Being that I've spent the last 17 years of my life being involved in some sort of business project or another, both online and offline, I am an easy target (for those that know me) for the infamous big question:

"How do I register or incorporate my business with the government?"

Before we get into the meat of the process of self-registering your business with your state online, using New Jersey as an example -- it's important to note that this question is a modestly loaded question. Why is that?

Well, when you think about it -- opening up shop (whether online or offline) and registering your business is an action that communicates many things to your local community and the local, state, and federal government. And this mostly nonverbal gestures comes with a diverse set of seen and unseen social, financial and legal implications like taxes, insurance, human resource issues and accompanying employee tax liabilities to name a few.

The other side of the loaded question coin is that there are varying types of business structures, for different purposes to consider before filling with your state government. I feel a personal responsibility to share an overview excerpt about the most common business structures to get you started on the research.

After covering these structures, we'll get right into the step-by-step process to self-register your business with your state government, using NJ as our example.

The Most Common Business Structures to Choose When Opening a Business

To be as direct and accurate as I can get with these business structure overviews, I relied on the U.S Small Business Administration's website to bring the following business structure description block quotes to you...

Sole Proprietorship:

A sole proprietorship is the most basic type of business to establish. You alone own the company and are responsible for its assets and liabilities.

A real world example of a sole proprietorship is like if you happened to discover a way of making a skin care product that you were able to easily produce and add some sort of cosmetic-feel to the product's packaging in a way that makes it professional enough to sell. You give a few friends some jars to try and the word gets out. All of a sudden everyone from church is asking you for a jar of your skin care product and money is rolling in...

You don't have to feel scared about the money pouring in because your business is "not registered" yet... Because as you collect the money for those sales, you are essentially operating as a business and the new income these sales bring in for you will be taxed accordingly under the specific tax code that effects a sole proprietorship business operation, keeping you compliant.

Limited Liability Company:

An LLC is designed to provide the limited liability features of a corporation and the tax efficiency and operational flexibility of a partnership.

An LLC, in my opinion, is the best way to go if you're more committed to your business concept and will be exposing it to a substantial amount of capital and risk during your operations. Also, as a new business owner, there's already plenty of work and paper work to deal with so you want to keep your reporting requirements as low as possible to stay compliant in the beginning. And an LLC gives you that reporting flexbility in just one annual report that's fairly easy to file and pay online.

Cooperative:

People form cooperatives to meet a collective need or to provide a service that benefits all member-owners.

A low hanging fruit real world example of a cooperative, in my view, is Steemit and us Steemians on here working and collaborating together for the mutual economic benefit of all of us community member-owners.

Corporation:

A corporation is more complex and generally suggested for larger, established companies with multiple employees.

Dreaming about your BIG day at Nasdaq, ringing the opening bell? This might be a good time to research deeper into the strengths and weaknesses of a corporation or consult with a lawyer skilled on corporation formations and structure.

Partnership:

There are several different types of partnerships, which depend on the nature of the arrangement and partner responsibility for the business.

If you're looking to start a business in the legal or real estate fields, looking into the details of a partnership structure would not be a waste of your time.

S Corporation:

An S corporation is similar to a C corporation but you are taxed only on the personal level.

Another good reason why it may be wise to involve a specifically-skilled attorney and certified public accountant with business structure formation in some capacity. I did say "save money" not go lose it all in business because of something an attorney or accountant could have cleared up for you at a reasonable cost.

Now that we have a better idea of the options available to you as a new business owner to structure your business, let's get into how to self-register your business online, using NJ as an example.

