Has money always been the same? How do we define it? Money’s history is filled with successes, innovations, failures and inefficiencies that have attempted to make the best method to transfer wealth and value. It has been an important concept since very early in human history and one of the most significant inventions, it has taken many forms and shapes. I’ll give a brief summary of the timeline of money in this post.

How did we even come up with the idea of money anyway? Nowadays, central banks are responsible of issuing, regulating and controlling the money that we exchange for goods and services, but in reality, money wasn’t the creation of governments. The need to transfer wealth created a market, and this market emerged out of the division of labour when people began to specialize in specific crafts and had to rely on others for materials or anything else they needed for their specialization. This led to the Barter Exchange.

Barter Exchange

The earliest form of wealth transfer was this method. Transactions were made by exchanging goods that involved parties agreed on. Let’s say livestock farmers met, one raises cows and the other one raises sheep. They agreed in exchanging 5 sheep for one cow and so they make a deal. There you go, that was how business was made. The problem with this method is the “double coincidence of wants” which states that is very rare that one person wants specifically what other person has at the same time that both parties are prepared to make a trade. This inefficiency Is thought to had created the need of money to act as an intermediary in the deal so people weren’t limited in exchanging what they physically had but instead exchange something that could hold a universal value. However, this argument is wrong. It was popularized by Adam Smith in his famous book “the wealth of nations” but it doesn’t justify the creation of money to replace the barter. Economies developed based on mutual trust, gifts and debt. Reputation within a community was crucial for debts to be payed and because communities were small, the exchange of something simultaneously wasn’t needed, all you needed was trust to know that debt was going to be payed sooner rather than later. Trading goods existed mainly when there wasn’t trust in between the parties involved (strangers or enemies), or where debt couldn’t be repaid easily such as in the case of travelling merchants. So in summary, money solved the problem of repaying debt, not a replacement of the barter. The existence of debt and credit systems was present way the barter, so the focus of money was to address this issue rather than replacing the barter.

Commodity Money

The definition of commodity money is that of a physical token that has value from the commodity that is made of. This means that it has an intrinsic value of the raw material that represents. For example, early commodity money was things like grain, or salt that you can eat. It can also have an extrinsic value, like a precious metal or shells by being scarce and beautiful. They have a stable and known value that is relatively easy to spend.

Representative Money

Then, we transition to representative money. The value for this type of money comes from an underlying item. For example, people used to trade gold for goods and services but it was dangerous to carry it around because of the risk of thieves. And what about carrying pounds of gold? It was impractical. The solution? Goldsmiths started to act as the first ever banks by safekeeping gold and issuing a receipt that became the first type of paper money. Also warehouses that stored grains or livestock did this same practice. The main difference between commodity money and representative money is that representative money relies on a third party to manage your “assets”. This was the stepping stone between commodity money and the ugly fiat currency.

Fiat Currency

In summary, fiat money is money because the authorities say so, is that simple. It has no intrinsic value like commodity money, and it doesn’t represent anything like representative money. Is just…money. We transitioned into fiat currency when banks decided to drop out from the gold standard, which was the commodity backing banknote’s value until 1976 in United States, then other countries also dropped out from the gold standard, a monetary practice that lasted around 5,000 years. There’s a lot of reasons why governments decided to cut the gold standard like the great depression, world wars, inflation, debt management, etc. So really, current fiat money is only valuable because governments declare them legal tenders and because their economies accept it.

So now that we have a clearer idea of the technical terms that have shaped money throughout time, we can take a look at the timeline of money.

9,000 BCE - Cattle

Cattle were the earliest form of commodity money. Cows were a medium of exchange that people accepted but was it efficient? I mean, it’s too complicated to price a cow because it depends in breed, age, health conditions, etc. They do have a built-in interest rate if you think about it, because they are able to reproduce. But really at the end, they had to be replaced.

