Hi friends if you are interested in joining the BTCC project, you must read a discussion that is able to help you get the data, which is able to help you see their vision and mission. Following Review:

What is Coin token / Btccredit?

The next generation crypto banking solution, the P2P Blockchain-based loan solution. The medium of USDT exchange is like a medium of exchange and bitcoins are like guarantees.

Btccredit is a very up-to-date loan platform formed and has not been easy to use for users. P2P lending is the hottest issue in the future that cryptocurrency can facilitate. We are building a strong infrastructure to make P2P lending crypto feasible for all people. This platform wants to support the Bitcoin and our original BTCC tokens like a guarantee. Make a deposit and withdrawal, USDT will be used. The use of USDT is very safe for users to transact on this platform. Alibi was originally a very liquid USDT, appeared in almost every exchange, and another is if the matter is supported by the same value of USD in the Bank's assets. Our very meaningful concerns are the protection of customer funds and want to always be the main focus.

We have other cool products on our track map of a decentralized P2P exchange, lurking platforms, crowdfunding, ico's investment platform.

BTCC tokens are like exchange media and BTCC tokens are like collateral.

Using USDT is like a media exchange fee system for borrowers to want 0, 25 percent. Using BTCC tokens is like a media exchange system fee for borrowers to be 0 percent.

When bitcoins are promised as collateral, the borrower must pay interest in accordance with the loan contract. The borrower is able to borrow upto 75 percent of the value of the collateral by pleading for a BTCC Token.

The borrower is able to borrow up to 60 percent of the LTV from the collateral value by promising Bitcoin. Loans with BTCC tokens want to look like a priority. Loans with bitcoins and ALT coins want to look like a middle priority.

By using USDT like a media exchange, EMI is able to be refilled using only USDT.

In the case of BTCC-like medium exchange tokens, the penalty fee would be 2.5 percent that the borrower would pay to the system if the installment payment was late.

In the case of the USDT as a medium of exchange, the penalty fee would be 5 percent that the borrower would pay the system for in the case of final EMI payments.

When BTCC tokens are promised as collateral, penalties for late payments become 0 percent, which are to be paid to the system, by borrowers in the matter of late installment payments.

When bitcoins are promised as collateral, penalties for late payment of 5 percent, which the system will pay, are borrowed on the issue of late EMI payments.

Rewards will be given in the form of a BTCC token on a successful handshake, both for lenders and borrowers, as well as for borrowers to pay EMI success by borrowers.

The system works?

USDT as well as BTCCredit loan system

USDT - users are able to Lend USDT supported by LDT Tokens whose value is 1 LDT: 1 USDT, by holding a smart contract on the Ethereum Blockchain, with Bitcoin (BTC) like a guarantee by the borrower.

BTCCredit - users are able to lend BTCC tokens, by holding smart contracts on Ethereum Blockchain, with BTCC tokens like collateral by borrowers.

Reward

The system wants to reward lenders and borrowers with BTCC tokens when contracts are deployed between them.

Borrowers want to be re-valued with the BTCC for each successful EMI payment.

15 percent bonus loan amount

On Alpha, the borrower found that 60 percent of collateral (BTC) LTV was placed, but in the Beta the borrower found 75 percent of the collateral LTV (BTCC token) was placed.

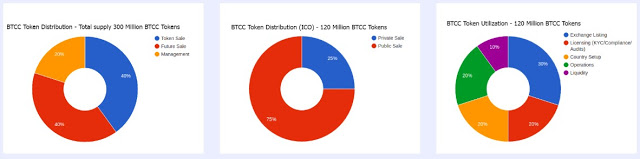

Token distribution

Roadmap

Q4 2018

Launch of P2P crypto loan system

The expedition began with a loan-loan, peer-to-peer Crypto Loans system Launch.

Smart Contract on Ethereum

LDT token contract, BTCC token contract.

Q1 2019

Launch of the USDT loan system

Users are able to lend USDT supported by LDT tokens and Smart contracts

Get applications in Mobiles

Obtain a platform loan compatible with Mobile Phones.

Get a license

Get a Crypto wallet and a loan license

Crypto Wallet Launches

Crypto Wallet Launches.

Q2 2019

BTCC token code on our lending system.

Currently Lend users are able to use BTCC tokens and are able to use BTCC like a guarantee. Launch of the P2P Exchange peer-to-peer Cryptocurrency Exchange launch platform.

Q3 2019

Launching of the Staking Plan Looking for a launch plan for investors, who want to benefit from interest in the BTCC / BTC, is like stalking ALT coins and Colateral loans.

Currently users are able to lend using Alt coins and are able to use Alt coins like a guarantee.

Q4 2019

Crowd-funding platform for Crowd's peer-to-peer funding platform.

You are able to join or participate in the BTC credit sales crowd through the following link:

Website: http://btccredit.io/

Whitepaper: http://btccredit.io/pdf/btccredit_whitepaper.pdf

Twitter: https://twitter.com/btc_credit

Facebook: https://www.facebook.com/BTCCredit-1017662868433011/

Telegram group: https://t.me/btccredit1

Medium: https://medium.com/@info_60688

AUTHOR

My Profile Link:https://bitcointalk.org/index.php?action=profile;u=1855756

ETH:0x83FA093A424FBA19Db78758Ba5a998928E8A83A5