Step 1: Google Your State's Official Revenue and Enterprise Website or Business Formation Website

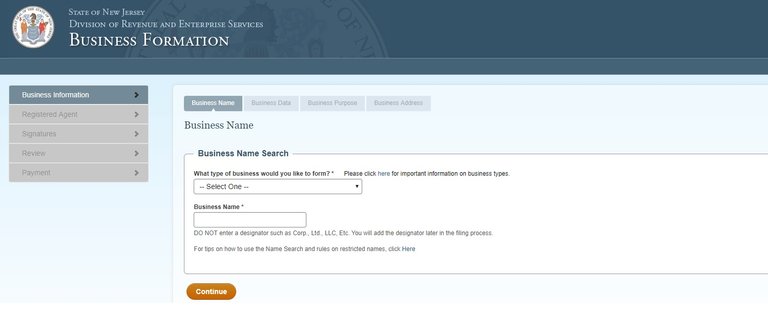

For those living in or wanting to register a business online with our example state (New Jersey), go here and start filling out the online form

Here's what the page you should see looks like:

Step 2: Diligently Fill Out Your State's Online Business Registration Form

Depending on how much forethought, research and planning you put into your business concept and/or operations, this form should take you less than 15 minutes to fill out in its entirety. The less information you know or have about your business or the business you're registering, the longer this step will take you so plan ahead and know the important operations and owner(s) related details about the business.

Step 3: Pay For Your Registration, Download and Save Your Business' Certificate of Formation PDF File

My favorite part about this process is that in the end, the system will spit out a digital certificate of formation PDF file after your payment is successfully processed. You can then go ahead and save this file on your hard drive for use later on.

Keep in mind that I'm not able to demonstrate this live for you because organizing a business with the government is not a child's play thing that I can do for demo purposes and then scrap it. However, from my experience the last time I went through this, I believe the cost to register a limited liability company (LLC), all-in, was $125.00 and I was able to get the Certificate of Formation immediately as a PDF file.

This instant filing is HUGE when it comes to being able to open bank accounts and meet certain paperwork requirements for an opportunity that you may have been pursuing prior to the need to now register your business ... including insurance requirements and so much more!

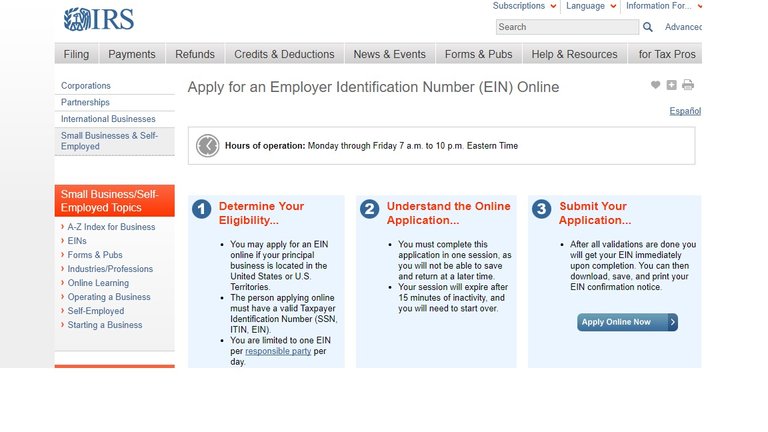

It's Also As Easy to Quickly Obtain Your EIN Number From The I.R.S

While you're at it.. Why not also obtain your EIN number and immediately qualify your business to open a business bank account?

Go here to go through a similar online application process to quickly obtain your EIN number from the IRS.

Here's what the page you should see, with a blue "Apply Online Now" button, looks like:

The End

That's really it guys. It's not a hard process as long as you plan ahead and do your homework on the details of the type of business you are starting and the type of business structure that fits your needs best. If you think you can handle registering your business yourself and feel confident enough with the legal and tax aspects of your business to fill out the form on your own, then go for it!

However, if you're not too sure about some details as it pertains to the aforementioned aspects of your business registration, then seek out a specifically skilled and proven lawyer and tax professional to help you with at least deciding on what type of information to provide and how to package that information when you self-register.

Feel free to add anything you might know about doing this for other states or in general. If you're an attorney or tax professional on Steemit, I am sure a lot of folks will still need some guidance with this process so feel free to chime in on this article as well!

Please share this article with those you know that may be looking for this kind of packaged, easy to understand and follow information.

Source for Business Structure Descriptions: SBA website

Thanks for sharing! Great post. Upvoted at onG too :D

Thank you @onenameglobal ... Loving onG so far!