3,000 - BCE - Earliest Banks

Mesopotamia firstly introduced the concept of safekeeping livestock, grain and precious metals. So we can say that it was the dawn of intermediaries playing a monetary role in people’s lives.

2,000 BCE - Lumps of silver

Around this time, silver ingots were the “gold standard” in Cappadocia, which is now Turkey. This was the transition between money with intrinsic value, to money with extrinsic value.

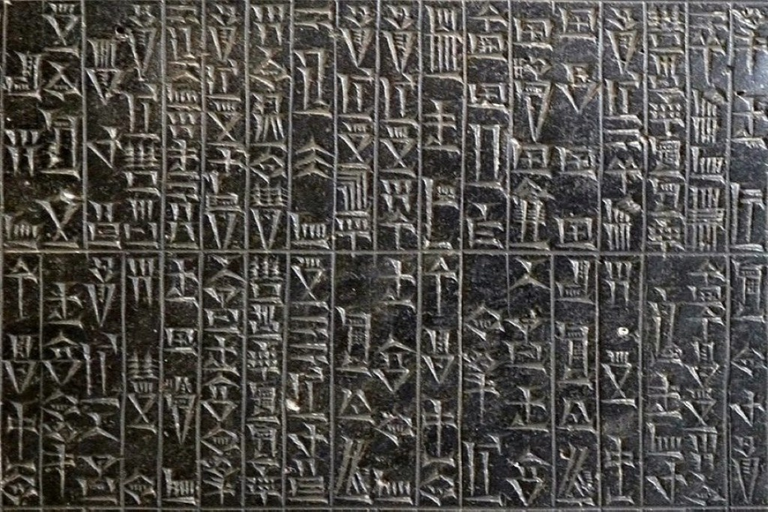

1,800 BCE - First Signs Of Regulation

In Babylon, the king Hammurabi came up with the “code of Hammurabi”. It included the first set of rules for prices of things, tariffs in trade, commerce, etc. Other laws also like family laws, criminal laws and civil laws.

1,200 BCE - Shell Money

The first shells to be every used as money were the Cowry Shells. They were mostly used in China.

700 BCE - Metal Coins

The first metal coins ever created were a mix of gold and silver called electrum. These coins didn’t have a consistence shape, they did have multiple weights which gave them their value.

400 BCE - Round Coins

The Chinese again, first introduced round coins made of non-precious metals, mainly because they were used for everyday transactions given their low value.

550 BCE - Precious Metal Coins

Lydia, which is now Turkey, introduced started to separate silver and gold, and made different coins based on those two precious metals.

336 BCE - Gold to Silver Peg

Alexander the Great introduced a fixed exchange rate of 10 units of silver for 1 unit of gold.

323 BCE - Representative Money

The Ptolemies, the dynasty after Ptolemy, established systems of warehouses where you could repay your debt by transferring the title of ownership of your commodity to someone else.

118 BCE - Leather Banknotes

The Chinese strike again! This time introducing square white deerskin leather as money.

