In our world, it is difficult to find successful venture capitalists. But recently the number of mediocre players in this sector has multiplied.

Successful representatives of this investment business also suffice. They are able to show spectacular moves in venture companies, increasing profits to the enormous size. One of them is Jim Goetz, who became a partner of Sequoia Capital investing in WhatsApp 60.0 million dollars, received fifty times more, after the instant messenger was sold to Facebooky for almost 20.0 billion dollars.

Of course, every day even a small number of such successful transactions are unlikely to be found in this area, they may not be at all. The same applies to venture fund clients - not many are as successful as Jim. Therefore, it is necessary to consider the differences between successful managers and losers. First of all, it's worth paying attention to who they were before.

The results of analysis of partners of venture funds

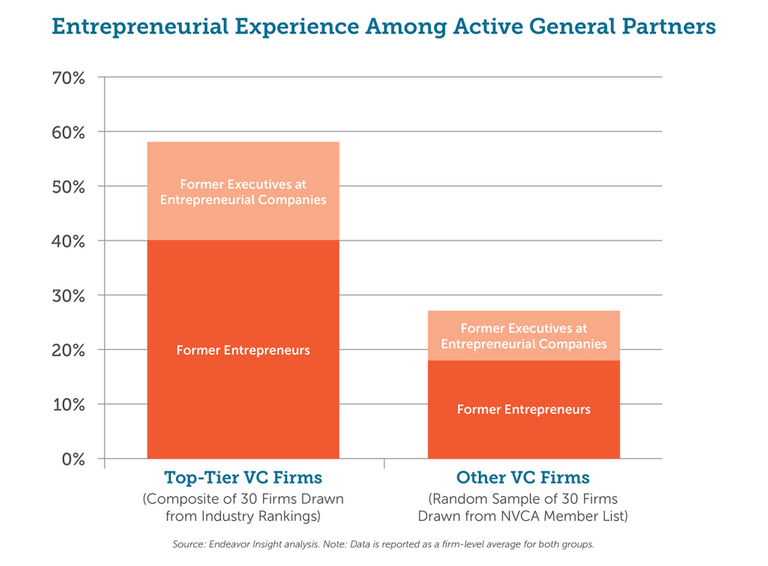

In order to answer the question of how a successful investor should be, consider the analysis of the most successful venture capital funds.

From the chart, we can conclude that in order to be a successful investor, one must have experience in entrepreneurship, that is, most of the investors once in the past were engaged in entrepreneurial activities.

But this does not mean that without the past experience of entrepreneurship one can not succeed, but only says that if there is such a past, the chances of success increase. Besides the entrepreneurs in this sphere, the employees of the banking sector show success.

Signs of a successful investor

The recipe for success is based on the main features:

- experience of entrepreneurial activity - with the experience it is easier to navigate and evaluate the opportunities of companies. In addition to a simple assessment, this type of investors has the ability to develop strategies and forecasting, leaving public information;

- dating, are able to help and give help in the formation of information and financial background. Perhaps your environment knows a lot more than you. Also, in order to make a substantial profit, it is often necessary to make significant contributions, in the provision of which your friends can also help you;

- a sign of attractiveness is manifested in the fact that it is easier for young entrepreneurs and large institutional players to contact themselves with such an environment.

If the investor has all three characteristics, then rather than its investments, the expected return will be made rather than losses, followed by disappointment in this investment sector. Also, when choosing a fund, do not forget to get acquainted with the biography of its owners and partners.

Congratulations @petrovic46! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP