorizing the criteria along 4 dimensions:

- Startup Characteristics

- Operational Transparency

- Crypto-Sale Resiliency

- Business Model Relationships

Read more here: http://startupmanagement.org/2016/11/24/how-to-evaluate-an-initial-cryptocurrency-offering-ico/

Hi! I am a content-detection robot. I found similar content that readers might be interested in:

https://startupmanagement.org/2016/11/24/how-to-evaluate-an-initial-cryptocurrency-offering-ico/

good info

Thanks for the information!