Fiat currency is about to end in an inevitable crash. The world is repeating the same mistakes that have been made over 100 times throughout history. After this crash, cryptocurrencies will save us from the constant failed attempts made by the US and other countries to fix banking with regulation and central control. Before I explain why USD and many other fiat currencies will crash, we need to go over a very brief history of America's failed banking systems.

History of banking in the US

First Bank of the United States (1791-1811)

The First Bank of the United States was created during George Washington’s Presidency. It was a well managed, profitable bank which issued paper currency and bought bonds. The bank had great success, but died in 1811 due to suspicion of corruption. It was foreign owned, it had power to regulate banks it competed with, and was deemed unconstitutional.

State Banks (1812-1815)

After the First Bank of the United States fell, state banks were unregulated and ended up inflating fiat currency by an average of 13.3% per year. The US decided this was too unstable and created another central bank, despite the failure of the last one.

Second Bank of the United States (1816-1836)

The Second Bank of the United States was almost identical to the First Bank except it was terribly managed and full of fraud. President Jackson vetoed the renewal of the Second Bank, therefore ending it in 1836.

"Free" Banking Era (1837-1862)

After the Second Bank ended, the US entered the Free Banking era. There was no central bank during this period, but banks were still restricted by the Michigan Act of 1837, keeping this period from being completely free. This act limited the value of currency issued by the bank to the market value of the bonds owned by that bank. This made it so whenever the market value of bonds increased, the money supply increased. And whenever the bond market decreased, the bank had to redeem back banknotes from the public, shrinking the supply.

The Michigan Act created great economic instability during the Free Banking Era. Whenever the bond market grew, banks would issue more currency, which increased economic activity because inflation incentivized people to buy. When the economy was improving, people took out too many loans causing debt to rapidly increase. Businesses soon couldn't pay off their debt, causing the economy and the bond market to crash. Then, banks had to redeem currency which deflated supply and decreased economic activity. All of this created too much volatility in the economy.

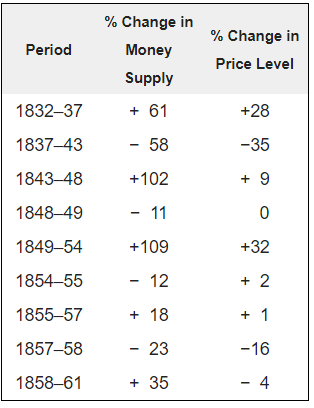

Here is a list of inflation and deflation periods during the free banking era. As you can see, each inflation and deflation period only lasted between 1-6 years. There were two times when currency inflated by over 50% in 5 years.

By the end of the Free Banking era, there were around 1500 state banks, all with their own currency. It was very difficult for merchants to keep track of all the different currencies throughout this period.

National Banking Acts of 1863 and 1864

Because of the issues created by having so many different currencies, the National Banking Act created a single national currency. People understood the problems with the First Bank and Second Bank and refrained from creating another central bank. State banks were replaced by national banks, which were basically the same thing except that they were regulated by the national government instead of state governments. The biggest problem with the National Banking Act is that the value of currency issued by each national bank was still limited to the market value of bonds it bought.

Because of this limitation, banks ran out of currency to issue whenever there was high demand for currency. This happened during planting seasons when farmers needed to pull money out of the bank to pay for crops. Banks were unable to meet the demands of farmers four times; in 1873, 1884, 1893, and 1907. Each time created an economic recession with the most severe in 1907, called the Wall Street Panic. Banks weren’t able to withdraw money to farmers, making it so they couldn’t pay for crops and the unemployment rate reached 20%.

The recession ended when JP Morgan and Rockefeller provided loans to multiple banks to solve their reserve issue. If they hadn’t provided those loans, the recession would have gotten much worse.

Federal Reserve Act (1913)

The US government decided that the only way to prevent another economic crash was to create another central bank called the Federal Reserve. The Federal Reserve provided liquidity to banks when there were a lot of withdrawals, just as JP Morgan did in 1907. The US government blamed the free market for not being able to provide liquidity, yet the real cause of this recession was the regulation that kept banks from issuing more currency than the amount of treasury bonds they own.

Time after time, the US government creates more regulations and more central control to fix the problems of the old regulations and central control. Yet the real cause of the problems are the regulations and central control themselves. If the government kept their hands off the banking system completely after the failure of the First and Second Banks, then banks would have found a better way to manage liquidity and supply. Any bank that solved these issues would create competition and other banks would follow. It might have taken a while for a bank to fix things, but the regulatory mess wouldn’t have lasted over 200 years. More on that later.

Coinage Acts and the Gold Standard

In 1792, at the start of the First Bank of the United States, Congress passed the Coinage Act which set the price of gold to $19.39/oz and silver to $1.29/oz. The central bank had to hold enough gold and silver in each bank so that people could exchange them for the fixed rate set by Congress. Essentially, it acted similar to the gold standard because the bank could not create too many banknotes in relation to the gold and silver supply. If they did, the bank could run out of gold and silver if enough people exchanged their banknotes at once.

During the free banking era, the Michigan Act also required state banks to allow exchange between banknotes and silver and gold for a fixed rate. If a bank failed to do so, the state would force it to close down.

In year 1900, the Gold Standard Act was approved which made it so only gold, and not silver, could be redeemed for currency. It fixed the price of gold to $20.67/oz. It limited the amount of currency that could be issued by banks because they were only allowed to issue currency when they received gold. This did not last for very long because in 1934, Roosevelt found a way to significantly increase the amount of gold held by the US; he outlawed gold and required everyone to give it to the US Department of Treasury in exchange for $35/ounce. The US dollar’s value has spiraled downwards ever since.

More on the Fed

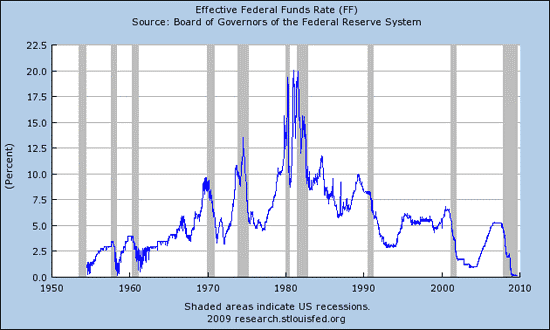

It can be argued that the Federal Reserve was the cause of every major recession since it started because of its control on interest rates and the money supply. The bubble that occured before the great depression occurred because the Fed lowered interest rates, incentivizing people to take out more loans which boosted the economy. Some of those loans went into the stock market which artificially inflated it. People expected the rates to stay low forever and borrowed more than they could pay off if the rates were to go higher. But whenever the Fed sees the economy is doing well, it raises interest rates. The minimum interest rate rose from 3.5% in January 1928 to 6% in September 1929, one month before the great depression started. This caused their debts to increase faster than they could handle causing profits to slump, spending to reduce, and then the markets popped. The fed both created the bubble and popped it. As you can see in the chart below, every major recession occurred after a recent interest rate increase. And after every recession, the fed lowers interest rates, re-inflating the bubble.

If the fed allowed the free market to control interest rates, the great depression never would have happened. There might have been economic instability during that time, but it never would have gotten as bad as it did if the free market controlled the economy.

Our current situation

Go take a look at the US debt clock. At the time of writing this, the US Federal Government is 20.8 trillion dollars in debt. The Federal deficit is 719 billion dollars. The total debt in the US is 69.6 trillion dollars. The savings per family is only $4,533. The reason why Americans are taking out so much debt is because after 2008, the Fed lowered interest rates to near zero. Then in December 2015, the Fed started raising interest rates again. It’s going to be back up to 2% in 2018. They say the Fed will raise the 10-year Treasury note to 3.3% by the end of 2018. It's impossible to say exactly what it'll be in the future but debt in the US is getting way too large and will eventually lead to lower profits and less spending. The faster the Fed raises interest rates, the sooner this bubble will burst.

As interest rates go up, the US national debt will also increase faster. There are only four ways for the US to pay off its debts:

- Higher taxes

- Cut spending

- More debt

- Create money

The most reasonable options here are to cut spending and balance the budget. But the US is doing the exact opposite. Trump wants to increase spending and lower taxes. And once a recession hits, there will be less income to tax and more spending as more people go on welfare programs. The deficit could easily go over a trillion dollars. If the US ends up using more debt to pay off the old debt, interest rates will have to be high enough to convince governments to buy that debt. Higher interest rates will increase the debt faster. The US can’t continue adding debt forever. This leaves the only option left to pay off debt: create money out of thin air. There is nothing else the US can do. The US is going to go back to zero interest rates like it did after 2008 and will be forced to pay off its trillion plus deficit using money created out of thin air.

Currently there are 14 trillion dollars of USD M2 supply. When the Fed creates over a trillion dollars of new money in a year, it’ll inflate USD by at least 7%. The Fed will also be creating money to buy business debt in order to “reboot the economy” which means even more than a trillion dollars will be created out of thin air. There will also be inflation created by less production during the recession. USD could easily end up inflating by 10% in a year. After that, countries around the world will start selling their USD reserves for a reserve that holds its value better. Countries will not want to hold onto a reserve that has lost 10% of its value in a year. There is about 5 trillion USD in foreign reserves. After the fed has created all that money, after countries have sold their USD reserves, and after the decrease in production caused by the upcoming recession, USD will have lost about 50% of its value. All of that could happen in less than two years.