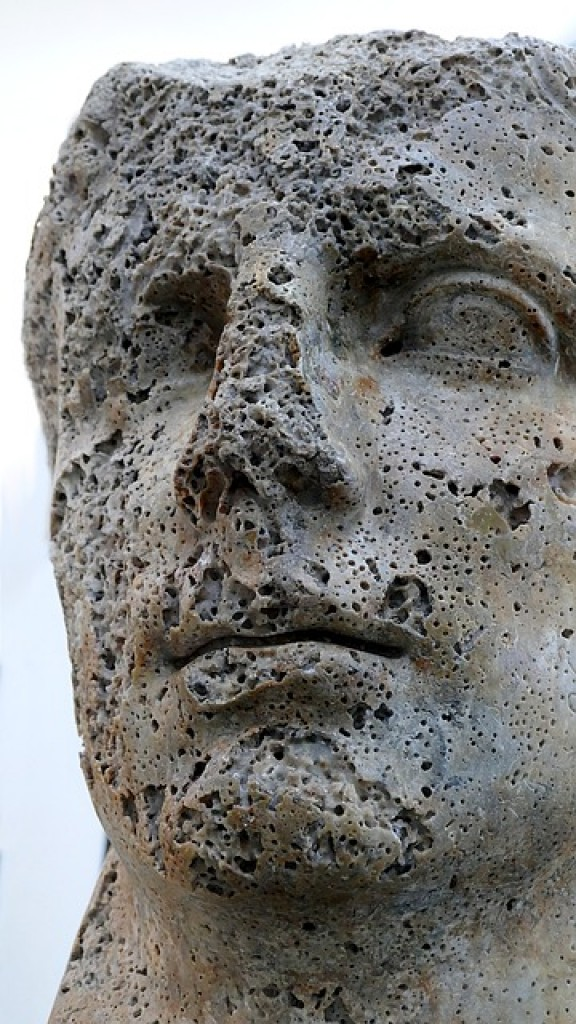

30 BCE - Augustus Caesar Reform

Augustus Caesar introduced taxes to roman provinces for sales, land and poll. He also introduced brass and copper coins.

270 CE - First Debasement

Overtime, Roman silver coins debased from being pure 100% silver, to only containing 4%.

306 CE - Constantine

Constantine was the first christian Roman emperor that introduced a new gold coin, the Solidus which didn’t have a debasement for over 700 years. However, that could be considered an achievement, if it wasn’t because the fact that the average citizen transacted in debased silver and copper coins. This only meant that the rich stayed rich, and the poor became poorer. Sounds familiar?

806 CE - Chinese Fiat Money

The Chinese again, what a surprise. They are always innovating and this time, due to a shortage of copper, Chinese Emperor Hien Tsung issued paper money for those merchants that couldn’t transact large volumes of money. overprinting money and inflation caused this paper money to depreciate against precious metals, proving that fiat money is never a good solution.

1600 - Central Banking

The first central bank ever created was the Sveriges Riksbank, in Sweden. They called banknotes, credit notes.

1913 - The Federal Reserve

The central bank of the United States, thought to be public but in reality is privately owned. Commercial bankers pretty much gave the central bank the monopoly of price and quantity of money ever since. I could write an entire post about how the Federal Reserve works and I think I will in the future.

1999 - The Euro

The Euro became the official currency of the members of the european union. First attempt of creating a consolidated currency for a whole entire region. There’s certain disadvantages and advantages of this of course.

2009 - Cryptocurrencies

As we all know, Bitcoin was a consolidation of a virtual currency that can go back to the roots of commodity money or in reality, representative money, because the number you see in your computer represents the computational work you own that have helped secure in the Bitcoin’s network. It represents something of value, the electricity the miners have consumed to generate one Bitcoin, in Proof of Stake coins, the participation and importance you have in the network, or Proof of Authorship as in other protocols. The great debate for some skeptics of Bitcoin’s value is that is just a number in the screen, that it has no intrinsic or extrinsic value. The reality of it is that Bitcoin is much more than just money, is a whole asset class of its own, it can be liquid as money, access of a protocol, ownership of your data, the fuel of a platform, a non-fungible asset and the list goes on. There’s been various attempts of virtual money, Bitcoin is not the first to attempt decentralization, cryptography and such. Torrent based platforms where the introductory points to decentralization, electronic gift cards or e-money was the first attempt of a virtual currency, but Bitcoin, Ethereum, EOS and all the big players have redefined these attempts with the introduction of blockchain technology.

So there it is, a brief history of money, how it evolved overtime and where we currently are. Thank you for reading!

Interesting, as we fear more and more to lose our money, we are trying to understand what it really is. It is an illusion and Bitcoin might be the biggest. However without agreeing that money, minted, printed or digitalised, has any value, we could't live as we used to do.

Congratulations @epic-express! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking