Short post today but we're talking about special dividends which are payouts companies make to shareholders that are declared to be separate from regular dividends. Special dividends are typically one-off events and are not factored into a stock's dividend yield.

These stocks are out there and it's just a matter of doing your research and finding them. For my own portfolio I have personally decided not to pursue many special dividends as I have noticed the rise of price of the stock and the sudden drop after the ex-dividend date but they can be a boost to one's capital - just remember, you have to pay taxes on capital gains and dividends!

These stocks are out there and it's just a matter of doing your research and finding them. For my own portfolio I have personally decided not to pursue many special dividends as I have noticed the rise of price of the stock and the sudden drop after the ex-dividend date but they can be a boost to one's capital - just remember, you have to pay taxes on capital gains and dividends!

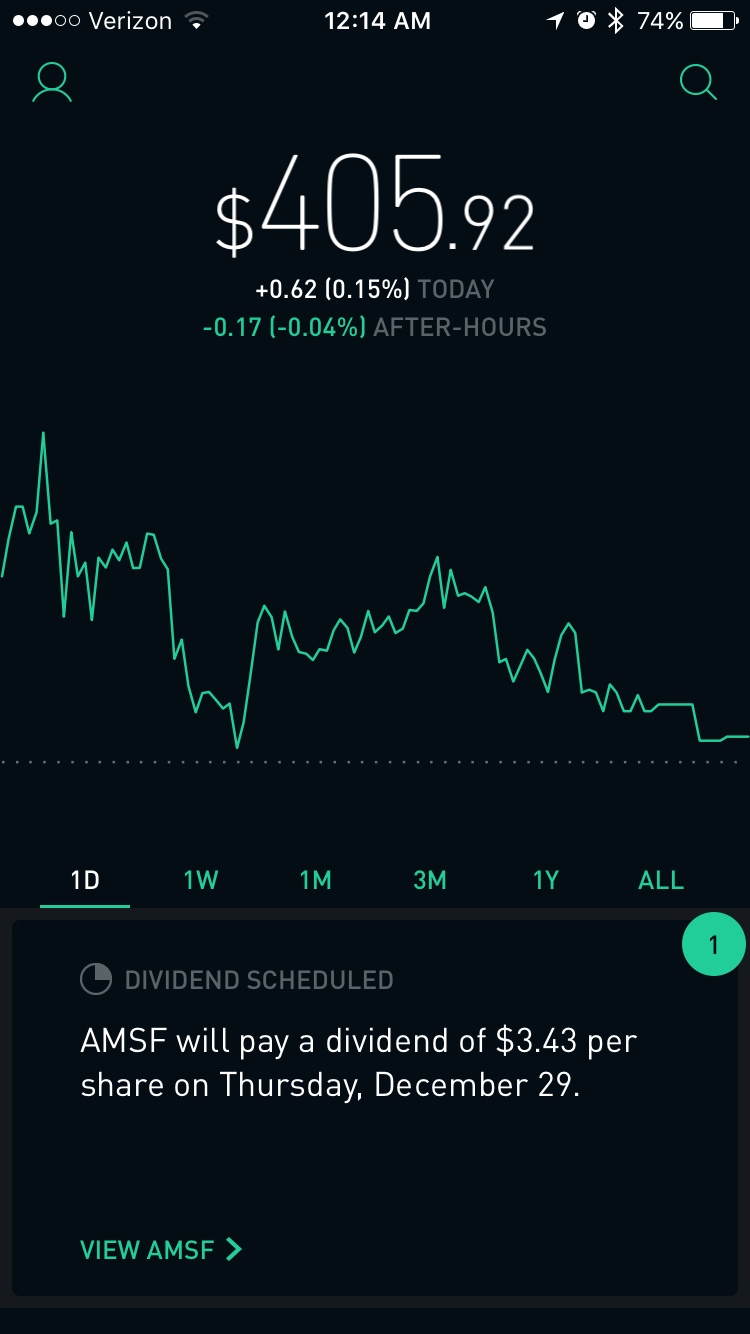

My Original Post from Dec 27