But the inflation isn’t over yet. If USD is inflating at a rate of 50% in two years, businesses aren’t going to want to accept USD anymore. If no one is accepting USD then its value is zero. USD will lose all of its value within 3 years after the next recession. USD is by far the world’s largest bubble in history.

Fiat always destroys itself

Hyperinflation is not uncommon for fiat currency. Based on a study of 775 fiat currencies throughout history, 156 were destroyed by hyperinflation caused by the government. Today, there are 176 fiat currencies. The median age of those currencies is only 39 years old. The currencies in Venezuela and Zimbabwe are going through hyperinflation today. The median life span for all the fiat currencies no longer in circulation is only 15 years.

We need a free market economy

For over 200 years, the US has had an unstable economy created by government regulation and central banks. The US went from the corrupt First and Second Banks of the United States to the over regulated, unstable State Banks to the Federal Reserve with depressing management abilities. We do not need to go back to the gold standard. That did not work because the US government was still in charge of it. As long as the government is in charge of the economy, it will never be stable. Free market banking in the US only lasted for 5 years between the First and Second Bank of the United States. That was not enough time for the bad banks to be weeded out and the good banks to take over, especially back then when progress was slow compared to today. Free market banking proved itself that it works when Scotland had a completely free banking system.

Free Banking in Scotland

Scotland prospered from free banking with almost no regulations up until 1845. There were two main banks: the Bank of Scotland and the Royal Bank. There were also a few smaller banks that competed against them. These banks either redeemed paper notes for specie or issued bonds and credit with interest. They didn’t have liquidity issues like the US did because banks offered a six month, interest free bond to anyone who needed a quick supply of cash. Over issuance was not a problem because any bank that did over issue would end up running out of specie in their reserves and lose customers. Banks made sure that did not happen. Competition kept interest rates low, averaging around 5%. Rates didn’t wildly spike upwards like the interest rates controlled by the Federal Reserve.

Free banking in Scotland created great economic growth while it lasted. Scotland's GDP was less than half of England’s GDP in 1750 but was equal to it in 1845. England’s banks were under heavy regulation during that period and received far more bank failures than Scottish banks. Scottish bank notes even circulated in England because they were trusted by the Brits while English bank notes never circulated in Scotland because of how distrusted they were.

People think that central banks such as the Federal Reserve are the only way to maintain interest rates, liquidity, and currency supply yet the free market in Scotland maintained all of that way better than the Federal Reserve ever has. We do not need government regulation to have a sustainable economy. Competition in itself is regulation. The only reason why countries adopt central banking is because it makes it easier for governments to fund their own interests. It is not for the benefit of its citizens.

Source

Cryptocurrencies will save us from regulations and central control

What I love most about cryptocurrencies is how it is impossible to regulate the currency itself. No one can change the supply of the currency and no one can control interest rates between private parties. There are no institutions to control. Once the code is set, it requires over half of the miners to agree on a change for it to be implemented. As the US Dollar collapses, people are going to move all of their wealth over to cryptocurrencies so it doesn’t continue to lose value. Cryptocurrencies will finally give us a free market economy for the first time in US history and governments won’t be able to do anything about it.

The world will be a very different place after cryptocurrencies take over. They will strip power away from governments. Cryptocurrencies make it very easy for businesses to hide the total amount of income they are receiving. Many businesses will report less earnings than they received to avoid taxes. Governments will no longer be able to control interest rates or finance themselves by printing money. This will substantially lower the size of governments.

If the US fails to transition its taxes from USD to cryptocurrencies before USD is worth zero, then the government might just collapse all together. They will no longer be able to pay for anything, not even the IRS to enforce taxes. I don’t know how the US government could recover if this were to happen. We might end up in complete anarchy.

How the economy will run after cryptocurrencies have taken over

Crypto will automate everything that banks do today. The Federal Reserve was supposed to provide liquidity by giving banks cash when they run low. There will be no need for this with crypto because everyone will be their own bank. People will carry their money in a hard drive at their house or in a safe. Crypto will take care of the money supply using algorithms. It will also allow people to make loans using smart contracts. All of this required banks before.

Once crypto completely takes over fiat currencies, the purchasing power of cryptos will change based on economic conditions. When production increases, prices will go down because there will be more products to buy but the same amount of currency. If the economy slows down then there’s less to buy with the same amount of currency and prices will increase. In the chart above that showed the inflation and deflation periods during the free bank era, there was deflation during economic downturns and inflation during economic increases, contrary to my last sentence. But this was because banks were increasing the supply of currency during economic increases and were decreasing the supply when there was a recession. Notice how during inflationary periods, currency supply always increased faster than prices increased. And during deflationary periods, currency supply always decreased faster than prices decreased. That’s because during a recession, lower productivity was trying to increase prices while currency contraction was decreasing prices. If the supply of money stays the same, there will be inflation during recessions and deflation while the economy improves.

Lending money will be much less common in a deflationary economy. Imagine you were to get a 30 year mortgage of 50 Bitcoin to buy a house. After 30 years, you have to pay back 55 Bitcoin. (No, there will not be negative or zero interest rates. No one would give someone 50 Bitcoin and want 45 back in the future. They would rather just hold onto their Bitcoin.) If the economy is improving at 3% per year, the purchasing power of Bitcoin will also increase about 3% per year. So at the end of the 30 years, you will have paid about 2.67 times as much as the original price of the house. That is way too much of an increase for most people to pay off. Most people wouldn’t be able to buy a house unless they can pay 100% down. The rich will own all the houses while everyone else rents from them.

But this isn’t entirely a bad thing. Bubbles burst when people can’t pay off their debt. If people aren’t going into debt buying houses and they aren’t buying things they can’t afford, there will be no debt bubbles. The housing crash that happened in 2008 never would have happened in a deflationary economy.

In a deflationary economy, debt will be used for investments that give people a greater return than the deflation rate. If the cryptocurrency is deflating at an average of 3% per year and someone wants to make an investment that they think will make them 10% returns, then it would be worth it to use that loan. Loans will primarily be used for investments that increase productivity, instead of being used to buy TVs, cars, and houses. That is very good because people won’t be buying things they can’t afford. It will mostly be a renting and sharing economy.

Yes, it is true that borrowing money is good for economic growth, but only temporarily. If people use loans to buy things that won’t give them a return on their investment, then it only pushes that payment into the future. It does not get rid of it. Eventually that person is going to have to pay for it. If they keep building up that debt, it will eventually cut into their income and lower their purchasing power. This is bad for the economy.

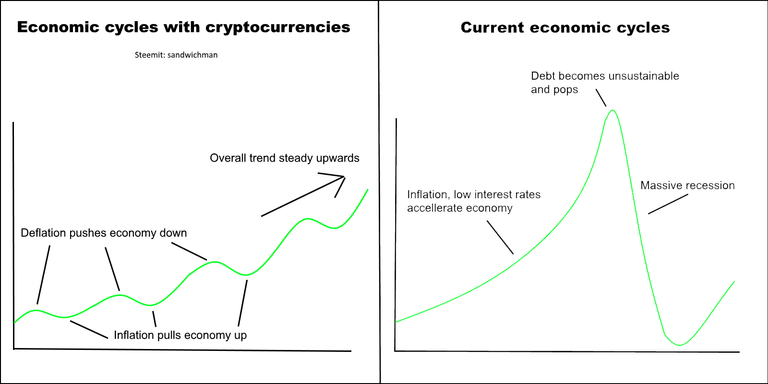

Yes, it is true that people will spend less if their currency is deflating because they know everything will be cheaper in the future. Whenever the economy is improving, deflation will cause people to spend less and slow down the economy. Whenever the economy is declining, inflation will cause people to invest and spend more, improving the economy. This will create an equilibrium where the economy has small dips and increases while the overall economic trend goes upwards as technology advances. Currently our economy is accelerated by inflation and low interest rates, creating a giant bubble before it bursts and turns into a recession. This is illustrated below.

Cryptocurrencies will turn countries into saving economies instead of debt economies. It will be much easier to save because the purchasing power of crypto will become greater as time passes. People will be able to save for retirement much easier than today. Currently our money deteriorates in value as it sits in our bank accounts. If you put $100 into savings and its value decreases at 3% per year, it will only be worth $22 in 50 years. But if it increases in value at 3% per year then it will be worth $438 in 50 years. This is the kind of robbery that Federal Reserve is doing to Americans and making it hard for them to save for retirement. If we had deflation instead of inflation for the past 50 years then we wouldn’t need social security to pay for people when they’re old. They would have been able to save up that money themselves.

It will be very interesting when cryptocurrencies become a global currency. It’ll be the first time currencies compete at a global level and some cryptocurrencies will be used in almost every country. I wonder if this will create a one world government where people only choose to fund the government if they believe in what it’s doing. Since people will be using the same currencies all around the world, everyone will be affected when one country does poorly. I think this will lead to less wars and more peace between countries. We will want every country to succeed.

Great analysis.

I hope that it happens as stated here about the future.

All the best!

Hey bro hows it going this morning? NIce post. I'm so passionate about crypto, simply because its decentralised and transparent. :)

Congratulations @sandwichman! You received a personal award!

Click here to view your Board

Congratulations @sandwichman! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!